Bhubaneswar Transforms into India's Premier Real Estate Investment Destination

Once celebrated primarily as a temple city, Bhubaneswar is now capturing national attention as India's most promising real estate market. Recent comprehensive market data reveals that the capital of Odisha has surpassed traditional real estate powerhouses like Mumbai and Delhi in delivering substantial long-term returns on property investments.

Impressive Performance Metrics Across Multiple Timeframes

The National Housing Bank's RESIDEX, which serves as India's first official housing price index (HPI), has documented Bhubaneswar's residential market achieving an annual capital appreciation ranging from 6% to 10%. This growth is complemented by rental yields averaging between 2% and 3%. This performance has positioned the city ahead of several tier-I metropolitan areas, where appreciation rates have slowed to just 3% to 5% in recent years.

A detailed assessment covering the period from September 2015 to September 2025 highlights Bhubaneswar's remarkable achievement of recording the highest returns at 148.3% over the ten-year span. Following closely are Ahmedabad with 147.3%, Gandhinagar at 145.6%, Gurgaon with 131.2%, and Greater Noida at 125.2%. In contrast, Bengaluru remained below the 100% threshold. Mumbai managed returns of only 35-45%, while Delhi recorded a modest 10-15%, primarily due to extended periods of stagnation and various regulatory challenges.

When examining the five-year assessment period, Bhubaneswar secured third place with returns of 57.7%. During this timeframe, Gurgaon and Greater Noida led the rankings with 94.1% and 76.1%, respectively. A similar evaluation over a three-year window confirms Bhubaneswar's status as a consistently strong performer in the real estate sector.

Driving Forces Behind Bhubaneswar's Real Estate Boom

Real estate experts attribute this significant growth to the city's smart city initiatives, which have facilitated large-scale infrastructure upgrades. These enhancements include substantial city expansion and improved connectivity, both of which have significantly boosted investor confidence. Additionally, the proliferation of IT parks and universities is fueling increased demand for both housing and rental properties.

Sangram Nayak, a prominent city-based real estate developer, emphasized, "Bhubaneswar is indeed an emerging tier-II city in the country. Real estate development in recent times is significant. Huge investment is being pumped in, which is evident from the rapid development of high-rises. Smart city and IT development are key factors of the growth."

Sameer Jena, a respected real estate analyst, pointed out that affordability plays a crucial role in attracting buyers to cities like Bhubaneswar. He explained, "Compared to sky-high prices in Mumbai or Delhi, Bhubaneswar offers accessible entry points for middle-class buyers and also first-time investors."

Broader Trends and Future Prospects

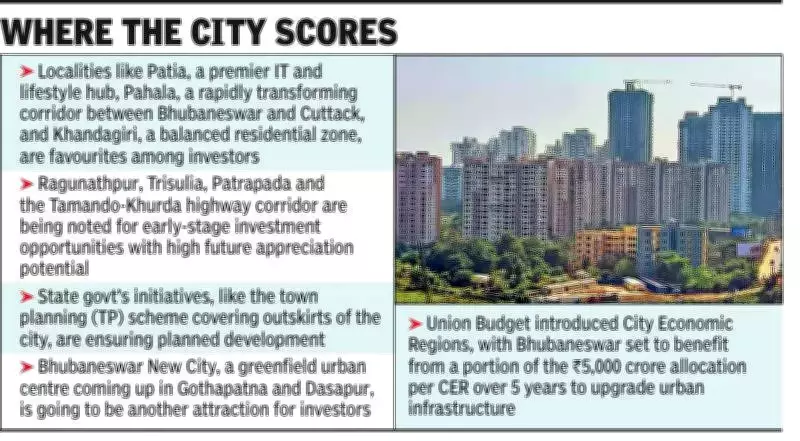

Industry experts believe that Bhubaneswar's steady growth reflects a broader national trend where tier-II cities are increasingly becoming preferred investment destinations. The recent announcement of the Capital Economic Regions (CER) in the Union Budget is expected to further enhance Bhubaneswar's reputation as a favored location for real estate investment.

However, urban planners have issued cautions regarding the potential challenges associated with rising property prices. Dipu Nanda, an experienced urban planner, warned, "Balanced development will be key to ensure Bhubaneswar's growth benefits all sections of society. The current situation will only be beneficial for higher income groups."

This transformation of Bhubaneswar from a cultural hub to a real estate powerhouse underscores the shifting dynamics of India's property market, where emerging cities are offering lucrative opportunities that challenge the dominance of traditional metropolitan centers.