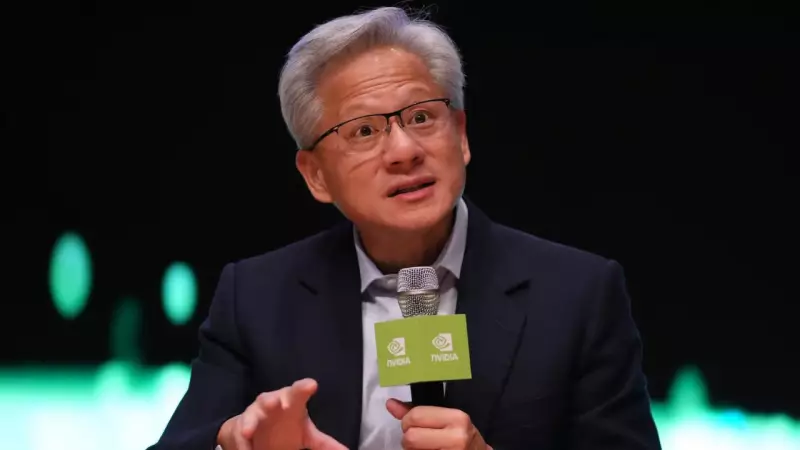

In a significant address that sought to reframe the global conversation around artificial intelligence, Nvidia's Chief Executive Officer Jensen Huang has directly confronted concerns about a potential AI bubble. Speaking at the 2025 US-Saudi Investment Forum, Huang delivered a compelling three-minute argument, shifting the focus away from market speculation and towards what he described as an irreversible, fundamental shift in global computing.

The End of Moore's Law: The Real Driver of AI Investment

Huang began his case by pointing to a foundational constraint in computer science: the end of Moore's Law. For decades, this principle predicted a steady doubling of transistor density on chips every two years, consistently boosting computing power. Huang stated that this trend has now plateaued, creating a critical and widening gap. On one side is the skyrocketing demand for processing power, primarily driven by AI. On the other is the industry's dwindling ability to meet that demand using traditional CPU-based systems.

"This isn't speculation—it's a fundamental challenge driving the need for new computing paradigms," Huang asserted. He explained that this gap is the core reason why corporations worldwide are not merely experimenting with AI but are committing massive capital expenditures (capex) to build new infrastructure out of sheer necessity.

Three Pillars of Real AI Demand

Huang built a three-part case to demonstrate that the current AI movement is grounded in structural change, not hype. First, he highlighted the industry-wide shift from legacy CPU systems to GPU-accelerated computing. He told analysts that data-heavy workloads in sectors like data processing, search, advertising, and engineering are moving to GPU infrastructure because they fundamentally "need the AI."

Second, AI is no longer just an incremental improvement tool. It is actively creating entirely new categories of software and applications that did not exist before. Third, Huang pointed to the imminent rise of "agentic AI"—advanced systems capable of reasoning and operating with minimal human guidance. This next wave, he noted, will demand even greater computing resources in the near future. Huang positioned Nvidia as the sole company equipped to power all three of these transformative transitions.

Growth Challenges and the Middle Eastern Pivot

Despite the robust demand, Huang and analysts acknowledge significant hurdles ahead. When questioned about constraints on Nvidia's growth, Huang emphasized the sheer scale and novelty of the AI transformation. However, experts like eMarketer's Jacob Bourne pointed to physical roadblocks like power availability, land, and grid capacity, which could slow down how quickly cloud providers can monetise the demand for GPUs.

Geopolitics also plays a role. With US export restrictions limiting advanced chip sales to China, Nvidia is actively cultivating the Middle East as a vital emerging market. In a notable development, the US Commerce Department has authorised the export of up to 35,000 of Nvidia's advanced Blackwell chips to firms in Saudi Arabia and the UAE—a shipment valued at over $1 billion by market estimates.

Concluding his argument, Huang stressed that the AI revolution is already entrenched. "The world is voting with real capex," he said, noting that from finance and healthcare to research and manufacturing, accelerated computing is now embedded in daily operations. This widespread adoption, he insists, proves the movement is a genuine ongoing transformation, not a speculative bubble waiting to burst.