The global shipbuilding landscape is witnessing a significant power shift in the opening months of 2024. According to the latest industry data, South Korean shipyards have made a formidable comeback, capturing a substantial slice of new orders while China's long-standing dominance shows signs of softening.

Clarksons Data Reveals a Competitive Resurgence

Data from the renowned British shipping consultancy, Clarksons Research, paints a clear picture of this changing tide. For the period spanning January to April 2024, new ship orders placed worldwide reached an impressive 17.85 million compensated gross tons (CGT). Within this total, South Korean shipbuilders demonstrated remarkable prowess by securing orders for vessels totalling 3.56 million CGT. This achievement translates to a commanding 20 percent share of the global market for the year so far.

China's Market Share Dips Below the 50% Mark

While still the world's largest shipbuilding nation by volume, China's grip on the market has noticeably loosened. During the same four-month period, Chinese shipyards received orders amounting to 8.72 million CGT. Although this figure is substantial, it represents a market share of 48.8 percent, falling below the psychologically significant 50 percent threshold. This development marks a notable shift from China's previously more dominant position and indicates a more competitive and balanced international shipbuilding arena.

The remaining global orders, approximately 31.2 percent, were distributed among other shipbuilding nations. This includes a notable contribution from Japanese shipbuilders, who have also been active in securing new contracts.

A Surge in Order Backlogs and Future Implications

The flurry of new orders has directly impacted the order backlogs held by major shipbuilding countries, which is a key indicator of future workload and revenue. As of the end of April 2024, the global backlog of ships awaiting construction stood at a robust 129.54 million CGT. South Korea's share of this future pipeline is strong at 23.2 percent, equivalent to 30.07 million CGT. China continues to hold the largest backlog, accounting for 55.5 percent of the global total, which amounts to 71.87 million CGT.

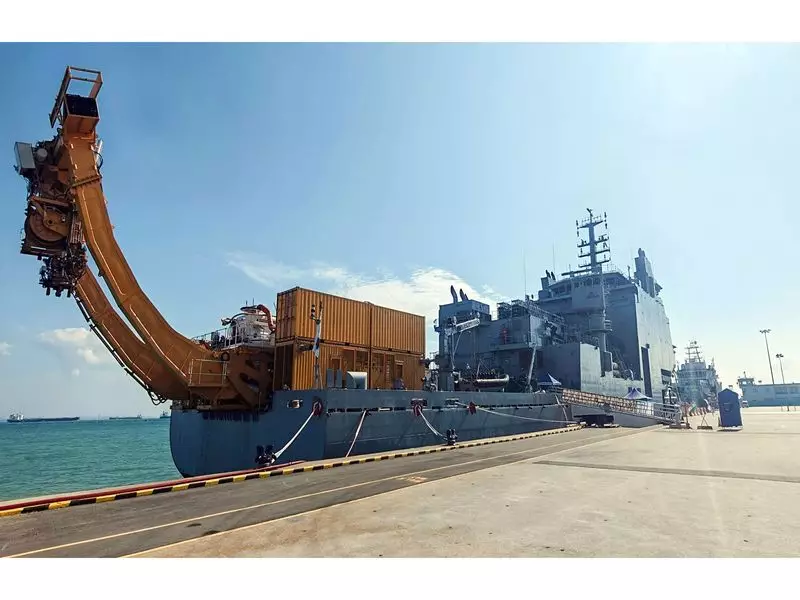

Industry analysts point to several factors behind South Korea's strong performance. Korean shipbuilders have strategically focused on securing orders for high-value, technologically advanced vessels, such as liquefied natural gas (LNG) carriers and very large container ships. This specialization allows them to compete effectively despite higher costs. Meanwhile, China's slight dip in market share could reflect a temporary adjustment in order flow or increased competition in standard vessel segments.

The resurgence of South Korea and the sustained, though slightly diminished, output from China signal a dynamic and fiercely competitive global shipbuilding industry. This rivalry is likely to drive further innovation and efficiency as both nations vie for leadership in one of the world's most critical heavy industries. For global shipping companies, this competitive environment may offer more choices and potentially better terms when commissioning new vessels.