Rajasthan's PSUs Deliver Meager Returns Despite Massive Government Infusion

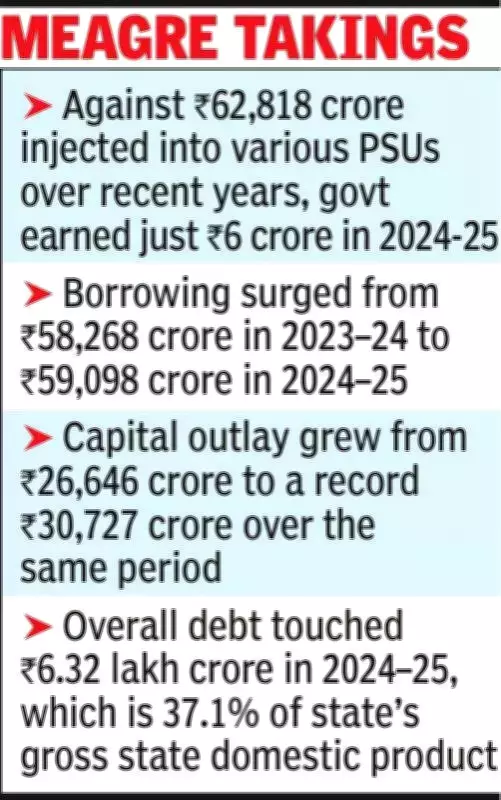

A recent audit by the Comptroller and Auditor General of India has exposed a stark financial reality for Rajasthan's public sector undertakings. The state government has invested a colossal Rs 62,818 crore into various PSUs over the years, yet earned a paltry return of just Rs 6 crore during the 2024–25 fiscal year.

Audit Highlights Weak Performance Amid Rising Public Investment

The report, which was tabled in the Rajasthan Legislative Assembly, underscores the persistently weak financial performance of state-run enterprises. This comes even as public investment continues to escalate. In the last financial year alone, the government made a fresh equity infusion of Rs 1,047 crore into state-owned companies, joint ventures, and cooperative institutions.

The distribution of this investment was heavily skewed:

- Rajasthan State Road Transport Corporation (RSRTC) received the lion's share of Rs 855 crore.

- Rajasthan Power Finance Corporation Ltd was allocated Rs 170 crore.

Sharp Surge in Borrowing and Capital Expenditure

The CAG report also documents a concerning trend of increased borrowing coupled with rising capital spending over the past five years. The data reveals a volatile financial trajectory:

- In 2020–21, total debt stood at Rs 48,941 crore with capital expenditure of Rs 15,271 crore.

- By 2021–22, debt slipped to Rs 45,235 crore as spending rose sharply to Rs 24,152 crore.

- In 2022–23, debt fell further to Rs 34,828 crore with a capex of Rs 19,798 crore.

However, a dramatic reversal occurred in the subsequent years:

- Borrowing surged to Rs 58,268 crore in 2023–24 while capital outlay touched Rs 26,646 crore.

- It climbed further to Rs 59,098 crore in 2024–25 alongside a record Rs 30,727 crore in capital expenditure.

Reliance on Short-Term Borrowing for Routine Expenses

Against this backdrop of escalating liabilities, the state has increasingly turned to short-term borrowing to meet its routine expenditure. The government availed special advances from the Reserve Bank of India on 133 separate occasions, amounting to Rs 91,251 crore over 271 days. This strategy incurred an interest payment of Rs 161 crore.

Notably, in 57 instances alone, advances worth Rs 31,029 crore were drawn for 100 days, resulting in an interest burden of Rs 19 crore, the report specified.

Grants to Local Bodies Expand as State Debt Balloons

Concurrently, grants to panchayati raj institutions and urban local bodies increased by nearly Rs 15,000 crore over the last five years. This expansion in fiscal support, however, coincided with a rapid rise in the state's overall debt burden.

By 2024–25, Rajasthan's total debt had touched a staggering Rs 6.32 lakh crore, which represents 37.1% of the state's Gross State Domestic Product. This figure highlights the growing fiscal pressure on Rajasthan's economy, raising questions about the sustainability of its public investment strategy and the efficiency of its state-owned enterprises.