As 2025 drew to a close, liquor retailers across Telangana witnessed a massive surge in year-end purchases, with stock worth a staggering over Rs 660 crore being reported. This significant figure, encompassing both Indian-Made Foreign Liquor (IMFL) and beer, highlights robust consumer spending in the final days of the year. However, the detailed sales data reveals a dramatic shift in what people are buying, challenging the state's long-standing reputation.

The Great Shift: Spirits Dethrone Beer

The most striking trend from the year-end sales data is the clear preference for stronger alcoholic beverages over beer. Telangana, often hailed as India's beer consumption capital, saw spirits like whisky, brandy, and rum significantly outperform beer in popularity. This change became particularly evident on December 29 and 30, when shopkeepers recorded stock purchases totalling Rs 315 crore and Rs 282 crore, respectively. During this peak period, the dominance of whisky, brandy, rum, vodka, and gin breezers was unmistakable, with all eclipsing beer sales.

Understanding Beer's Steep Decline

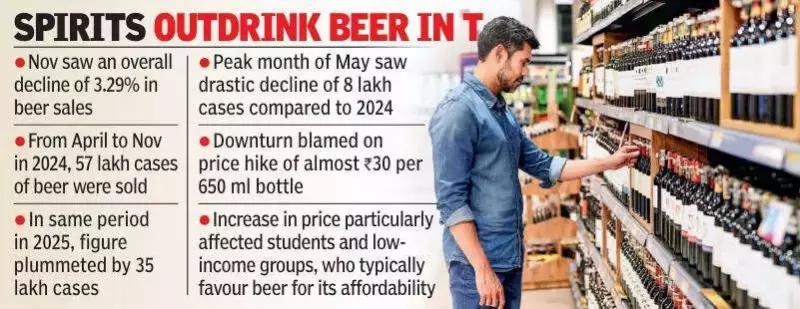

The downturn for beer was not just a year-end phenomenon but part of a sustained decline. The month of November 2025 was especially troubling, reflecting an overall sales drop of 3.29 percent. A broader look at the data shows a sharp year-on-year fall. From April to November 2024, 57 lakh cases of beer were sold. In the same period in 2025, this figure plummeted by 35 lakh cases.

Even the peak summer month of May, which traditionally sees the highest beer sales, experienced a drastic reduction. May 2025 saw sales drop by a massive 8 lakh cases compared to May 2024. Industry sources and data point to a primary culprit: a significant price hike. The cost of a standard 650 ml bottle of beer rose from Rs 150 to Rs 180. This increase disproportionately affected price-sensitive consumer groups, such as students and low-income earners, for whom beer was the preferred affordable option.

Weather and Market Forces

Adding to the beer sector's challenges, the month of December brought an unexpected adversary—a cold wave. The chilly conditions, which notably impacted the key market of Hyderabad, further dampened the demand for a beverage typically associated with warmer weather. This seasonal factor compounded the existing issues of rising prices, creating a perfect storm for declining beer sales.

In contrast, the market for spirits remained resilient and even grew, suggesting a shift in consumption patterns rather than an overall reduction in alcohol spending. The data from the closing days of 2025 paints a clear picture of a state in transition, where consumer tastes are evolving, and market dynamics are being reshaped by economic and environmental factors.