CM Naidu Urges Banks to Boost Lending for Inclusive Growth in Andhra Pradesh

Chief Minister N Chandrababu Naidu on Friday emphasized that no resident of Andhra Pradesh should be forced to borrow from private lenders. He called upon banks to ensure accessible loan facilities for all sectors, including agriculture, micro, small, and medium enterprises (MSMEs), and startups. Naidu made these remarks while chairing the 233rd and 234th State-Level Bankers' Committee (SLBC) meetings at the state secretariat in Vijayawada.

Focus on Inclusive Economic Progress

During the meeting, Naidu urged bankers to increase credit allocation to MSMEs operated by backward classes (BC), scheduled castes (SC), and scheduled tribes (ST) communities. This move aims to foster inclusive economic development across the state. Bankers provided a review of the annual credit plan implementation for 2025-26, revealing significant disbursements:

- Loans worth Rs 2.96 lakh crore have been issued to agriculture and allied sectors, including Rs 1,490 crore specifically to tenant farmers.

- MSMEs have received Rs 95,714 crore in loans, highlighting the sector's growing financial support.

Job Creation and MSME Strengthening

Naidu identified job creation as the government's top priority and stressed the need for enhanced support to the MSME sector, which holds immense potential for generating employment. He noted that strengthening MSMEs would boost the state's economy. The government is advancing with the 'One Family – One Entrepreneur (OFOE)' approach, with a particular focus on bolstering the services sector.

Funding for Renewable Energy and PPP Projects

The Chief Minister also directed banks to increase lending to the renewable energy sector, citing focused efforts by both the central and state governments. He mentioned that DISCOMs are providing counter guarantees to facilitate this initiative. Additionally, Naidu emphasized funding for public-private partnership (PPP) projects, noting that the central government is prepared to offer viability gap funding (VGF) for such ventures.

Development of Amaravati and Financial Sector Hub

Naidu outlined plans to develop Amaravati as a hub for finance-sector institutions and urged bankers to expedite works for projects where foundation stones were recently laid. He highlighted the importance of streamlining financial operations to support this vision.

Strengthening Farmer Producer Organisations and Resolving Issues

Naidu underscored the need to strengthen Farmer Producer Organisations (FPOs), modeled on DWCRA groups. He appealed to bankers to consider waiving or reducing 15 types of charges currently imposed on DWCRA accounts. Furthermore, he urged resolution of technical issues in providing loans for TIDCO houses, which were neglected during the previous administration.

Land Records and QR Code Integration

With land records being cleansed and pattadar passbooks with QR codes being issued, Naidu assured that proper documentation should no longer hinder loan issuance. He suggested that bankers explore using QR codes for bank accounts to enhance efficiency and transparency.

Support for Startups and Innovation Hubs

The meeting also discussed support for startups. Bankers informed Naidu that various banks are assisting entrepreneurs through the Ratan Tata Innovation Hub (RTIH). Key collaborations include:

- Union Bank supporting the hub's headquarters in Amaravati.

- State Bank of India (SBI), Bank of Baroda, Canara Bank, Punjab National Bank, Indian Bank, and HDFC supporting spokes in Rajahmundry, Anantapur, Visakhapatnam, Tirupati, and Vijayawada, respectively.

Meeting Attendees and Future Directions

The SLBC meeting was attended by ministers Payyavula Keshav and Kondapalli Srinivas, Chief Secretary K Vijayanand, the Managing Director of Union Bank, RBI regional officials, NABARD representatives, directors of the National SC/ST Commission, and officials from various banks. Naidu directed that district collectors be invited to future SLBC meetings to ensure broader participation and localized insights.

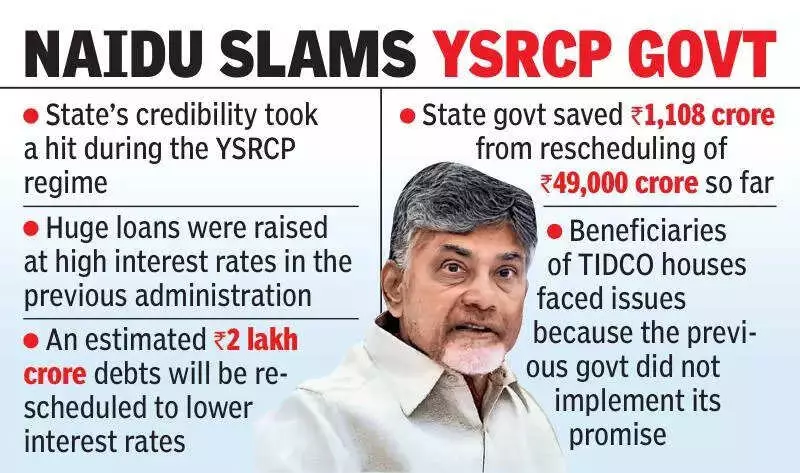

Addressing Past Challenges and Restoring Credibility

Naidu addressed challenges from the previous YSRCP regime, noting that the state's credibility suffered due to high-interest loans. He highlighted efforts by the NDA government to restore Andhra Pradesh's brand and improve its financial standing. Key measures include:

- Rescheduling an estimated Rs 2 lakh crore in debts to lower interest rates.

- Achieving savings of Rs 1,108 crore from the rescheduling of Rs 49,000 crore so far.

- Addressing issues faced by TIDCO house beneficiaries due to unfulfilled promises by the previous government.