Pune Municipal Corporation Proposes 10% Property Tax Increase to Boost Revenue

The Pune Municipal Corporation (PMC) administration has put forward a proposal to raise property tax by 10% as a measure to enhance municipal revenue. This significant move is set to be discussed and potentially approved at a standing committee meeting scheduled for Monday, according to civic officials. The decision comes at a time when the standing committee is composed solely of civic officials, as the new general body of elected corporators has not yet been formed, adding a layer of administrative urgency to the proceedings.

Citizen Groups Voice Strong Opposition to Tax Hike

In response to the proposal, various citizens' groups and activists in Pune have expressed strong opposition, arguing that the administration should focus on intensifying efforts to recover outstanding dues from tax defaulters rather than imposing additional burdens on compliant taxpayers. Prashant Badhe of Aple Pune, Apala Parisar, a prominent citizen group, emphasized that revenue generation is feasible through the recovery of dues from major defaulters. He stated, "There are many big tax defaulters. Revenue generation is possible if their dues are recovered."

Echoing this sentiment, Vivek Velankar of Sajag Nagrik Manch highlighted the unfairness of burdening diligent taxpayers. He remarked, "The civic body should make sure the property owners who pay the tax are awarded, but instead it is imposing more tax on them." This criticism underscores a growing frustration among residents who feel penalized for their compliance while defaulters evade consequences.

PMC Data Reveals Massive Unrecovered Dues and Revenue Targets

According to PMC data, the corporation is facing a substantial challenge with approximately Rs 7,000 crore in dues yet to be recovered. These outstanding amounts stem from various sources, including:

- Mobile towers

- Double taxes

- Disputed tax claims

- Taxes on government properties

In its budget for the financial year 2025-26, the civic administration set an ambitious target of generating Rs 2,800 crore in revenues. So far, around Rs 2,200 crore has been collected, indicating a shortfall that has prompted the consideration of a tax hike. Civic officials have noted that recovery drives have been conducted, and under an amnesty scheme that ended on January 15, approximately Rs 713 crore was recovered from tax defaulters over two months. This scheme has now been extended by an additional month to further aid recovery efforts.

A civic official explained the rationale behind the amnesty scheme, stating, "Since the 2% compound interest-like penalty levied monthly exceeded the original tax amount, an amnesty scheme was introduced." This move aimed to incentivize defaulters to clear their dues without facing excessive penalties.

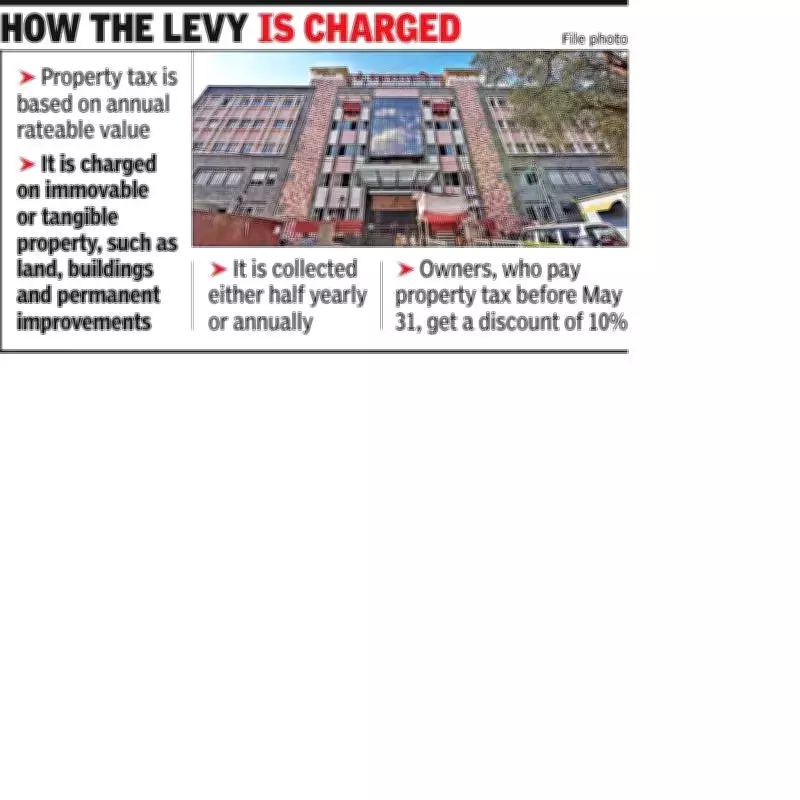

Property Tax as a Key Revenue Source Post-Octroi Abolition

With the abolition of Octroi and local body tax, the Pune Municipal Corporation finds itself with limited options for revenue generation, making property tax a critical financial pillar. Within the corporation limits, nearly 14.5 lakh properties are liable to pay tax, with commercial properties subjected to higher rates compared to residential ones. This structural reliance on property tax underscores the administration's push for a hike amid revenue constraints.

In a past initiative to reward compliance, the PMC in 2022-23 awarded diligent taxpayers with prizes worth Rs 1 crore, selected through a lottery system. However, this program was discontinued afterward, and there is a growing public demand for its revival as a means to encourage timely tax payments and recognize responsible citizens.

The proposed tax hike, therefore, sits at the intersection of fiscal necessity and public discontent, highlighting the ongoing challenges in municipal governance and revenue management in Pune.