The initial public offering (IPO) of Sundrex Oil Company Limited, aimed at raising capital on the small and medium enterprise (SME) platform, has successfully garnered strong investor interest. The public issue, which opened for subscription on Tuesday, was fully subscribed by the close of the second day on Wednesday.

Strong Investor Response on Day Two

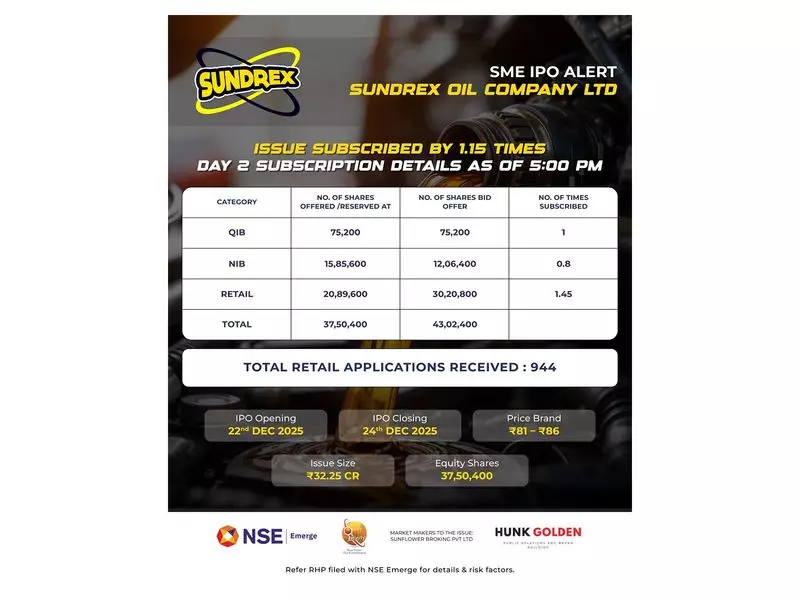

Data from the exchanges revealed that the Sundrex Oil SME IPO was subscribed 1.15 times overall by the end of the bidding period on May 22. The most significant demand came from retail individual investors (RIIs), who showed robust confidence in the company's prospects. The portion reserved for retail investors was oversubscribed 1.45 times, indicating healthy participation from the public.

The qualified institutional buyers (QIB) portion of the offering was subscribed 0.01 times, while the non-institutional investors (NII) category saw a subscription of 0.03 times. The overwhelming response from retail investors was the primary driver behind the issue getting fully covered ahead of its closing date.

IPO Details and Fund Utilization

Sundrex Oil Company Limited's IPO is a fresh issue of 25.20 lakh equity shares, each with a face value of Rs 10. The company has set a price band of Rs 140 to Rs 150 per share for the offer. At the upper end of the price band, the IPO aims to raise approximately Rs 37.80 crore.

The funds raised through this public offering are earmarked for crucial business expansion activities. The company plans to utilize the net proceeds for the following purposes:

- Financing capital expenditure requirements.

- Meeting working capital needs.

- Covering general corporate expenses.

The IPO is being managed by Skyline Financial Services Private Limited, which is acting as the book running lead manager for the issue. The shares of the company are proposed to be listed on the NSE Emerge platform of the National Stock Exchange (NSE), providing liquidity and visibility to its investors.

About Sundrex Oil Company Limited

Sundrex Oil Company Limited is engaged in the business of manufacturing and supplying a range of industrial and edible oils. The company's product portfolio includes castor oil and its derivatives, which find applications across various industries such as pharmaceuticals, cosmetics, and lubricants. The successful subscription of its IPO reflects market belief in the company's growth trajectory and its position within the specialty oils sector.

The final allotment of shares is expected to be completed shortly after the IPO closing, followed by the listing of the company's equity shares on the stock exchange. Investors who participated in the offering will be able to trade their shares once the listing process is formalized, marking a new chapter for Sundrex Oil as a publicly-traded entity.