Asian financial markets experienced a broad-based rally on Friday, with major indices trading firmly in positive territory as investor confidence received a dual boost from robust US economic data and a significant reduction in transatlantic trade tensions.

Regional Markets Show Widespread Gains

The positive sentiment was evident across the Asia-Pacific region. In Hong Kong, the Hang Seng Index advanced by 158 points, representing a solid gain of 0.6%, to close at 26,788. Japan's benchmark Nikkei 225 index jumped 193 points, or 0.36%, finishing the trading session at 53,882.

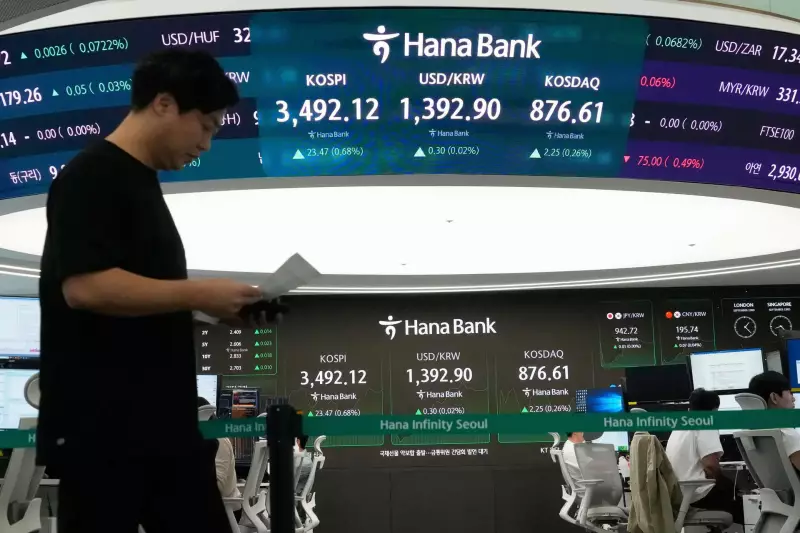

Mainland Chinese markets also participated in the upward movement. The Shanghai Composite Index rose by 0.37%, while the Shenzhen Component Index posted an even stronger gain of 0.56%. South Korea's Kospi index added 0.27% to reach 4,965 by 8:00 AM Indian Standard Time, reflecting the region-wide bullish trend.

Global Context and Catalysts

The Asian rally followed a strong performance on Wall Street, where US stocks extended their gains for a second consecutive session on Thursday. The S&P 500 climbed 0.5%, while the technology-heavy Nasdaq Composite rallied an impressive 0.9% as market sentiment improved globally.

Several key factors contributed to the improved investor mood. The easing of trade tensions between the European Union and the United States proved particularly significant, with former President Donald Trump withdrawing tariff threats against the bloc. This diplomatic development, alongside discussions concerning Greenland, helped reduce geopolitical uncertainty that had previously weighed on markets.

Furthermore, revised economic data from the United States revealed that the world's largest economy expanded slightly more than initially estimated during the third quarter, providing additional evidence of economic resilience. This combination of improving diplomatic relations and stronger economic fundamentals encouraged investors to return to riskier assets.

Currency and Commodity Movements

The shift in market sentiment was also reflected in currency and commodity markets. The US dollar remained relatively muted after experiencing its steepest decline in a month, which in turn boosted demand for traditional safe-haven assets.

This dynamic pushed spot gold prices close to $4,960 per ounce, while silver climbed to a fresh all-time high, underscoring the ongoing appetite for precious metals amid the changing market conditions.

In currency trading, the Japanese yen weakened by 0.1% against the US dollar, trading at 158.54 ahead of the Bank of Japan's upcoming policy meeting. This movement followed the release of government data on Friday showing that Japan's core consumer prices rose by 2.4% in December compared to a year earlier, precisely matching analysts' estimates.

Technology Sector and Future Indicators

Ongoing gains in major artificial intelligence-linked stocks contributed to the positive market performance, highlighting the continued investor enthusiasm for technology and innovation sectors. The rebound in global equities after earlier weekly losses demonstrated how quickly sentiment can shift in response to geopolitical and economic developments.

Looking ahead, investors are closely monitoring several key indicators. The release of US Purchasing Managers' Index data scheduled for later on Friday will provide further signals about the momentum of the American economy. Additionally, markets are tracking developments at the Federal Reserve following statements about potential leadership changes at the central bank.

The widespread gains across Asian markets on Friday underscored the interconnected nature of global finance, where developments in US economic policy, international trade relations, and central bank actions collectively influence investor behavior and market performance across continents.