The Indian stock market is witnessing another blockbuster IPO as Groww, the popular fintech platform, opens its public offering for subscription. The much-anticipated debut has created significant buzz among investors, with early indicators showing strong market sentiment.

Groww IPO: Grey Market Premium Signals Strong Demand

On the first day of subscription, Groww's grey market premium (GMP) has been trading at impressive levels, indicating robust investor interest. The GMP, which reflects the premium investors are willing to pay over the issue price in unofficial trading, suggests the IPO might see substantial listing gains.

Subscription Status: Day 1 Performance

Early subscription data reveals healthy participation across investor categories. Retail investors, who have been Groww's core user base, are showing particular enthusiasm for the offering. The subscription numbers are being closely monitored as they provide crucial insights into market sentiment.

Key IPO Details Every Investor Should Know

- Price Band: The company has set an attractive price band that aims to balance valuation with investor appetite

- Lot Size: Retail investors can participate with manageable lot sizes, making it accessible to smaller investors

- Offer Structure: The IPO comprises fresh issue and offer for sale components

- Listing Exchanges: Shares are expected to list on both major Indian stock exchanges

Expert Analysis: Should You Apply for Groww IPO?

Market analysts are divided on the IPO, with some highlighting Groww's strong growth trajectory and market position, while others express concerns about valuation and profitability. The company's journey from a mutual fund platform to a comprehensive investment app has been remarkable, but investors should carefully consider several factors:

- Growth Metrics: User base expansion and revenue growth trends

- Market Position: Competitive landscape in the fintech space

- Financial Health: Profitability timeline and cash flow situation

- Valuation: Comparison with peers and growth justification

What Makes Groww IPO Special?

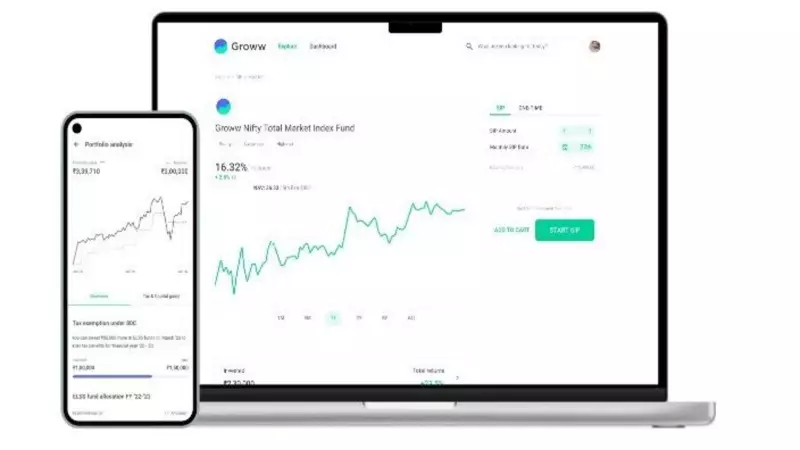

Groww has revolutionized how young India invests, making stock market participation accessible to millions of first-time investors. The platform's user-friendly interface and educational content have democratized investing in a country where traditional brokerage services were often intimidating for newcomers.

The Road Ahead: As the IPO subscription progresses, all eyes will be on the final subscription numbers and institutional investor participation. The outcome of this IPO could set the tone for other fintech companies waiting in the wings to go public.

Investors are advised to read the red herring prospectus carefully, understand the risk factors, and consult with financial advisors before making investment decisions. The IPO market can offer significant opportunities, but it's crucial to align investments with individual financial goals and risk appetite.