Porbandar Police Uncover Elaborate Bike Loan Scam, Arrest NBFC Executive

In a significant crackdown on financial fraud, the Porbandar police have exposed a sophisticated bike loan scam, resulting in the arrest of a Non-Banking Finance Company (NBFC) executive. The accused, identified as Dhaval Khudai, allegedly defrauded at least 66 individuals seeking to purchase new two-wheelers, with the total reported fraud estimated to be around Rs 38 lakh.

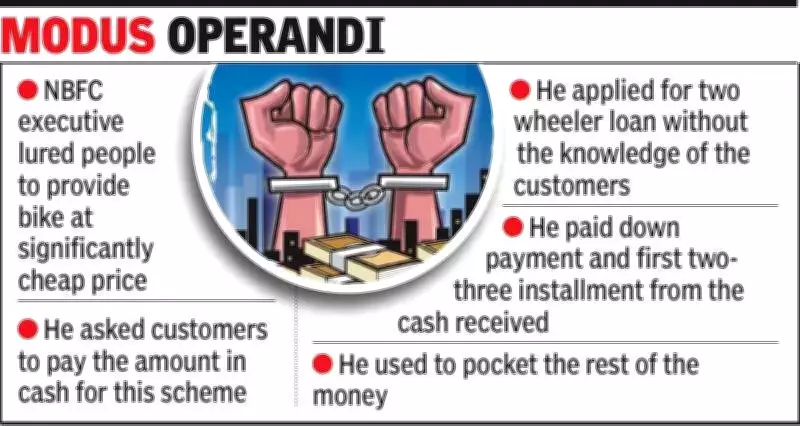

Modus Operandi: Luring Victims with Fake Discounts and OTP Theft

According to police inspector NN Talaviya of Ranavav, Khudai operated by enticing customers with offers of bikes at exceptionally low prices, significantly below market rates. For instance, he would propose a bike with a market price of Rs 95,000 for just Rs 75,000 in cash. After collecting the full cash amount from the customer, Khudai would, without their knowledge, process a two-wheeler loan in their name.

To execute this scheme, Khudai used a fraction of the collected cash to pay the down payment and a few initial instalments on the fraudulent loan. He tricked customers into sharing their OTPs by falsely claiming it was necessary for the bike registration process. When victims received loan-related messages from the bank, Khudai reassured them it was merely a system error. Many customers, pleased with their new bike and the perceived discount, often dismissed these bank notifications.

Scam Discovery and Victim Impact

The fraud came to light two to three months later when victims began receiving calls from banks demanding loan repayment. One notable case involved complainant Prakash Dhandhas, who was lured into a scheme to exchange his 2024 model financed bike. Khudai promised Dhandhas a new bike in exchange for two extra instalments of his existing loan plus Rs 10,000, assuring him no new loan would be taken. However, Dhandhas later discovered he was liable for an Rs 80,000 loan on the new vehicle, and his old bike's loan remained unpaid.

Police inspector Talaviya added, "Khudai created a fake No-Objection Certificate (NOC) from the finance company, falsely showing the old loan as repaid, and then sold the old vehicle to a used vehicles' broker."

Investigation and Legal Action

The investigation was initiated after a formal complaint was registered against Khudai under BNS sections 318(4), 338, and 340(2) at the Ranavav police station. Khudai, who was also posted at a two-wheeler showroom in Ranavav as part of his job, was arrested after clinching documentary evidence was gathered by the police.

Authorities revealed that Khudai defrauded approximately 66 people in the last four months alone. The police have documented the details of all victims included in the FIR and are urging anyone else who may have been a victim of this scam to come forward to assist in the ongoing investigation.

This case highlights the vulnerabilities in financial transactions and the importance of vigilance among consumers when dealing with loan offers and discounts that seem too good to be true.