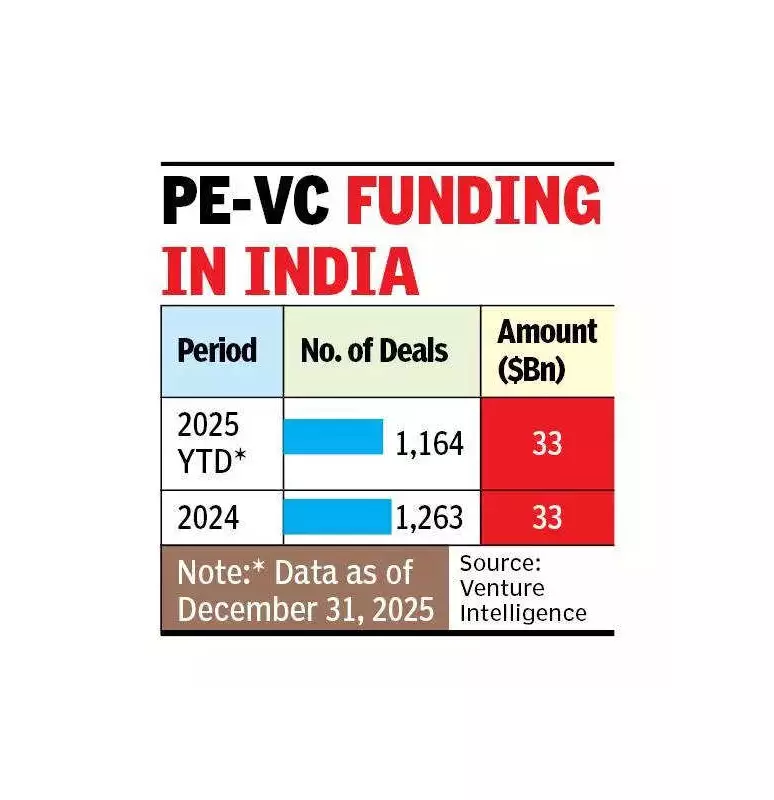

India's private equity and venture capital (PE-VC) landscape demonstrated remarkable resilience in 2025, with total investments holding steady at $33 billion, matching the previous year's figure. According to data released by research firm Venture Intelligence, the year witnessed 1,164 deals, which was approximately 100 deals fewer than the 1,263 recorded in the calendar year 2024. These numbers specifically exclude investments in the real estate sector.

Sectoral Performance: IT & BFSI Lead the Charge

The IT & IT-enabled Services (ITeS) sector emerged as the undisputed leader, attracting a massive $13.1 billion in PE-VC funding. This represented a significant 15% increase from the $11.4 billion it secured in 2024. Following closely was the Banking, Financial Services, and Insurance (BFSI) sector, which saw investments grow by 23% to $5.4 billion in 2025, up from $4.4 billion the year before.

Quarterly Trends and Stage-wise Investment Breakdown

On a quarterly basis, the first quarter (January-March) of 2025 recorded the highest influx at $10.2 billion. The final quarter (October-December) followed as the second strongest period, with investments totaling $9.9 billion. Analyzing the data by company maturity reveals that late-stage companies, those older than ten years, secured the lion's share of capital, amounting to $10.8 billion. Growth-stage firms, defined as companies aged between five to ten years, attracted approximately $7.4 billion in institutional investments.

Expert Insight: Navigating Global Headwinds

Arun Natarajan, founder of Venture Intelligence, commented on the stability of the market despite significant challenges. "Despite significant headwinds in the form of the Trump tariffs and various international developments, PE-VC investments have ended 2025 remarkably flat compared to the previous year," he stated. He attributed investor confidence to the continued growth opportunities in the domestic economy and a robust IPO market.

Natarajan noted that in the last quarter, investors had absorbed the mid-year shock from the tariffs and showed a keenness to place significant bets on companies focused on the domestic economy, particularly in BFSI, manufacturing, e-commerce, and retail. Looking ahead to 2026, he expressed cautious optimism: "Provided the international environment does not throw new curve balls, the stable PE-VC figures of the past two years offer a good base to grow from with catalysts in the form of good exits and the IT and GST reforms unveiled by the Union government in 2025."