Despite repeated police warnings and growing public anger, a dangerous trap set by illegal digital lending applications is tightening its grip across Telangana. Thousands of residents, lured by promises of instant credit, continue to fall victim to systematic harassment, extortion, and severe financial loss. The scale of the crisis has escalated dramatically this year.

Staggering Surge in Financial Losses

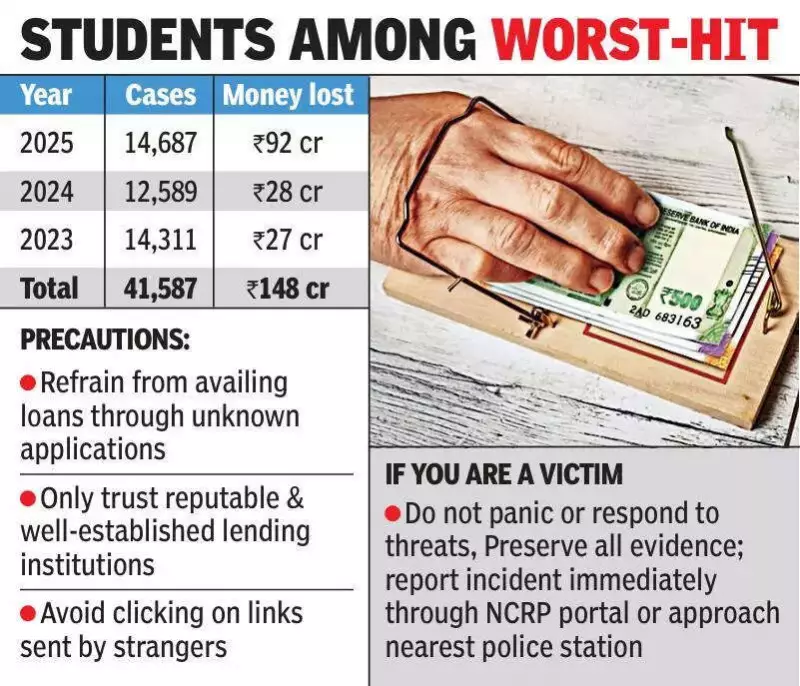

The financial damage inflicted by these fraudulent loan apps has reached alarming new heights. In 2025 alone, the amount lost by victims has skyrocketed by a staggering 221% compared to the previous year. Official data reveals a sharp escalation: while 12,589 victims lost Rs 28.61 crore in 2024, the current year has seen not only a rise in complaints but also a surge in extorted money to a massive Rs 92.12 crore.

This alarming trend has prompted the Telangana Cyber Security Bureau (TGCSB) to flag loan app fraud as one of the top three digital threats in the state, alongside investment scams and fake part-time job offers. As part of a six-week, statewide cybercrime awareness drive, the TGCSB, with The Times of India as its media partner, is intensifying its public alerts.

Who is Being Targeted and How the Scam Operates

TGCSB director Shikha Goel identified the most vulnerable groups, stating that youngsters, students, housewives, and individuals with limited incomes are among the primary targets. "The loanees were targeted, harassed, and their data was misused before finally causing financial loss to the victims by tormenting," she explained.

The fraud follows a well-established and ruthless pattern:

- Victims are enticed through pop-up ads, SMS, and social media promotions guaranteeing instant loans with minimal documentation and low interest rates.

- Upon installing the app, it secretly gains access to the user's contacts, photo gallery, messages, and other sensitive personal data.

- After disbursing a small loan amount, the agents begin applying intense pressure. They demand exorbitant interest rates, issue threats, and weaponize the stolen personal data to intimidate not just the borrower, but also their family members and friends listed in their contacts.

Officials note that while some victims knowingly risked borrowing with no intention to repay, many others turned to these apps out of sheer desperation, completely unaware of the devastating consequences that would follow.

Awareness as the Primary Defence

With 14,684 loan app-related complaints registered this year—the highest in the past three years—the problem shows no sign of abating. Cybercrime investigators emphasize that in the face of this relentless menace, public awareness and extreme caution remain the most effective immediate defences.

The relentless harassment and sophisticated misuse of personal data have created a climate of fear among victims, even as the financial losses continue to mount. The TGCSB's campaign underscores the critical need for citizens to be vigilant against offers that seem too good to be true and to rely only on regulated financial institutions for credit needs.