Ahmedabad Tobacco Market in Turmoil Ahead of Major Tax Overhaul

With just days remaining before a significantly stricter tax regime takes effect on February 1, 2026, cigarettes, pan masala, and various other tobacco products have virtually vanished from retail shelves throughout Ahmedabad. This sudden disappearance has triggered rampant black market activity and inflated pricing across the city as traders scramble to maximize profits ahead of the impending levy hike.

Retailers Bear Brunt of Supply Crunch

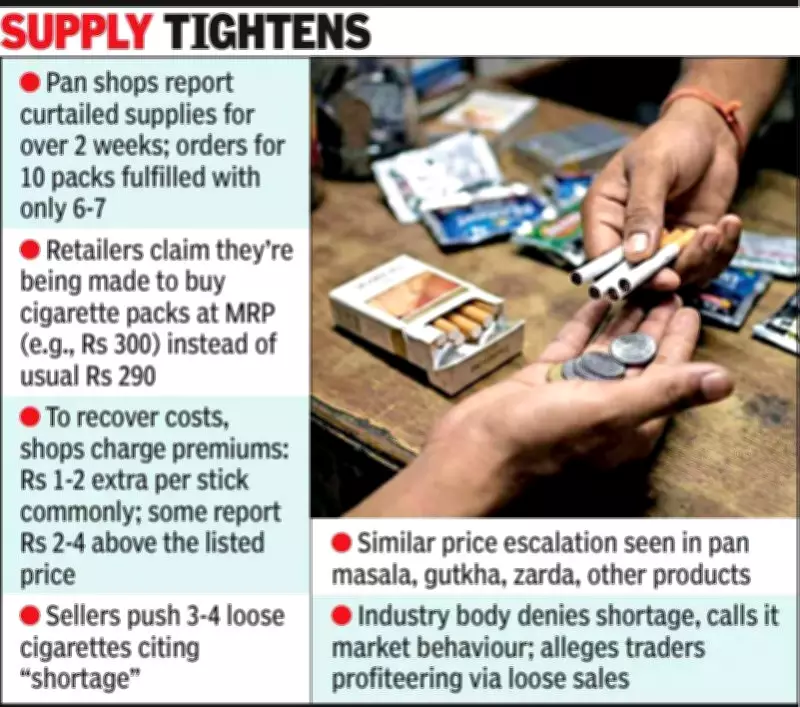

Pan shop owners across Ahmedabad report that supplies of most tobacco products, including cigarettes and pan masala, have been severely curtailed over the past two weeks. Bharat Vaghela, a local pan shop owner, explained that retailers are absorbing the heaviest impact of this supply crunch. "For the past two weeks, we have been forced to procure stock at maximum retail price, which has completely eroded our margins," he stated.

Vaghela detailed the difficult choices retailers face: "For our regular customers, we absorb the losses and sell at normal rates, while others are being charged Rs 1-2 extra per stick just to keep our businesses viable. The situation has become so dire that even when we place orders for 10 packets, we receive only six or seven due to short supply."

Consumers Face Premium Pricing and Limited Availability

Consumers throughout Ahmedabad report that pan shop owners are increasingly reluctant to sell full cigarette packets, citing acute shortages. Nayan Patel, a sales executive, shared his experience: "If I ask for a pack, I am offered only three or four loose cigarettes. Plus, Rs 2 is being charged extra per stick."

Industry sources reveal the financial mechanics behind these price increases. Typically, when a retailer purchases a pack of cigarettes with a maximum retail price of Rs 300, the cost price hovers around Rs 290, providing a modest margin of Rs 10 per pack. Currently, despite no official increase in tobacco prices, numerous retailers allege that distributors and wholesalers are compelling them to procure the same pack at prices equal to or even slightly above the MRP.

This means retailers are effectively paying Rs 10 more per pack even before any revised tax rates come into effect. To recover this additional procurement cost, retailers are selling cigarettes at a premium above the printed MRP. In many instances, individual sticks are being sold at Rs 2-4 above the listed price. A similar pattern of price escalation and artificial scarcity has emerged in the sale of pan masala, gutkha, and other tobacco products across Ahmedabad.

Major Taxation Framework Overhaul Explained

Tax expert Monish Bhalla clarified the upcoming changes: "The government has introduced a much stricter and more comprehensive taxation framework for pan masala, tobacco, gutkha, chewing tobacco, zarda scented tobacco, cigarettes and allied products effective from February 1, 2026. The primary objective behind this overhaul is to eliminate issues of under-valuation, revenue leakage and misuse of input tax credit mechanisms by decisively shifting the tax base to the retail sale price and capacity-based production metrics, instead of transaction value or actual clearances."

Bhalla added that the tobacco industry will once again fall under central excise jurisdiction, alongside GST and cess. "Manufacturers will pay tax based on machine capacity, which will substantially increase their tax liability. Prior to the GST rollout, excise duty was applicable on tobacco products, and it will now return in addition to GST and cess," he explained.

Detailing the revised valuation method, Bhalla noted: "GST will no longer be calculated on invoice value or dealer price, but on the MRP printed on the package. The retail sale price (RSP) includes all taxes, cess, duties, freight, dealer margin and other charges. If more than one RSP is printed on a package for different markets, the highest RSP will be applied."

Industry Representatives Dispute Shortage Claims

Despite widespread reports of scarcity, industry representatives contest claims of a supply crunch, attributing the situation to market behavior rather than actual stock availability. Sanjay Joshi, national president of the All-India Pan Masala, Gutkha Wholesalers' & Retailers' Association, denied any supply disruption.

"There is no shortage in the market. Adequate stock is available with both wholesalers and retailers. In fact, ahead of February 1, many traders procured additional stock to avoid higher procurement costs after the tax rate hike," Joshi asserted.

However, multiple sources indicate that some traders, seeking to profit ahead of the tax change, are supplying loose cigarettes, pan masala and other tobacco products instead of properly sealed packs, often at inflated prices, exploiting consumer demand during this transitional period.

Market Dynamics Create Perfect Storm

The current situation in Ahmedabad represents a complex interplay of factors:

- Pre-tax hike stockpiling by traders seeking to avoid higher procurement costs

- Artificial scarcity created by distributors and wholesalers

- Black market emergence with premium pricing for available products

- Consumer frustration over limited availability and increased costs

- Retailer margin compression forcing difficult pricing decisions

As February 1 approaches, Ahmedabad's tobacco market remains in a state of flux, with consumers, retailers, and distributors all navigating the uncertain terrain created by the impending tax overhaul. The coming weeks will reveal whether the new taxation framework achieves its stated objectives of reducing revenue leakage and creating a more transparent system, or whether current market disruptions foreshadow ongoing challenges in the tobacco sector.