The Gujarat High Court has stepped into a major banking controversy after a couple from Rajkot alleged that gold ornaments worth a staggering Rs 1.15 crore, pledged by them for loans, went missing from the custody of a nationalized bank. The court has issued notices to the Centre, the Reserve Bank of India (RBI), and the Indian Bank, seeking their responses.

What Happened: The Missing Jewel Pocket

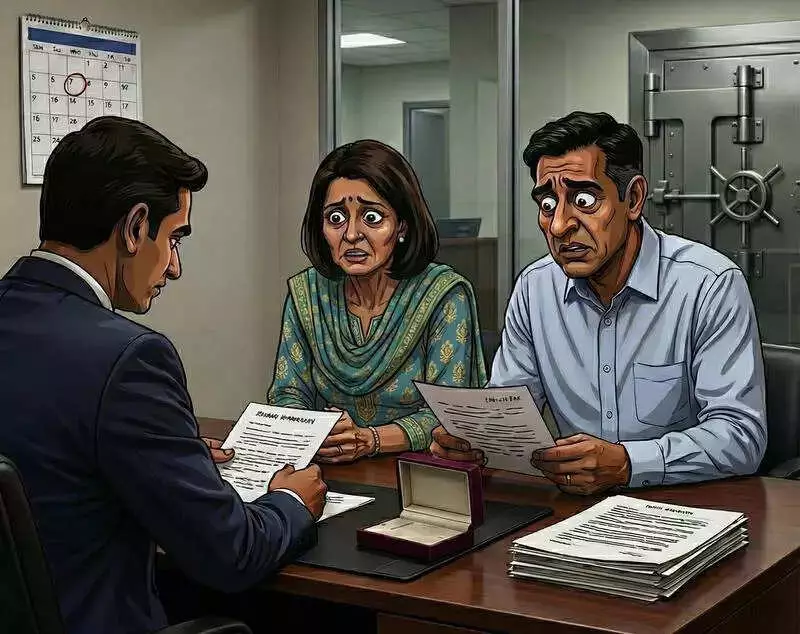

The petitioners, Sangeeta Shah and Shyam Shah, had availed two MSME jewel loan facilities in 2023 from the Rajkot branch of Indian Bank. To secure these loans, they pledged a significant quantity of jewellery weighing 1004.1 grams of 22-carat gold, which included precious ornaments and gemstones. The total market value of this pledged collateral was assessed at Rs 1.15 crore.

The loans were routinely renewed on an annual basis, with the bank conducting regular appraisals of the pledged gold's value. However, the situation took a shocking turn on October 28, 2025, when the couple approached the bank for renewal. The very next day, the bank informed them that it could not process the renewal because the "jewel pocket" containing their pledged ornaments was missing.

Allegations of Suppression and Coercion

According to the petition filed in the High Court, the bank disclosed that the ornaments had been missing since March 2025. A police complaint was filed by the bank in July of the same year, though no First Information Report (FIR) had been registered at the time of the court hearing. The couple's advocate, Nimit Shukla, argued that the bank deliberately suppressed this critical information for several months.

During this period, the bank continued to demand and accept interest payments on the loans. The petitioners claim this action was a clear breach of the bank's duty of care towards its customers. The situation escalated when the bank began threatening to classify their loan accounts as Non-Performing Assets (NPA), imposed penal charges, and their credit scores started getting negatively affected.

In their representation dated November 5, 2025, the couple highlighted the bank's negligence and claimed reimbursement for the lost gold, making charges, and the value of the gemstones. The bank, while admitting the loss in writing, asked them to submit a reimbursement claim, quoting a reference rate of Rs 10,813 per gram for 24-carat gold.

Legal Battle and Court's Intervention

The petition contends that the bank's actions, including the suppression of information and subsequent coercive steps, amount to an unjustified abuse of dominance. It further states that the bank's conduct is in absolute disregard for the guidelines laid down by the RBI for such situations.

The couple has sought several reliefs from the court, including:

- Directions to the Centre and RBI to take necessary action against Indian Bank.

- A directive for the bank to appropriately compensate the petitioners as per law.

- The formation of an independent vigilance committee to probe the matter.

- Complete disclosure of their loan account details and internal enquiry reports.

- An order restraining the bank from taking any coercive action against them regarding the loan accounts.

After a preliminary hearing, Justice Aniruddha Mayee issued formal notices to the Centre, the RBI, and Indian Bank. The court has asked them to file their replies by January 27, on which date the next hearing in the case is scheduled.

This case raises serious questions about the safekeeping of high-value collateral in public sector banks and the protocols followed when such assets are lost. The outcome could set a significant precedent for customer rights and bank accountability in similar disputes involving pledged assets.