Union Budget 2026 Unveils Major Customs Duty Revisions

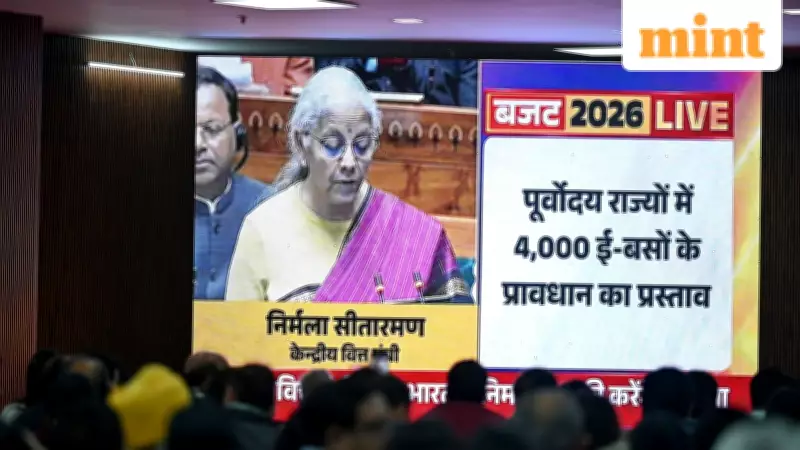

Finance Minister Nirmala Sitharaman presented the Union Budget 2026 on Sunday, introducing significant modifications to basic customs duty rates for a wide array of items. This strategic move is designed to lower input costs, stimulate domestic manufacturing capabilities, and strengthen India's position in global export markets. The revised duty structures are scheduled to come into force starting 2 February 2026, marking a pivotal shift in the country's trade and industrial policy framework.

Key Sectors Benefiting from Duty Reductions

The budget outlines substantial duty cuts across several critical sectors, aiming to foster growth and innovation. Here are the major highlights:

- Critical Minerals: Customs duty on monazite has been completely eliminated, dropping from 2.5% to nil, facilitating easier access to essential raw materials.

- Renewable Energy: To accelerate green energy initiatives, duty on Sodium antimonate used in solar glass manufacturing has been reduced from 7.5% to nil. Additionally, specified capital goods for producing lithium-ion cells for Battery Energy Storage Systems (BESS) will now attract zero duty.

- Nuclear Energy: Comprehensive reductions include zero duty on all goods for nuclear power generation (tariff item 8401 30 00) and related components like control rods (8401 40 00), down from 7.5%. Projects registered by 30 September 2035 under the Project Import Regulations, 1986, will also enjoy nil duty for setup requirements.

- Electronics: Goods needed for manufacturing microwave ovens (tariff item 8516 50 00) will see duty slashed to zero from current rates.

- Civil Aviation: Components and parts, including engines, for aircraft manufacturing will now be duty-free, boosting the aerospace sector.

- Defence: Zero duty applies to goods for aircraft parts maintenance and components imported by Defence Ministry PSUs, enhancing self-reliance in defence production.

- Drugs/Medicines: Duty on 17 drugs listed in notification No. 45/2025-Customs drops from 5% or 10% to zero. Medicines for seven rare diseases under the National Policy for Rare Disease, 2021, will also be duty-free.

- Personal Imports: Goods under Chapter 9804 for personal use will see rates standardized to a flat 10%, down from previous 10% or 20% charges.

Sectors with Increased or Modified Duties

While many sectors benefit from reductions, the budget also adjusts duties upward in specific areas to protect domestic industries:

- Chemicals: Potassium hydroxide now faces a 7.5% duty, up from zero, to support local chemical manufacturing.

- Umbrellas and Parts: Umbrellas (excluding garden types) under tariff items 6601 9100 and 6601 9900 will maintain a 20% duty or a minimum charge of ₹60 per piece, whichever is higher. Parts and accessories under tariff heads 6601 to 6602 will retain a 10% duty or ₹25 per kg, ensuring competitive pricing for domestic producers.

These comprehensive changes reflect the government's focused approach to balancing import costs with domestic industrial growth, setting the stage for enhanced economic resilience and global trade leadership in the coming years.