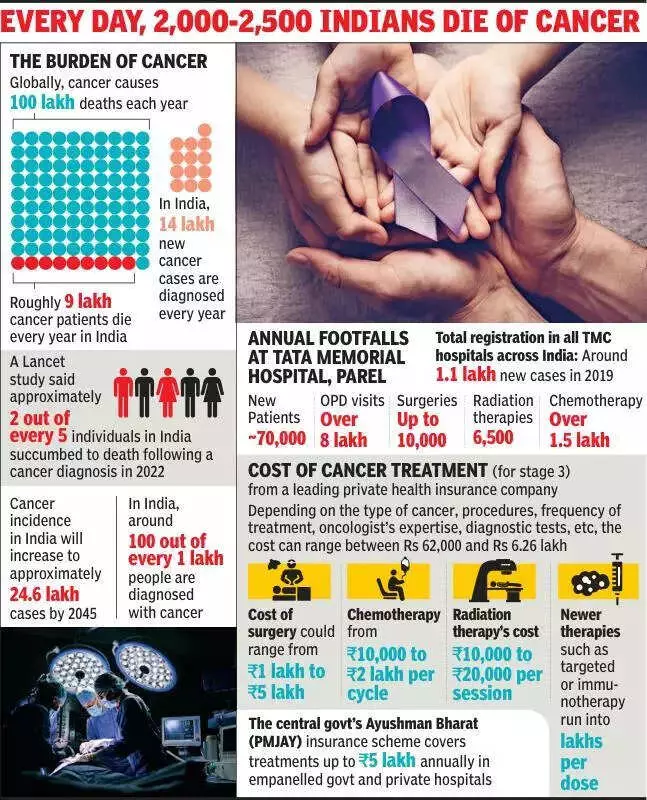

In a significant shift for Mumbai's healthcare landscape, cancer treatment has emerged as the fastest-growing sector, with revenues from oncology services in many premium hospitals now exceeding those from cardiac care. This growth is fueled by a stark reality: cancer claims an estimated 2,500 lives every day across India.

The Investment Surge in Advanced Cancer Infrastructure

Leading private hospitals in the financial capital are making massive capital expenditures to expand their cancer care facilities. They are constructing entire floors, wings, and even new buildings dedicated to oncology. The investments include installing heavily shielded bunkers for linear accelerators, with each machine costing up to Rs 25 crore, and acquiring digital PET scanners for around Rs 10 crore.

These hospitals are aggressively marketing premium services such as robot-assisted surgeries for more precision, chemotherapies with fewer side-effects, and immunotherapy doses that can cost over Rs 2 lakh each. This boom marks a dramatic change from two decades ago, when cancer care was largely synonymous with the government sector.

Hospital planning consultant Dr Vivek Desai notes that the private sector stepped in as government centres became overcrowded with long waiting lists. Dr Vivek Talaulikar, COO of Nanavati Max Super Speciality Hospital, attributes the current expansion to a huge gap between patient demand and the supply of specialised cancer beds and experts.

Drivers of Growth: Rising Cases and Insurance Support

A key driver behind this expansion is the chilling increase in cancer cases, attributed to better diagnostics and lifestyle- or environment-related causes. With more people undergoing annual check-ups, cancers are being detected earlier. Experts anticipate the national caseload will rise from the present 14 lakh cases annually.

Another crucial factor is financial viability. The central government's Ayushman Bharat insurance scheme offers "good reimbursement rates" for chemotherapy and radiation, creating a steady revenue stream for both public and private hospitals. Dr Talaulikar highlighted the scale of need, stating that currently, 25 lakh Indians are under treatment for various cancers, with about 70% requiring multi-stage chemotherapy.

Hospitals are racing to meet this demand. Nanavati Max's new Block B will have two floors dedicated to oncology patients. The hospital has increased its linear accelerator bunkers from two to five and, remarkably, expanded its fleet of surgical robots from two to thirty in just three years.

Other major players are also expanding. Fortis Hospital Mulund recently inaugurated its Cancer Institute, while Gleneagles Hospital in Parel, known for transplants, has recruited renowned surgeon Dr Shailesh Shrikhande from Tata Memorial Hospital and announced a new cancer wing. Gleneagles CEO Dr Bipin Chevale indicated that new beds would primarily serve oncology, citing India's aging population as a factor.

Challenges, Regulation, and the Road Ahead

Despite the boom, experts warn of significant challenges. Dr Desai points out that while the situation mirrors the cardiology surge a decade ago, a similar infrastructure explosion may not occur in cancer care because it is too cost-intensive. He also highlights a looming shortage of specialised nursing staff and radiation technicians.

A senior doctor explained the high revenue per patient, noting that unlike a heart patient who might undergo a one-time procedure, a cancer patient often requires continuous, recurring treatment.

There are growing calls for oversight. Former Tata Memorial Centre director Dr Rajendra Badwe emphasized the need for treatment access but also for audits and checks on private hospitals. He proposed a government-led Quality Assurance and Quality Control (QAQC) system that could rate hospitals based on their complication rates, five-year survival rates, innovation, and research.

Dr Badwe also raised the critical issue of pricing, pointing out that at Tata Memorial, medicines are provided at 20% of the MRP, and questioned the practices in private settings where a significant portion of earnings comes from pharmacy sales. As Mumbai's hospitals bet big on cancer, balancing growth, affordability, and quality remains the sector's biggest test.