Politics

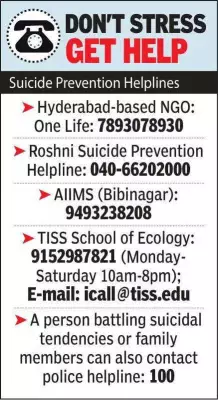

Dowry Harassment Tragedy: Mother Allegedly Kills Children, Dies by Suicide in Hyderabad

A 28-year-old woman in Gollagudem village near Bibinagar allegedly smothered her two young children before dying by suicide, with police citing dowry harassment as the motive in this heartbreaking case.

World

Goa's Youth Swap Sunday Leisure for Community Clean-Up Drives

Young Goans are transforming Sundays into community action days, organizing beach and plateau clean-ups across the state. Volunteer groups collect hundreds of kilograms of waste, driven by social media coordination and local initiative.

Business

Loco Pilot Strips to Show Surgery Scars After Sick Leave Denial in Lucknow

A loco pilot in Lucknow was forced to undress to display post-surgery wounds after railway authorities denied his sick leave, sparking outrage among colleagues.

Entertainment

Bollywood Stars Varun Dhawan, Katrina Kaif, Vicky Kaushal Revel in Holi Festivities

Bollywood celebrities including Varun Dhawan, Katrina Kaif, and Vicky Kaushal were seen celebrating Holi with vibrant colors and joyous gatherings, sharing festive moments on social media.

Sports

Lifestyle

Technology

OpenAI Loses 1.5M Users After Pentagon AI Deal Backlash

OpenAI faces a major backlash as over 1.5 million users abandon ChatGPT in 48 hours after it allowed the US Department of Defense to use its AI models on classified networks. Rival Anthropic's refusal of similar deals boosts its Claude chatbot.

Dr. Gurtej Sandhu's 2,211 Patents Exceed Thomas Edison's Record

Dr. Gurtej Sandhu, an Indian-born semiconductor inventor, holds 2,211 global patents, surpassing Thomas Edison's 1,432. His innovations power smartphones, cameras, and cloud servers worldwide.

Nothing Phone (4a) in 4 Colors with Periscope Camera

Nothing CEO Carl Pei confirms the Phone (4a) will debut in White, Black, Pink, and Blue, featuring a periscope camera and Snapdragon chipset, with launch on March 5.

Nvidia's AI Chip Empire Faces US Military Ban Threat

Nvidia's neutral stance as AI chip supplier is jeopardized by a US Defense Secretary order banning military contractors from business with Anthropic, potentially forcing Nvidia to cut off one of its biggest customers.

Apple Launches MacBook Air M5 & Studio Display Series

Apple has introduced the new MacBook Air M5 with double the base storage and the Studio Display series, marking significant advancements in its product lineup for 2026.

Health

Get Updates

Subscribe to our newsletter to receive the latest updates in your inbox!

We hate spammers and never send spam