Elderly pensioners across Madhya Pradesh are facing a terrifying new wave of cybercrime, losing crores of rupees in sophisticated cons known as "digital arrest" frauds. In these elaborate schemes, criminals impersonate high-ranking officials from agencies like the police, CBI, ATS, or even the Supreme Court to psychologically trap and financially devastate their victims.

The Alarming Cases: A Trail of Devastation

The trend has seen a sharp and disturbing rise, with multiple high-value cases reported in quick succession. In Jabalpur, two separate incidents within just six days highlight the scam's ruthlessness. One 72-year-old was defrauded of a staggering Rs 76 lakh after being ensnared in a fake "national security" investigation. Another man, also 72, lost Rs 21.5 lakh after scammers claiming to be from the ATS Pune kept him under constant video surveillance for three days.

The manipulation reaches another level of complexity in Bhopal. A 71-year-old retired BHEL supervisor was held in a state of digital confinement for 70 days, ultimately being forced to transfer Rs 68.3 lakh. In another heartbreaking case, a 55-year-old retired Navy Commodore was defrauded of Rs 68.49 lakh through a web of forged RBI notices, fake narcotics officers, and staged Skype hearings.

Perhaps the most audacious case involved an 85-year-old retired Military Engineer Services officer. He spent an entire week believing he was attending online Supreme Court hearings, receiving "orders" from individuals impersonating judges and Enforcement Directorate officials. This charade culminated in him transferring Rs 36 lakh to accounts in Delhi and Dibrugarh.

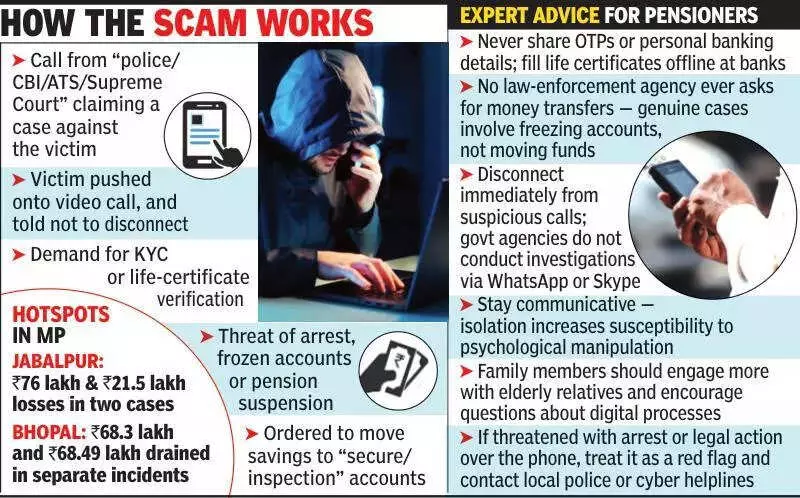

How the Scam Works: Exploiting Age and Isolation

According to police experts, the fraudsters systematically exploit specific vulnerabilities common among pensioners. Rajesh Dandotiya, Additional DCP (Crime) in Indore and author of 'Inside The Cyber Crime Files', explains the chilling methodology. "Pensioners have to submit life certificates at year-end. Cyber frauds first target these pensioners during these phases in the name of life-certificate submission," he said.

"They get access to their data on any pretext, execute small OTP-based frauds, and filter out vulnerable victims. Once they realise the victim has substantial savings and limited digital awareness, they target them further for digital arrest. Data leaks, hacked pensioner databases, and social media trails help fraudsters zero in on targets," Dandotiya added.

A Psychological Assault, Not Just a Theft

Psychiatrists emphasize that this crime is far more than a financial scam; it is a calculated psychological attack. Consultant psychiatrist Dr. Satyakant Trivedi, author of 'Overthinking Se Azadi', states, "Digital arrest is basically psychological arrest. The older generation is less aware of digital processes, often living alone, and becomes emotionally dependent on the scammer's instructions. Fraudsters trigger fear responses so intensely that the victim's decision-making collapses."

Dr. Trivedi also points to a crucial role families can play in prevention. "Elderly people stop asking questions when they are dismissed or mocked for not understanding technology. That isolation makes them more vulnerable," he warns.

Advisories and Protective Measures

With several cases amounting to over Rs 2.5 crore reported in a matter of months, cybercrime units across Madhya Pradesh have issued urgent advisories. The key recommendations for pensioners and their families include:

- Stay consistently connected with family members and inform them of any suspicious contact.

- Immediately question and verify the identity of anyone claiming to be an official over the phone.

- Never transfer money or share sensitive information under threat, no matter how convincing the impersonation seems.

- Be extremely cautious with sharing personal data, especially during life certificate submission periods.

This new form of cybercrime represents a grave threat to the financial security and mental well-being of India's elderly population, demanding heightened vigilance from both individuals and authorities.