Pune Firm Linked to Deputy CM's Son Faces Recovery Action

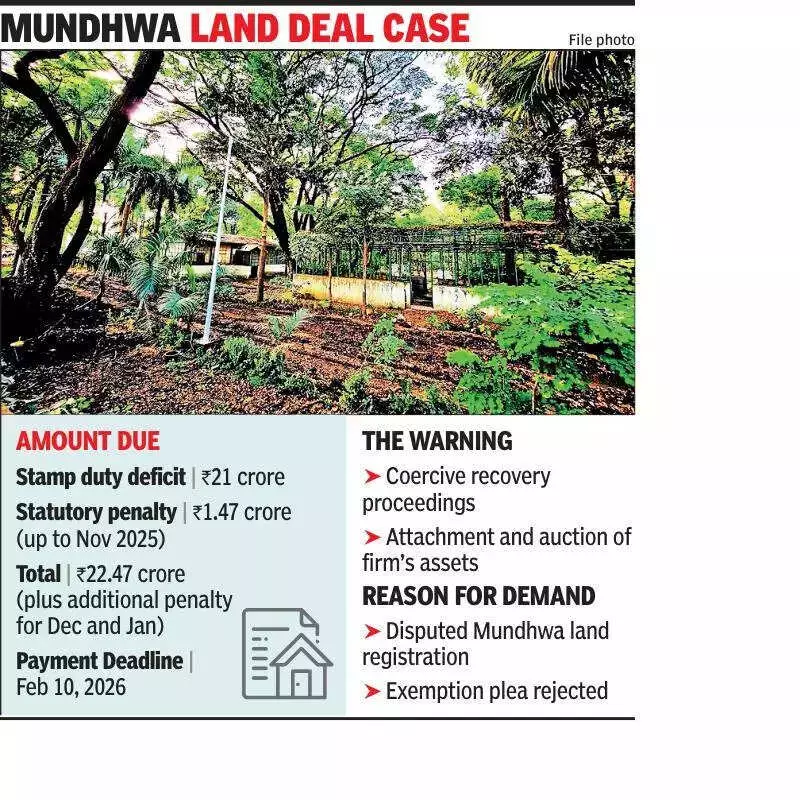

The Maharashtra state registration department has issued a stern warning to Amadea Enterprises LLP, a firm connected to deputy chief minister Ajit Pawar's son, Parth Pawar. The authorities have threatened to initiate coercive recovery proceedings, which could include the attachment and auction of the company's assets, if it fails to clear its pending stamp duty dues by February 10, 2025.

Final Order Rejects Exemption Plea

This decisive move comes after the department's final order on December 10, 2024, which completely rejected the firm's plea seeking exemption from stamp duty liability. The duty is related to the disputed registration of land in Mundhwa. Senior officials have reiterated that the company must pay the entire deficit amount along with the applicable statutory penalty, with no exemptions granted.

According to officials, the firm is liable to pay a stamp duty deficit of Rs 21 crore. Additionally, a statutory penalty calculated at 1% per month (Rs 21 lakh monthly) has been imposed. This penalty amounted to Rs 1.47 crore for the seven months up to November 2025. The penalty will continue to accumulate for December 2024 and January 2025 as well.

Deadline and Consequences of Non-Payment

"The order issued by the department on December 10 is final. The firm is required to make the payment within the stipulated 60-day period from the date of the notice. Failure to comply will lead to forceful recovery proceedings," a senior registration department official stated.

The officials clarified that the recovery measures would be taken under the provisions of the Maharashtra Stamp Act. These measures could involve the attachment and public auction of the firm's movable and immovable properties to recover the dues.

Amadea Enterprises LLP, which has Digvijay Patil and Parth Pawar as partners, had previously submitted a detailed representation claiming it was eligible for an exemption from the stamp duty shortfall. However, the registration department rejected this submission in full, affirming that both the principal duty and the penalty must be paid in their entirety.

Separate from Sale Deed Cancellation Case

Officials also made a critical distinction, noting that the current recovery notice is solely for the Rs 21 crore stamp duty shortfall and penalty. It is not directly related to the cancellation of the sale deed for the Mundhwa land. A separate civil suit seeking the cancellation of that sale deed has already been filed by the district administration.

Because that civil suit is pending, the proposed cancellation deed amount of Rs 21 crore is no longer applicable. The outcome of that aspect will now be governed by the final order of the civil court.

The action against Amadea Enterprises LLP follows the report of a five-member committee chaired by Joint Inspector General of Registration Rajendra Muthe, which was submitted in mid-November 2024. The findings were sent to the state government for further action and are expected to be merged with the report of the Kharge panel, which is scheduled for submission next month.

Another senior official indicated that based on the committee's recommendations, letters have been sent to other government departments. The aim is to strengthen transparency within the functioning of the registration machinery across Maharashtra.