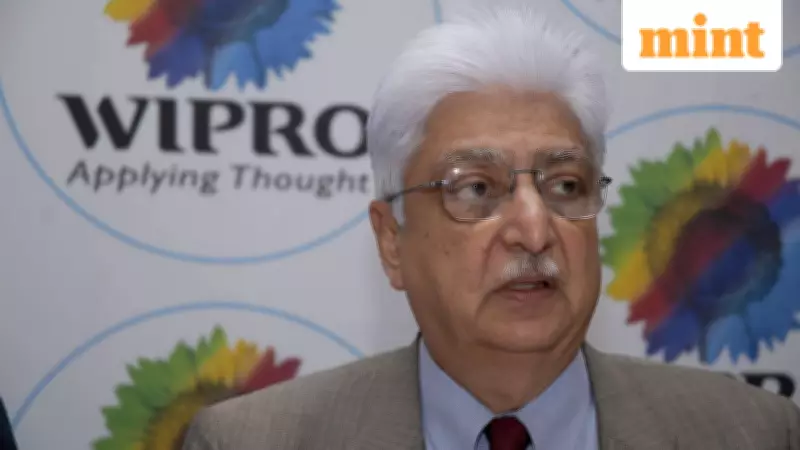

In a significant strategic move, Premji Invest, the family office of Wipro founder Azim Premji, is set to acquire a substantial 23% stake in JS Auto Cast Foundry India Pvt. Ltd., a subsidiary of the renowned automotive components manufacturer Bharat Forge. The transaction, valued at ₹300 crore, was disclosed through stock exchange filings by the Baba Kalyani-backed firm, with completion targeted by March 31, 2026.

Investment Details and Strategic Objectives

JS Auto, a fully-owned step-down subsidiary of Bharat Forge, specializes in supplying ferrous castings for a wide range of industrial and automotive applications. The investment will be executed through the infusion of primary capital into the company, facilitated by the PI Opportunities Fund I Scheme II, an alternate investment fund managed by Premji Invest. This capital injection is earmarked for enhancing medium casting capacity and actively pursuing acquisition opportunities within the industry, positioning JS Auto for accelerated growth and market expansion.

Transaction Terms and Non-Compete Clause

As part of the transaction terms, Premji Invest will be bound by a non-compete clause, restricting it from engaging in the ferrous casting business within India. However, the investment firm retains the flexibility to explore casting-related investments outside the country, with JS Auto holding the first right of rejection on such ventures. This arrangement underscores a collaborative approach while safeguarding JS Auto's competitive interests in the domestic market.

Background and Financial Performance

This transaction follows Bharat Forge's acquisition of Coimbatore-based JS Auto in July 2022, which was valued at an enterprise valuation of ₹490 crore. Since then, JS Auto has demonstrated robust financial performance, with revenues just under ₹700 crore in FY25, contributing approximately 5% to Bharat Forge's consolidated topline for that year. According to Amit Kalyani, vice-chairman and joint managing director of Bharat Forge, the company has achieved impressive growth metrics post-acquisition, including a compound annual growth rate (CAGR) of 17% in topline, 24% in exports, and 25% in profitability, alongside improvements in product mix and customer base.

Strategic Vision and Market Impact

Manoj Jaiswal, partner at Premji Invest who leads the firm's industrials and buyout investments, emphasized that collaborating with leading conglomerates on their growth and consolidation journey is a key strategic pillar for the investment firm. He expressed optimism about building a leading ferrous casting platform in India through this partnership. The announcement had a positive impact on the market, with Bharat Forge shares surging nearly 5% to close at ₹1,443.85 on the BSE, outperforming the benchmark Sensex, which recorded a 1.2% gain on the same day.

Broader Context and Premji Invest's Profile

Premji Invest, with assets under management totaling $14 billion, continues to make strategic bets in diverse sectors, reflecting its commitment to fostering innovation and growth in the Indian economy. This investment in JS Auto aligns with its focus on industrial sectors and buyout opportunities, leveraging the expertise of established players like Bharat Forge to drive value creation and industry consolidation.