Charlie Munger's Timeless Wisdom: The Art of Waiting for Wealth

The late billionaire Charlie Munger, renowned as the capital partner of Warren Buffett and former CEO of Berkshire Hathaway, left behind a remarkably simple yet profound rule for accumulating wealth: do not confuse activity with progress. In a world obsessed with constant motion, Munger championed the virtue of stillness and selectivity as the true path to financial success.

The Pressure to Act and the Power of Restraint

Munger famously observed that holding significant cash creates immense pressure to act—whether through investing, buying assets, expanding businesses, or seizing fleeting opportunities. However, he argued that real strength lies in resisting this urge and exercising patience. "It takes character to sit with all that cash and to do nothing. I didn't get to where I am by going after mediocre opportunities," Munger stated in one of his memorable quotes.

This perspective underscores a critical distinction: success stems from being selective rather than merely busy. Munger implied that pursuing average or "good enough" options can actually hinder progress, while exceptional gains emerge from waiting for truly outstanding opportunities. His approach was not about inaction but about disciplined, confident action when the moment is right.

Core Principles of Munger's Investing Philosophy

In his final interviews, Munger distilled his wealth-building advice into actionable insights. He noted that earning the first $100,000 is often the most challenging step, emphasizing that "you only have to get rich once." This mindset shifts focus from repetitive striving to strategic, one-time breakthroughs.

Munger's philosophy rested on four foundational ideas:

- Patience over action: Prioritizing waiting and observation over impulsive moves.

- Avoiding stupidity before seeking brilliance: Focusing on minimizing errors rather than chasing genius.

- Long-term thinking: Embracing extended time horizons for investments and decisions.

- Inversion thinking: Approaching problems by considering what to avoid rather than what to achieve.

He encapsulated this with the adage: "The big money is not in the buying or selling, but in the waiting." For Munger, this stance was about gaining an edge through understanding—knowing when to act with conviction and when to acknowledge limitations without pretense.

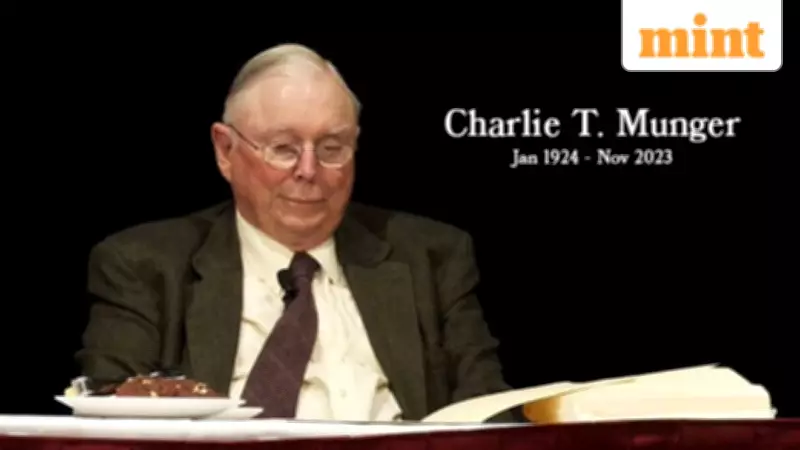

The Legacy of Charlie Munger: Architect of Berkshire's Success

Charles Thomas Munger was instrumental in shaping Berkshire Hathaway's legendary success. As vice chairman from 1978 until his death at age 99 in 2023, he influenced Warren Buffett to move away from cheap "cigar-butt" stocks toward investing in high-quality businesses at fair prices. Known for his sharp wit, brutal honesty, and pragmatic thinking, Munger was not just Buffett's business partner but also his closest friend, leaving an indelible mark on modern investing strategies.