Vigilant Bank Managers in Goa Thwart Major Cyber Fraud Attempts

In a remarkable display of vigilance and customer care, bank managers in Goa successfully intervened to save over ₹1 crore from being transferred to cyber fraudsters. The timely actions of these alert banking professionals prevented further financial devastation for customers who had already fallen victim to sophisticated online scams.

Digital Arrest Scam Unraveled Through Manager's Suspicion

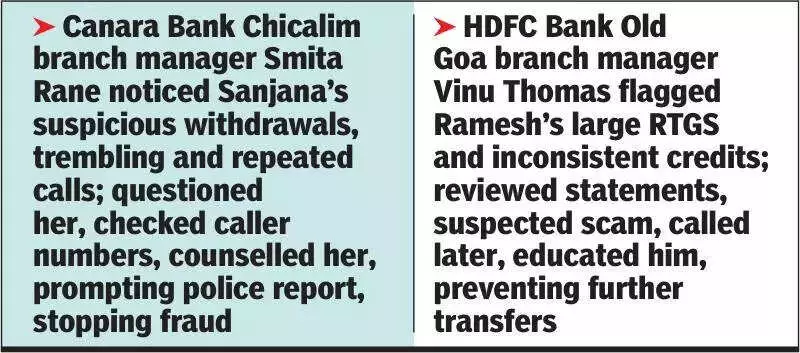

The first case involved a South Goa resident identified as Sanjana (name changed), who visited her Canara Bank branch in Chicalim to prematurely break her fixed deposit. Branch manager Smita Rane noticed something unusual when she inquired about the reason for the transaction. Sanjana claimed her sister urgently needed money, but her nervous behavior raised immediate red flags.

The following day, when Sanjana returned to open her locker and sell gold jewelry, Rane's suspicions deepened. During the bank visit, Sanjana began receiving repeated phone calls and started trembling visibly. "On being questioned, she revealed that he asked her to send money immediately," explained SP (cybercrime) Rahul Gupta.

Rane firmly requested Sanjana to disclose details and show the calling number. Investigation revealed the calls originated from cyber criminals impersonating officials from the Telecom Regulatory Authority of India and Mumbai crime branch. The fraudsters falsely claimed Sanjana's SIM card was involved in illegal activities and that she had been under digital arrest for several days.

After receiving counseling from the branch manager, Sanjana realized she was being defrauded and immediately reported the matter to police authorities.

Investment Scam Detected Through Transaction Analysis

In a separate incident demonstrating similar vigilance, HDFC Bank Old Goa branch manager Vinu Thomas became alert when customer Ramesh (name changed) attempted to make large RTGS transfers. Unlike the visibly distressed victim in the first case, Ramesh appeared calm and composed, making detection more challenging.

When questioned about the transactions, Ramesh stated he was purchasing property. However, Thomas decided to examine the bank statement more closely and noticed something concerning: credits from financial institutions indicating Ramesh had recently sold gold. This unusual pattern raised further suspicion about the nature of the transactions.

Thomas took the proactive step of contacting Ramesh later that evening to educate him about various cyber fraud schemes. "After reflecting overnight, Ramesh consulted Thomas again the next morning and confirmed that he fell victim to an investment scam," SP Gupta revealed.

The Critical Role of Banking Vigilance

These incidents highlight several important aspects of combating cybercrime:

- Customer behavior observation: Both managers paid close attention to customer demeanor and transaction patterns

- Proactive questioning: Rather than processing transactions automatically, they asked appropriate questions

- Financial pattern recognition: Thomas identified unusual transaction patterns that suggested something amiss

- Timely intervention: Both managers acted before additional funds could be transferred to fraudsters

- Customer education: Thomas took the extra step of educating his customer about cyber fraud risks

SP Rahul Gupta emphasized the significance of these interventions, noting that over ₹1 crore was saved through the managers' alertness after customers had already transferred substantial amounts to cyber criminals. The cases involved both digital arrest scams and investment frauds, representing two of the most prevalent cybercrime categories affecting Indian citizens today.

These successful interventions demonstrate how trained banking professionals can serve as crucial first lines of defense against increasingly sophisticated cyber fraud operations. Their vigilance not only prevented immediate financial losses but also helped victims recognize they were being manipulated by criminals, enabling them to report the crimes to authorities and potentially prevent others from falling victim to similar schemes.