The Indian equity market navigated a turbulent year in 2025, marked by significant volatility and global headwinds. However, amidst this challenging backdrop, a cluster of companies headquartered in Gujarat emerged as standout performers, delivering impressive returns to their investors and defying the broader market's subdued trend.

Top Performers from Gujarat Defy Market Odds

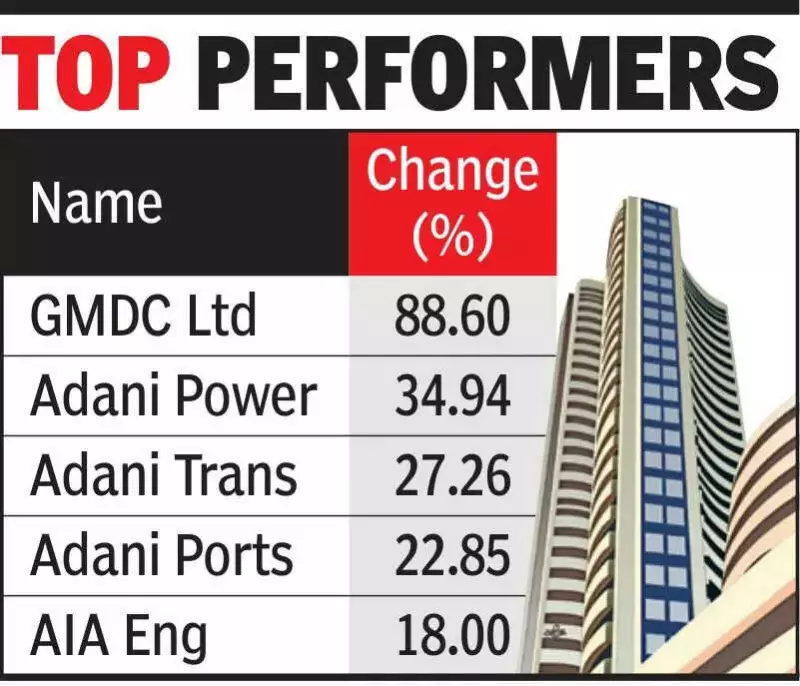

State-run Gujarat Mineral Development Corporation (GMDC) Ltd emerged as the undisputed champion, rewarding its shareholders with a stellar 88% return over the calendar year. It was closely followed by Adani Power Ltd, which generated substantial gains of approximately 35%. The list of strong performers from the state did not end there.

Other Gujarat-based giants also posted robust gains. Companies including AIA Engineering, Adani Ports and Special Economic Zone (SEZ), and Adani Transmission all provided returns exceeding 18% for the year. This collective strength highlighted the resilience and fundamental robustness of several major corporates from the region.

A Year of Consolidation and Global Uncertainty

Vanesh Panchal, director of a stock broking firm, provided context for the year's market behavior. "2025 witnessed consolidation for Indian equity markets," he stated. The period was characterized by intensifying global uncertainty, primarily driven by renewed tariff concerns from the United States and ongoing geopolitical tensions.

These external trade risks, coupled with already high domestic valuations, created a difficult environment. This led to muted overall returns and heightened volatility across the board. The benchmark Nifty 50, while managing to stay in positive territory, closed only about 10% higher than the previous year's close. Mid-cap and small-cap segments, in particular, remained under pressure.

Resilience Rooted in Fundamentals and Positive Outlook

Despite the lack of major celebration for the average equity investor, the Indian market marked a significant milestone: it delivered positive returns for the tenth consecutive calendar year. Within this sustained uptrend, the outperformance of select Gujarati companies was notable.

Analysts point to strong earnings visibility and solid fundamentals as the key drivers behind this outperformance. Many of these corporates demonstrated clear growth trajectories, which allowed their shares to rise even when the broader markets struggled.

As the investment community turns its gaze towards the new calendar year, several companies from Gujarat are already projecting a very positive outlook for their future performance. Their ability to navigate a tough global economic scenario in 2025 has bolstered confidence in their operational strength and strategic positioning.

In summary, while 2025 was a year where investors had to brace for volatility, a focus on companies with strong fundamentals, particularly those headquartered in Gujarat, proved to be a rewarding strategy. The performance of GMDC, Adani group companies, and others underscores the importance of stock-specific selection in a complex market environment.