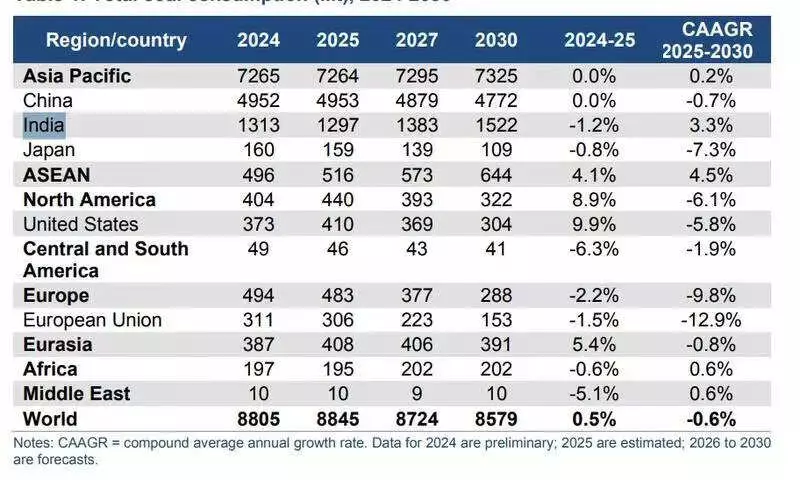

A new report from the International Energy Agency (IEA) projects a significant yet evolving trajectory for coal consumption in India. The nation's overall coal demand is expected to grow by approximately 17% by the year 2030, reaching a substantial 1,522 million tonnes (MT). This growth, however, masks a pivotal shift in the sources of demand, with industries like steel and cement taking a leading role.

Power Sector Slowdown vs. Industrial Surge

The report highlights a nuanced picture for 2025. While total coal consumption is forecast to see a marginal decline of 1.2% year-on-year to 1,297 MT, this dip is largely attributed to a temporary slowdown in coal-fired power generation. Factors like higher hydropower output following an extended monsoon, lower cooling demand, and the relentless expansion of renewable capacity are expected to reduce coal-based power generation by around 3% this year.

Despite this, coal remains the bedrock of India's electricity system, accounting for an estimated 940 MT, or 73% of total coal demand in 2025. The government's push for 500 GW of non-fossil capacity by 2030 is making headway. However, in a parallel development, India commissioned or began trial operations for 20 new coal-fired power plants in 2025 alone, adding about 14 GW of capacity, with more under construction.

Non-Power Industries Become Key Growth Driver

The most striking trend identified by the IEA is the rising share of non-power coal consumption. This segment, which fuels core industries such as steel and cement, is estimated at 356 MT in 2025 and is projected to surge to around 470 MT by 2030.

Growth in coal demand for 2025 is largely attributable to these non-power uses, fueled by sustained industrial activity, fuel switching, and strong infrastructure development. This shift allows non-power coal to capture a larger portion of total demand and remain a principal driver of India's industrial growth throughout this decade.

The Evolving Energy Mix and Future Outlook

India's installed power generation capacity stood at approximately 505 GW as of October 2025. The fossil fuel segment accounted for 246 GW of this, including 218 GW from coal, 20 GW from gas, and 7 GW from lignite.

Looking ahead, coal's dominance in the power mix is expected to gradually recede, projected to fall from about 70% in 2025 to 60% by 2030 as renewable and nuclear generation expand. Electricity demand is forecast to rise modestly in 2025, but increased renewable and hydropower output will likely cap near-term growth in coal-fired generation. Over the medium term, however, coal consumption for power is still projected to increase moderately in line with the nation's rising electricity needs.

The IEA report underscores a dual reality for India: a determined march towards renewable energy goals, coupled with the enduring, albeit changing, role of coal in powering both its grid and its industrial engine.