Gujarat's real estate landscape is undergoing a fundamental transformation, moving away from traditional land purchases towards collaborative partnership models. Driven by skyrocketing land costs and new business strategies, redevelopment and joint development projects are rapidly gaining ground across the state, reshaping urban skylines and investment patterns.

Data Reveals a Surging Trend

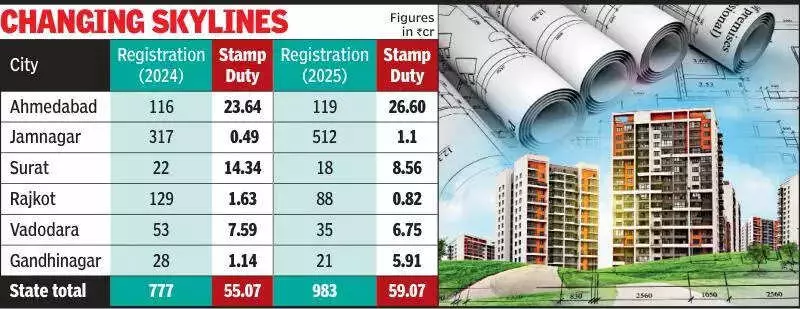

Official government statistics paint a clear picture of this accelerating shift. In the year 2024, a total of 777 redevelopment and joint development agreements were formally registered across Gujarat. This activity generated a substantial Rs 55 crore in stamp duty revenue for the state exchequer.

The momentum has only increased in the current year. As of November 30, 2025, the number of registered agreements has jumped to 983. This higher volume has also translated into greater revenue, with stamp duty collections crossing Rs 59 crore. This consistent year-on-year growth underscores the sustained and rising interest in these partnership-led real estate ventures.

Ahmedabad Leads the Charge in Urban Redevelopment

At the forefront of this change is Ahmedabad, Gujarat's major metropolitan hub. The city recorded 116 development agreements in 2024, contributing a significant Rs 23.64 crore in stamp duty. In 2025, the pace has remained robust with 119 agreements already registered, pushing stamp duty collections even higher to Rs 26.60 crore.

Industry experts indicate that a large portion of Ahmedabad's agreements are tied to the redevelopment of old housing societies. This trend is revitalizing existing neighborhoods and optimizing land use in prime city areas.

Why Builders and Landowners are Choosing Partnership

The primary catalyst for this trend is the prohibitive cost of land. Instead of undertaking massive capital expenditures to purchase plots outright, developers are increasingly opting for joint development arrangements. In this model, they partner with landowners, sharing both the risks and the eventual profits of the project.

For landowners, this approach offers a far more lucrative outcome than a simple land sale. "Landowners may receive money slightly later, but they earn 20–25% more compared to a direct land deal. In premium locations, their share from project sales is substantially higher," explained Taral Shah, a city-based developer.

Tejas Joshi, President of CREDAI Gujarat, highlights the growing clarity and confidence in such projects. "Redevelopment projects are increasing in Ahmedabad because there is much more clarity today—for both buyers and developers," he said. Joshi also pointed out that targeted incentives, like lower premiums on Floor Space Index (FSI) for redevelopment, could further accelerate this trend and dramatically alter city skylines.

From a legal perspective, the framework is also well-defined. Advocate Ravi Shah noted that societies entering redevelopment sign agreements attracting a stamp duty of 3.5% and a 1% registration fee, calculated on the government's jantri value of the land and proposed construction.

Key Data from Major Gujarat Cities (2024 vs 2025):

- Ahmedabad: 116 registrations (Rs 23.64 Cr duty) → 119 registrations (Rs 26.60 Cr duty)

- Jamnagar: 317 registrations (Rs 0.49 Cr duty) → 512 registrations (Rs 1.10 Cr duty)

- Surat: 22 registrations (Rs 14.34 Cr duty) → 18 registrations (Rs 8.56 Cr duty)

- Rajkot: 129 registrations (Rs 1.63 Cr duty) → 88 registrations (Rs 0.82 Cr duty)

- Vadodara: 53 registrations (Rs 7.59 Cr duty) → 35 registrations (Rs 6.75 Cr duty)

- Gandhinagar: 28 registrations (Rs 1.14 Cr duty) → 21 registrations (Rs 5.91 Cr duty)

The collective move towards joint development and redevelopment marks a strategic evolution in Gujarat's real estate sector. It represents a win-win model that unlocks the value of underutilized land for owners while providing developers with viable projects in high-demand areas, ultimately fueling the state's urban transformation.