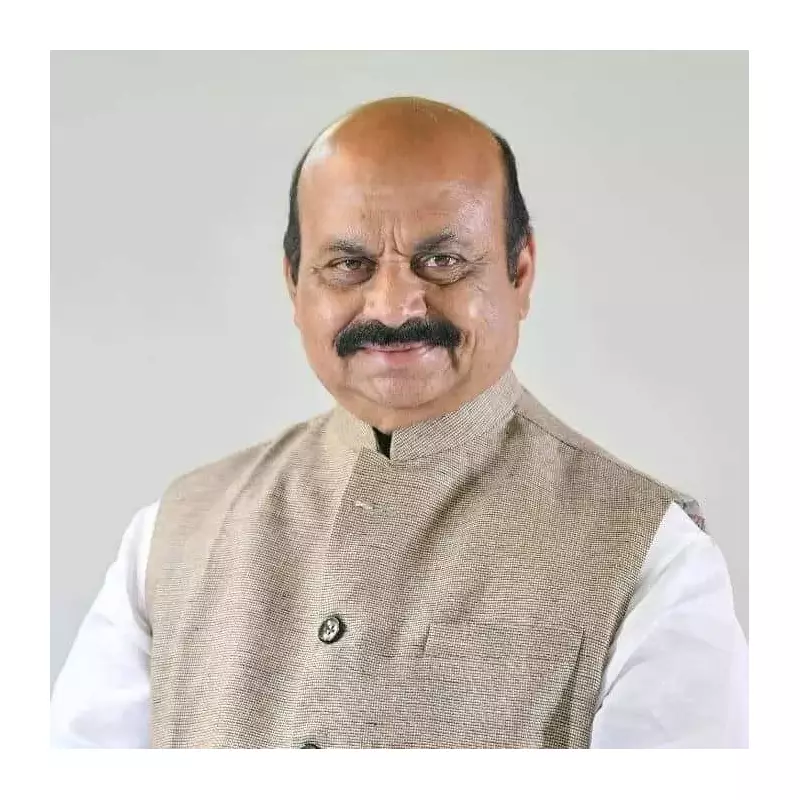

Haveri Member of Parliament Basavaraj Bommai has issued a strong directive to financial institutions, stating that banks must act as catalysts for local economic growth rather than just repositories of money. He made these remarks while chairing the District-Level Bankers' Advisory Committee (DLBAC) meeting in Gadag on Tuesday.

Banks as Engines of Local Development

Bommai emphasized that the fundamental role of banks extends beyond being mere financial intermediaries. He stressed that they are pivotal drivers of economic activity, especially at the regional level. The MP insisted that funds collected through customer deposits in the Gadag district should be utilized locally to finance development projects and businesses. This approach, he argued, is critical for reducing regional imbalances and ensuring that the area's own financial resources contribute directly to its progress.

The MP issued a clear warning to bank officials, stating that unsatisfactory performance would be flagged to the Reserve Bank of India (RBI). He conducted a thorough review of several key banking parameters, including loan disbursement rates, the status of financial inclusion initiatives, and the progress in implementing various central and state government welfare schemes.

Focus on Housing and Key Government Schemes

During the review, Bommai highlighted the transformative power of housing loans in lifting families out of poverty. He urged all banks operating in the district to prioritize the disbursement of housing loans to eligible beneficiaries. The meeting also involved a detailed assessment of major central government schemes like:

- Pradhan Mantri Jan Dhan Yojana

- Mudra Loans

- PM SVANidhi

- Kisan Credit Cards

- Loans to self-help groups

Gadag's Banking Landscape: Key Figures

Lead Bank Manager Santosh MV presented crucial data on the district's banking health. He reported that as of December 31, a total of 183 bank branches were operational in Gadag district. A particularly significant figure revealed was the credit-deposit ratio (CDR), which stood at a robust 102.2% as of September 30. A CDR above 100% indicates that banks in the district are lending out more money than they collect in deposits, a positive sign for local investment.

Furthermore, for the financial year 2025-26, banks have already disbursed loans worth Rs 2.8 crore to priority sectors, with agriculture being a major beneficiary. The meeting saw attendance from key officials including the District Commissioner (DC), the Superintendent of Police (SP), and senior representatives from NABARD, RBI, State Bank of India, and various other government departments and banks.

Bommai's push underscores a growing emphasis on ensuring that the banking sector's operations are closely aligned with grassroots economic development, making financial inclusion a tangible reality for regional growth.