The Income Tax Department of India has issued a crucial final reminder for all taxpayers: link your Permanent Account Number (PAN) with your Aadhaar card by 31 December 2025. This mandatory linking is essential for a smooth tax filing process and to avoid severe financial and operational consequences. The government's move aims to streamline taxpayer identification and eliminate the issue of duplicate PAN cards across the nation.

The New Final Deadline and Associated Penalties

The journey to link these two critical identity documents has seen several extensions. The Central Board of Direct Taxes (CBDT) first set a deadline of 30 June 2023, which was later pushed to 31 May 2024 with a late fee of ₹1,000. In its latest notification dated 3 April 2025, the CBDT has now fixed 31 December 2025 as the absolute final date for compliance.

Taxpayers who complete the linking process on or before this new December deadline will not be subject to any additional late fee, as confirmed by Protean, a Government of India company. However, individuals who had already missed the previous deadlines are likely to be charged the ₹1,000 penalty under Section 234H of the Income-tax Act when they finally link.

Severe Consequences of Non-Compliance

Failing to link your Aadhaar and PAN by the year-end cutoff will trigger a cascade of problems starting 1 January 2026. The most immediate impact will be that your PAN will become inoperational. This single change will have multiple downstream effects on your financial life.

You will face higher Tax Deducted at Source (TDS) and Tax Collected at Source (TCS) rates under Sections 206AA and 206CC of the I-T Act. Filing Form 15G/15H to prevent TDS deduction will be disrupted. Perhaps most critically, financial institutions like banks, mutual funds, and stockbrokers may suspend services due to invalid Know Your Customer (KYC) documentation linked to an inactive PAN.

Furthermore, any income tax refunds due to you will not be processed until your PAN is reactivated. To revive an inoperative PAN after the deadline, you will need to pay the ₹1,000 fee and undergo additional verification steps, causing further delay and inconvenience.

How to Link Your Aadhaar and PAN: A Simple Guide

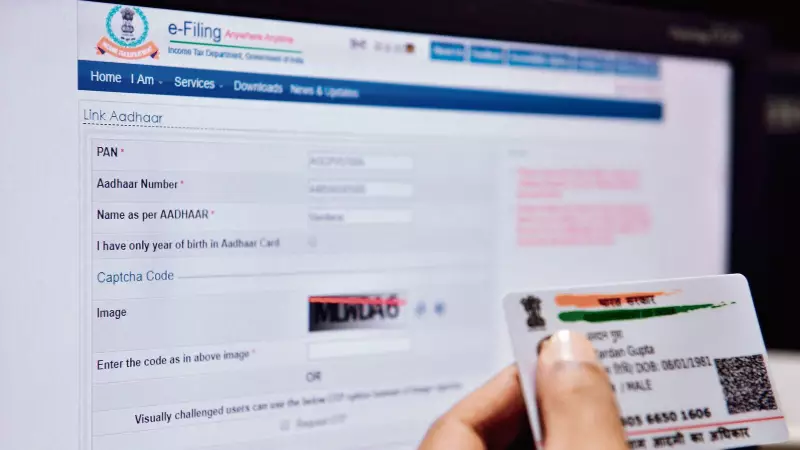

Linking your Aadhaar and PAN is a straightforward online process. Ensure you have your valid PAN card, Aadhaar number, and the mobile number registered with your Aadhaar handy.

- Visit the official Income Tax e-filing portal at https://www.incometax.gov.in/iec/foportal/.

- Under the 'Quick Links' section, select the 'Link Aadhaar' option.

- Enter your PAN, Aadhaar number, and your name exactly as it appears on your Aadhaar card.

- Click on 'Validate'.

- Enter the One-Time Password (OTP) sent to your Aadhaar-registered mobile number.

- If you are linking after missing an earlier deadline, ensure you select the '₹500 Fee for delay in linking PAN with Aadhaar' option (the fee is ₹1,000, displayed as ₹500 for each of two instances of delay) before final submission.

- Submit the form. A confirmation message will appear, and the status will update on the portal within 3-5 working days.

Do not wait for the last moment. Complete this mandatory linking today to ensure your financial and tax-related activities continue without any interruption in the new year.