In a significant move for India's financial sector, the Parliament has given its final approval to the crucial Insurance Amendment Bill. This legislative action, finalized on 17 December 2025, sets the stage for comprehensive reforms in the country's insurance landscape.

What Does the Bill Amend?

The newly passed bill is not a standalone law but an instrument to modify three pivotal pieces of legislation that have governed the insurance industry for decades. The amendments will directly alter the Insurance Act of 1938, the Life Insurance Corporation (LIC) Act of 1956, and the Insurance Regulatory and Development Authority (IRDA) Act of 1999. Together, these three laws form the bedrock of insurance regulation, public sector life insurance, and the powers of the sector's watchdog.

Implications for the Insurance Sector

The passage of this bill marks a historic step towards modernizing India's insurance framework. While the specific details of the amendments are to be formally notified, such a sweeping change typically aims to enhance policyholder protection, increase market efficiency, and provide greater operational flexibility to insurers. Amendments to the LIC Act are particularly noteworthy, as they could redefine the functioning of the country's largest life insurer in the post-disinvestment era.

Similarly, changes to the IRDA Act 1999 may empower the regulator with new tools to oversee a rapidly digitizing and expanding market. Updating the decades-old Insurance Act of 1938 is expected to align the sector with contemporary global practices and address emerging risks.

The Road Ahead for Insurance in India

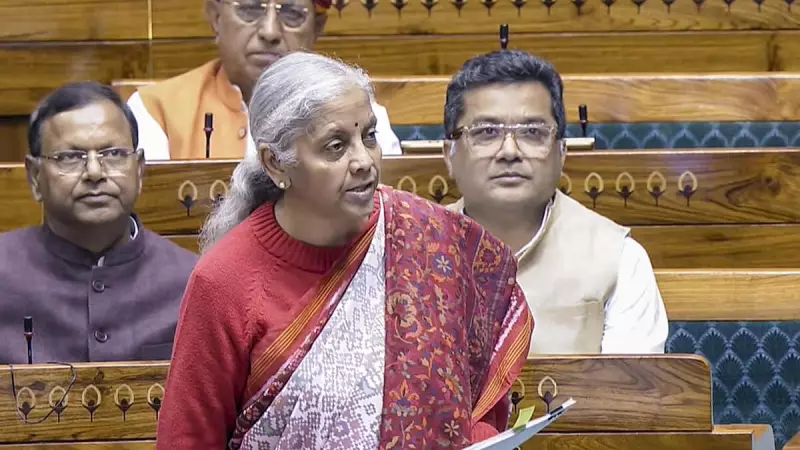

The parliamentary nod, reported by Gyanendra Keshri, is the culmination of a legislative process aimed at revitalizing the insurance sector. This reform is poised to have far-reaching consequences for millions of policyholders, insurance companies, and investors. The amendments are likely to foster a more robust, competitive, and consumer-friendly insurance ecosystem in India, potentially increasing insurance penetration and financial inclusion.

The government's move underscores its commitment to updating legacy laws to fuel growth in a critical segment of the economy. All stakeholders will now keenly await the official gazette notifications detailing the precise changes to each of the three amended acts.