In the high-stakes race for artificial intelligence dominance, technology giants are pouring billions into computing infrastructure, convinced that underinvesting poses greater risks than overspending. However, Intel's recent catastrophic experience with massive capital expenditure serves as a stark warning that spending too much can indeed lead to corporate disaster.

The Intel Catastrophe: A $25 Billion Lesson

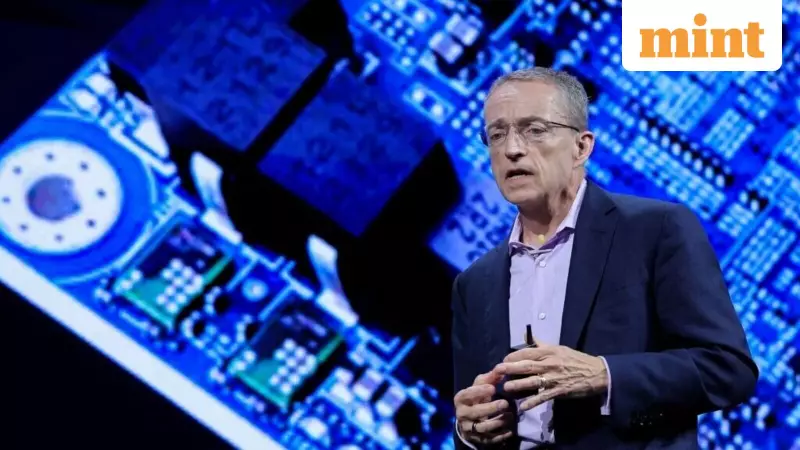

Intel, the once-dominant American chipmaker, faced a critical turning point in 2021 when it appointed Pat Gelsinger as chief executive to orchestrate a turnaround. The company had fallen behind Asian competitors in manufacturing cutting-edge semiconductors, and Gelsinger devised an ambitious strategy to leapfrog rivals while transforming Intel into a leading contract chip manufacturer.

This bold plan demanded massive expansion of chip-manufacturing capacity, with individual factories costing tens of billions of dollars and requiring years to construct. Intel had to commit enormous resources before seeing any returns on these investments. Capital expenditures ballooned from approximately $14 billion in 2020 to $25 billion in 2022, as the company pursued what Gelsinger called "a very conscious decision to get back in front of it" during a Credit Suisse conference in late 2021.

The strategy backfired spectacularly. Technological missteps and shifting market conditions undermined Intel's efforts within two years, resulting in what can only be described as a corporate meltdown. Manufacturing projects were canceled or put on hold, while the company's financial health deteriorated dramatically.

The Aftermath: Financial Carnage and Leadership Purge

Intel's financial collapse has been nothing short of breathtaking. The company recorded negative free cash flow in 11 of its last 14 quarters, forcing desperate measures to stay afloat. Intel sold assets including stakes in Mobileye, divested its programmable-chip business to Silver Lake, implemented thousands of layoffs, and ultimately suspended its dividend payments.

The crisis culminated in Gelsinger's ousting in late 2024, and the company now faces potential breakup to salvage value. The U.S. government took an unprecedented 10% stake in Intel in August 2025, providing temporary stock support but failing to reverse the fundamental decline. Intel's current valuation stands at approximately $171 billion—just 1/26th of AI chip leader Nvidia's market value, a stunning reversal from five years ago when Intel was worth more than its rival.

Parallels to Today's AI Spending Frenzy

Today's technology leaders echo the same rationale that guided Intel's disastrous strategy. OpenAI CEO Sam Altman recently argued that companies face a choice between overinvesting and losing money versus underinvesting and losing revenue. Meta Platforms chief Mark Zuckerberg emphasized similar logic during an earnings call, stating that AI's revenue potential justifies aggressive investment to avoid "underinvesting."

However, investors are growing increasingly nervous about the AI spending spree, fearing it might inflate a bubble destined to burst. The parallel with Intel's situation is striking: like the chipmaker, AI companies believe they cannot wait for proven business potential before making massive infrastructure commitments.

Financial analysts note that if assumptions about AI asset values and contracts change, significant write-downs become inevitable, potentially wiping out numerous startups and damaging even established players. AI-related stocks have already experienced volatile trading in recent weeks as investor apprehension grows.

Which Companies Face Greatest Risk?

Not all technology firms are equally vulnerable to an AI investment downturn. Microsoft, Alphabet (Google's parent), and Amazon.com maintain strong financial positions despite substantial AI spending. Alphabet has been particularly strategic, leveraging its search engine dominance to advance in AI while controlling capital expenditures. The company's planned capital spending represents only 23% of projected revenue, significantly below industry peers.

Companies that have taken on debt to fund AI ambitions or lack diversified revenue streams face greater peril. Oracle, CoreWeave, and to some extent Meta Platforms could find themselves forced into Intel-style emergency measures if AI returns fail to justify their massive investments.

Intel's experience demonstrates that companies can survive periods of overspending, but the recovery comes at tremendous cost. While Intel avoided bankruptcy, it emerged substantially weakened and strategically compromised. As the AI gold rush continues, technology leaders must weigh whether their massive infrastructure bets will deliver promised returns or become the next cautionary tale in corporate overspending.