Indian equity benchmarks recorded their most severe weekly drop in three months, rattled by renewed fears of aggressive US trade tariffs linked to a new sanctions bill targeting Russian energy imports.

Markets Tumble on Geopolitical Tensions

The benchmark Nifty50 index closed the week at 26,683.30, registering a weekly decline of 2.4%. The sell-off intensified on Friday, with the index falling another 193.55 points or 0.8%, after having dropped over 1% in the previous session. Analysts attributed the downturn to investors locking in profits following a recent rally and rising anxiety over global trade tensions.

Vipin Kumar, Assistant VP of Equity Research at Globe Capital Market, stated that domestic markets retreated from all-time highs due to profit-booking amid escalating global tensions and fresh tariff threats related to Russian oil purchases.

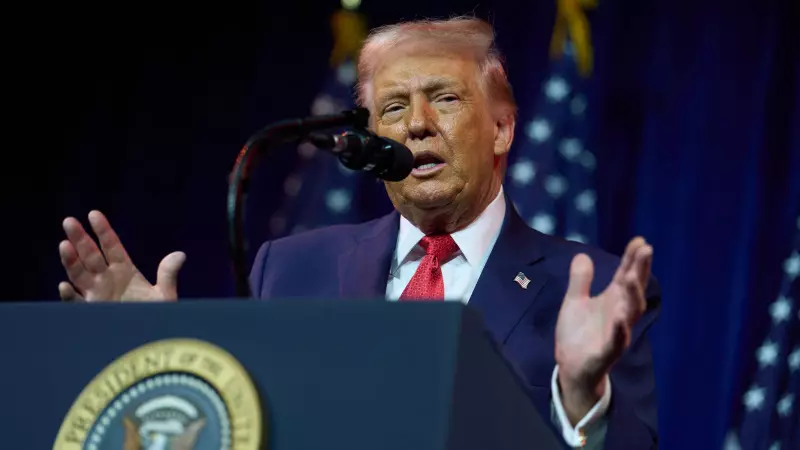

The trigger for the market's nervousness was the approval of the 'Sanctioning Russia Act of 2025' bill by US President Donald Trump. This legislation proposes hiking import duties to at least 500% on goods and services from nations that knowingly trade in Russian-origin uranium and petroleum products. The bill could be put to a vote in the US Congress next week, with Republican Senator Lindsey Graham indicating that potential targets include India and China.

Oil & Gas and Banking Stocks Bear the Brunt

The uncertainty hit specific sectors hardest. The Nifty Oil & Gas index plummeted nearly 6% over the week. Reliance Industries, the sector heavyweight, slumped 7.3%, with the company stating it did not expect to import any Russian oil in January. Other public sector oil marketing companies like Bharat Petroleum, Indian Oil, and Hindustan Petroleum fell between 6-10%.

These companies are likely to be significantly impacted if access to cheaper Russian crude is curtailed. While Indian refiners have already reduced their exposure, some state-owned entities continue to purchase Russian oil. Further pressure came from rising Brent crude prices, which climbed nearly 4% after President Trump threatened intervention in Iran.

The banking sector also faced pressure. The Nifty Bank index declined 1.5% for the week. HDFC Bank fell 7.1% amid concerns over weak business growth, as its loan and deposit growth for the quarter ending December 2025 remained subdued. Nomura analysts highlighted that constrained deposit growth weighed on the bank's performance.

Trade Deal Uncertainty Adds to Gloom

Market sentiment was further dampened by comments from US Commerce Secretary Howard Lutnick on Friday. He claimed that India did not respond in time to a trade deal offered by the US, suggesting Prime Minister Narendra Modi was uncomfortable making a call to President Trump. India's Ministry of External Affairs countered, stating this characterization of negotiations was "not accurate."

While some analysts believe the market is now discounting the possibility of a near-term trade deal, others see the US actions as delaying tactics as it considers the new Russia sanctions. Reflecting the heightened anxiety, the India Volatility Index (VIX) surged nearly 16% this week to a one-month high.

VK Vijaykumar, Investment Strategist at Geojit Financial Services, noted that the stock market in the short run "will be swayed more by sentiments than fundamentals," adding that geopolitical uncertainty has spiked following recent US moves in Venezuela and the capture of a Russian-linked oil tanker.