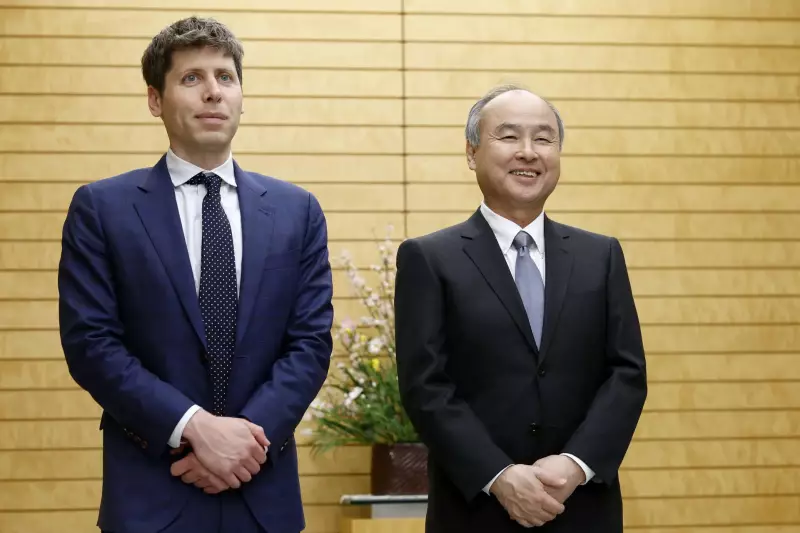

Japanese technology conglomerate SoftBank, led by billionaire Masayoshi Son, has reportedly completed its colossal $40 billion investment commitment to artificial intelligence leader OpenAI, the creator of ChatGPT. According to a CNBC report citing sources, the final portion of this staggering financial infusion was transferred just last week.

The Details of the Landmark Deal

This recent transaction, valued between $22 billion and $22.5 billion, follows two earlier direct investments of $10 billion and $8 billion. With this completed commitment, SoftBank's total ownership stake in the Microsoft-backed OpenAI now exceeds 10%. The capital injection places a pre-money valuation of a staggering $260 billion on OpenAI.

A significant part of this investment is earmarked for Project Stargate, a massive joint venture in AI infrastructure announced earlier this year. This ambitious project is a collaboration between OpenAI, SoftBank, and tech giant Oracle. To support its AI ambitions, OpenAI has also forged key partnerships with industry leaders for hardware and capacity, including:

- Nvidia and AMD for high-performance GPUs and AI accelerators.

- Broadcom for custom silicon chips.

- Oracle for cloud capacity and data centre scaling.

Funding the Future: The Cost for SoftBank

Amassing such a large war chest for AI investment required major financial moves from SoftBank. Last month, the company liquidated its entire stake in chipmaker Nvidia, worth approximately $5.8 billion. In another significant sale, SoftBank offloaded its stake in telecom operator T-Mobile for $9.17 billion.

SoftBank's Chief Financial Officer, Yoshimitsu Goto, assured that despite these sales, the company retains its financial strength. He stated that through various options and tools, SoftBank ensures it is prepared for funding in a very secure manner. The company has also recently bolstered its physical AI infrastructure by acquiring data centre investment firm DigitalBridge for $4 billion.

Masayoshi Son's Emotional Stake Sale

In a candid revelation earlier this month, Masayoshi Son expressed his reluctance to part with Nvidia shares. He admitted he "didn't want to sell a single share" but was compelled by the need for capital to invest in OpenAI and other ventures. "I was crying to sell Nvidia shares," Son said, explaining that the decision was driven purely by the requirement to raise funds for pivotal AI investments.

This monumental $40 billion investment by SoftBank underscores the intense global race for dominance in artificial intelligence. It signals a deep, long-term commitment to backing OpenAI's frontier research and infrastructure projects, positioning both companies at the very centre of the AI revolution.