Madhya Pradesh's Central Tax Allocation Sees Significant Reduction in Union Budget 2026-27

Finance Minister Nirmala Sitharaman's presentation of the Union Budget 2026-27 has brought concerning news for Madhya Pradesh, as the state faces a comparatively reduced yearly increase in central tax allocations. The budget reveals that MP's share in central taxes has been substantially curtailed for the upcoming five-year period starting from fiscal year 2027.

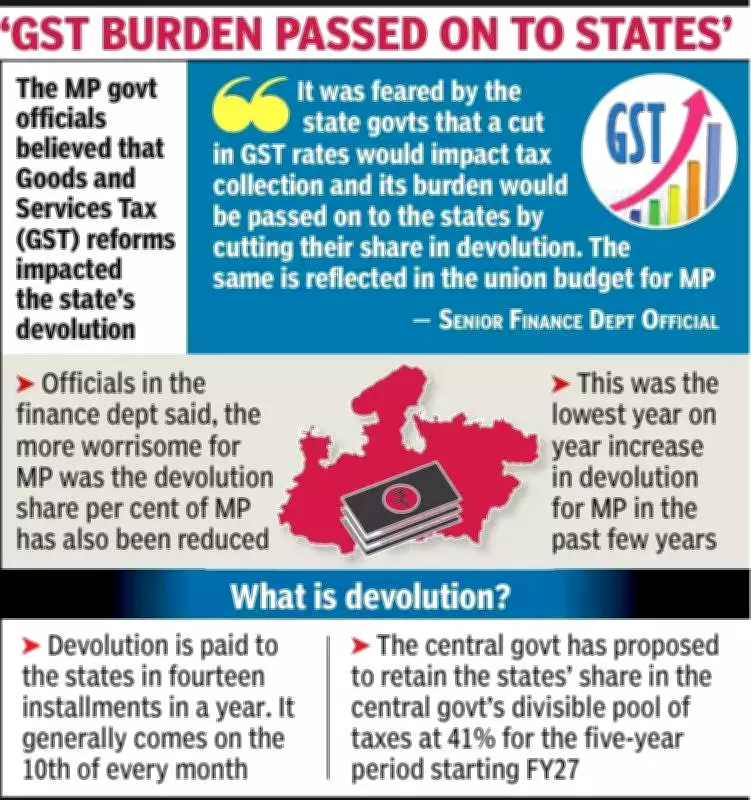

Declining Devolution Figures for Madhya Pradesh

In the state-wise distribution of net proceeds from union taxes and duties, Madhya Pradesh has been allocated Rs 112,133.93 crore for the Budget estimate of 2026-27. This allocation represents the lowest year-on-year increase in devolution that MP has witnessed in recent years. For context, during the revised estimates of 2025-2026, the state received Rs 1,09,348.21 crore, which was marginally lower than the current budget estimates. Looking back further, in the financial year 2024-25, Madhya Pradesh obtained Rs 1,00,018.52 crore as devolution from the central government.

Reduction in Percentage Share Raises Concerns

Finance department officials have expressed particular alarm about the reduction in MP's percentage share of central taxes. Previously set at 7.850 percent until 2025-26, this share has now been decreased to 7.347 percent. Officials estimate that this reduction of approximately 0.5 percent in yearly devolution will result in Madhya Pradesh receiving thousands of crores less from the central government annually over the next five-year period.

Background of the Sixteenth Finance Commission Recommendations

The central government has proposed maintaining states' share in the divisible pool of central taxes at 41 percent for the five-year period commencing FY27. This decision aligns with recommendations from the Sixteenth Finance Commission (SFC), chaired by economist Arvind Panagariya. During her parliamentary address, Finance Minister Sitharaman confirmed that the commission submitted its report to the president on November 17, 2025, and the government has accepted its recommendation to keep the vertical devolution ratio unchanged.

GST Reforms and Their Impact on State Finances

Madhya Pradesh government officials believe that Goods and Services Tax (GST) reforms have significantly influenced the state's devolution figures. A senior finance department official stated, "State governments had long feared that reductions in GST rates would adversely affect tax collections, with the burden ultimately being transferred to states through cuts in their devolution shares. The Union Budget for MP clearly reflects this concerning development."

The budget allocation reveals a challenging fiscal landscape for Madhya Pradesh, with reduced central support potentially impacting the state's development initiatives and financial planning for the coming years.