India's Motorcycle Exports Achieve Historic Milestone in 2025

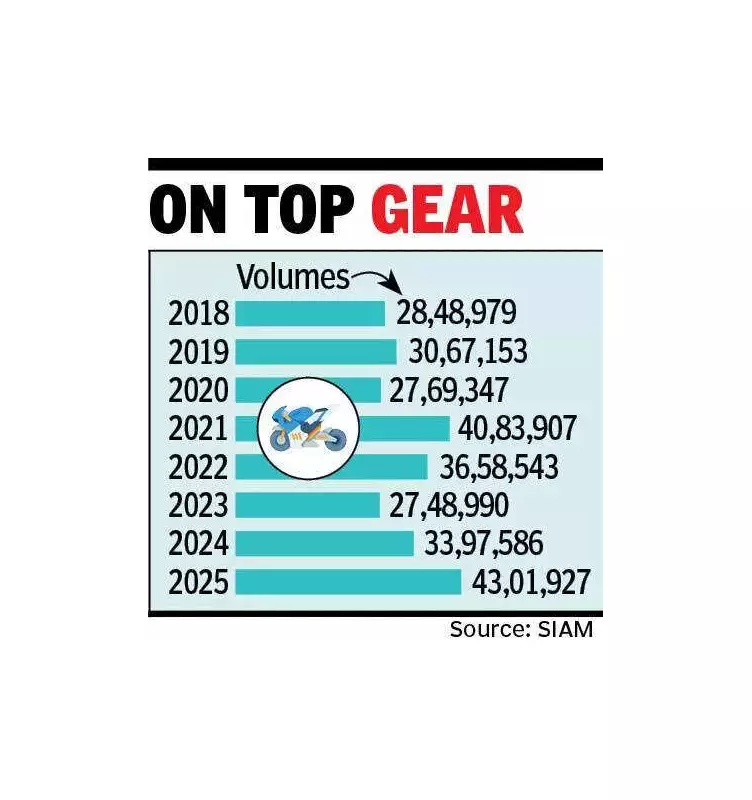

The year 2025 has emerged as a landmark period for India's motorcycle manufacturing sector, with exports reaching an unprecedented annual volume. According to recent data, motorcycle exports from India soared to 4.30 million units in 2025, representing a substantial 27% increase compared to the shipments recorded in 2024. This achievement not only marks the highest-ever annual export volume but also establishes a fresh post-pandemic peak for the industry.

Strong Growth Momentum Driven by Global Demand

Poonam Upadhyay, director at Crisil Ratings, highlighted the factors behind this impressive growth. "A combination of India's competitive manufacturing capabilities and a well-established global distribution network has enabled the country's motorcycle exports to maintain strong growth momentum," she stated. The robust export performance was primarily fueled by healthy demand from multiple emerging markets across the globe.

Latin America stood out as a significant contributor, with countries like Colombia and Brazil leading the charge. Africa remained a crucial market, with Nigeria being a key destination for Indian motorcycles. Additionally, improved foreign currency availability in these regions supported the export growth. Asian markets, including Nepal and the Philippines, also provided a further boost to the overall export figures.

Historical Context and Recovery Post-Pandemic

In the pre-pandemic phase spanning from 2017 to 2019, motorcycle exports from India were on a gradual upward trajectory. The exports rose from 2.33 million units in 2017 to 3.07 million units in 2019, which marked the earlier peak before the Covid-19 pandemic disrupted global trade in 2020.

While exports experienced a brief dip during the first year of the pandemic, they rebounded strongly thereafter. By 2021, exports had already surpassed pre-pandemic levels. Despite some volatility in the intervening years, the consistent climb culminated in the record 4.30 million units exported in 2025. This figure represents an increase of nearly 40% over the 2019 pre-pandemic peak, indicating that exports have not only recovered but have reached a new high.

Key Players and Market Share

The rise in motorcycle exports from India was significantly driven by stronger penetration into overseas markets and a widening export basket by leading industry players. In 2025, Bajaj Auto and TVS Motor together accounted for approximately 72% of India's total motorcycle exports.

- Bajaj Auto held a 43% share, with its motorcycle exports growing from 1.60 million units in 2024 to 1.86 million units in 2025.

- TVS Motor contributed 29%, with shipments rising sharply from 0.91 million units to 1.25 million units during the same period.

Other notable motorcycle exporters from India in 2025 included:

- Hero MotoCorp with 3.37 lakh units

- Yamaha with 2.72 lakh units

- Honda with 2.47 lakh units

- Suzuki with 1.92 lakh units

This distribution underscores the dominant role of Bajaj Auto and TVS Motor in driving India's export growth, while other manufacturers also contributed to the overall expansion.

Domestic Market Contrast

Interestingly, while exports reached record highs, domestic motorcycle volumes in India remained below their earlier peaks. This contrast highlights the shifting focus of Indian manufacturers towards international markets, leveraging competitive advantages to capture global demand.

The success in 2025 reflects the resilience and adaptability of India's motorcycle industry, which has effectively navigated post-pandemic challenges to achieve historic export milestones. With continued emphasis on emerging markets and strategic expansions, the sector is poised for sustained growth in the coming years.