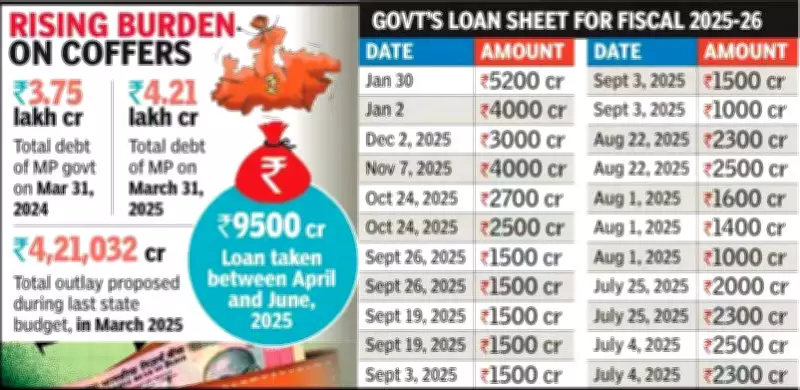

Madhya Pradesh's Rs 5,200 Crore Borrowing Raises Fiscal Autonomy Concerns

Barely two days after Finance Minister Nirmala Sitharaman presented her ninth consecutive Union Budget, the Madhya Pradesh government, on Tuesday, made its first borrowing of Rs 5,200 crore in the current fiscal year. This loan, which is to be released in three tranches, comes at a significant cost to the state's fiscal autonomy. It is reliably learned that the state will lose out majorly in terms of devolution, a term for the transfer of financial resources and decision-making powers from the Centre to states.

Mounting Debt and Budgetary Pressures

With this fresh borrowing, the total debt of Madhya Pradesh now stands at approximately Rs 4.75 lakh crore, which is almost Rs 55,000 crore more than the state budget of Rs 4.21 lakh crore for fiscal 2025-26. This alarming gap highlights the growing financial strain on the state's coffers.

Justifying the state's burgeoning loan burden, the government had previously cited the need for funds to build public infrastructure aligned with its larger development goals, adding that it would continue to make borrowings going forward. Every time before taking a loan, the government puts out a gazetted notification that typically reads: "Though no actual assessment has been made of the value of the physical assets of the state government, it can be safely assumed that it far exceeds the state's outstanding liabilities."

Political and Administrative Perspectives

While noting the state's growth rate at approximately 14-15 percent over the last two years, in a daylong special session of the Assembly convened on December 17 last year to mark 70 years of the first full session of the legislature on December 17, 1956, Chief Minister Mohan Yadav also pointed to the mounting public debt, saying that the state's total loans had exceeded its budget. However, the CM was quick to add in his Assembly address that the majority of the loans were taken by previous governments.

Questioned on the state's loan burden, Deputy Chief Minister Jagdish Devda, who also handles the Finance portfolio, said previously that the state needed to make borrowings for infrastructure development. Explaining the rationale behind frequent public borrowings, the government stated that all loans from the Centre or global funding institutions in the recent past were largely utilized for meeting development targets and creation of remunerative assets.

Infrastructure and Development Focus

These assets include:

- Construction of irrigation dams, canals, tanks, and wells

- Improvement of communications and transport services

- Investment in the share capital of co-operative banks and societies

- Grant of loans to third parties such as cultivators and local bodies, which are mandated to repay with interest in installments

- Loans to power generation, transmission, and distribution companies under the state Energy department

Impact of Social Welfare Schemes

Adding to the state's fiscal burden is the Ladli Behna scheme, under which the government hands out a monthly dole of Rs 1,500 each to eligible women. The public exchequer now has to shell out Rs 300 crore more under this head after the dole was increased from Rs 1,250 per month to Rs 1,500 each. The monthly outlay from the state coffers for Ladli Behna now stands at about Rs 1,850 crore, up from over Rs 1,540 crore previously.

The government has, in fact, promised to increase the monthly payout under this scheme to Rs 3,000 each by 2028, which is likely to put further strain on the state coffers. Possibly with an eye on the next assembly elections, the CM has publicly expressed a desire of raising the monthly dole to the Ladli Behnas to Rs 5,000 each. However, no timeline has been announced for the same.

Regulatory and Central Oversight

Officials said the state also needs money to meet its share of centrally funded schemes, adding that the consent of the Union government is obtained every time the state opts for a loan. After assessing the state's current financial position, a threshold limit was previously set by the Reserve Bank of India (RBI) to make public borrowings. This regulatory framework underscores the delicate balance between state autonomy and central oversight in fiscal matters.

As Madhya Pradesh navigates these financial challenges, the interplay between development needs, social welfare commitments, and fiscal prudence will continue to shape its economic trajectory in the coming years.