In a significant operational turnaround, Rajasthan's electricity distribution companies (discoms) have reported a sharp reduction in their Aggregate Technical and Commercial (AT&C) losses for the fiscal year 2024-25. This improvement marks a crucial step towards better financial health and more efficient power supply for the state.

Sharp Decline in Losses Across Key Regions

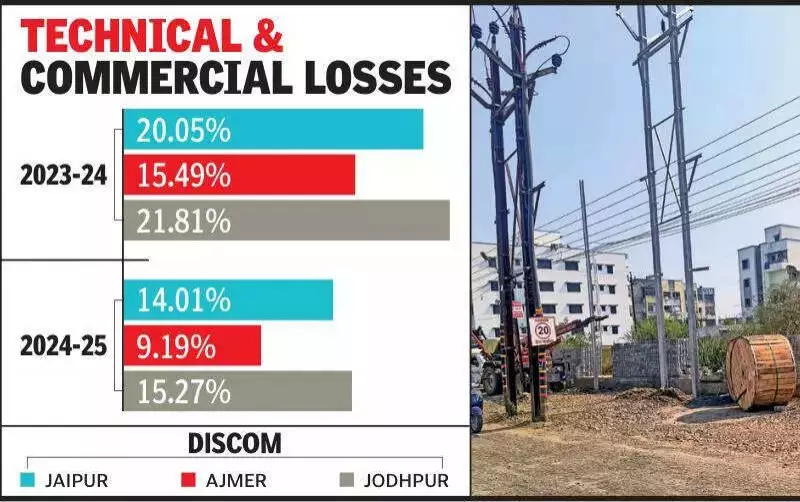

The most notable progress was seen in the Jaipur discom, which managed to slash its AT&C losses to 14% in FY25, down from 20% in the previous fiscal year. The Ajmer discom witnessed an even more dramatic fall, with losses plummeting from 15.49% in FY24 to 9.19% in FY25.

While the Jodhpur discom also showed improvement, bringing down its losses by a healthy 7 percentage points to 15.27% from 21.8%, officials and experts note that its wastage level remains high and a cause for concern, as it distorts the overall performance average of the state's power distributors.

Strategic Initiatives Behind the Improvement

Explaining the reasons for this positive trend, discoms chairman Arti Dogra credited a series of strategic measures. "This operational improvement was achieved through strategic initiatives such as replacing faulty meters, enhancing feeder monitoring, and boosting billing efficiency," she stated.

Dogra highlighted intensified efforts to combat the perennial issue of power theft. These efforts include conducting regular field surveillance and inspections, particularly in areas identified as high-loss zones. The discoms have also adopted stricter enforcement actions against illegal connections.

An additional factor contributing to the decline in losses is the growing adoption of solar energy across the state, which reduces dependency on the traditional grid and associated transmission losses.

Financial Impact and Future Challenges

The reduction in AT&C losses is a welcome development for the financial health of the discoms, which have historically struggled with significant deficits, partly due to pending government subsidy revenues. Lower losses mean improved revenue realization and reduced operational costs.

However, industry representatives have sounded a note of caution. They warn that these gains could be reversed if there is a let-up in the ongoing surveillance and enforcement drives. The focus must remain steadfast, particularly in high-loss zones.

DD Agarwal, director of Samta Power, an NGO working in the power sector, emphasized the need for targeted action. "The focus should be on the zones that are reporting high losses. Also, political leaders should not get involved to save those who are drawing power illegally," he advised.

Agarwal specifically pointed to the Jodhpur discom, suggesting it should be provided with more resources and a better, focused strategy to curtail its persistently high losses.

The issue of discom losses has a direct bearing on consumers. These losses ultimately affect power tariffs, which are then passed on to the public. It is noteworthy that power rates in Rajasthan are already among the highest in the country, making operational efficiency even more critical for consumer affordability.