Chandigarh Excise Revenue Nears Record High as New Policy Looms

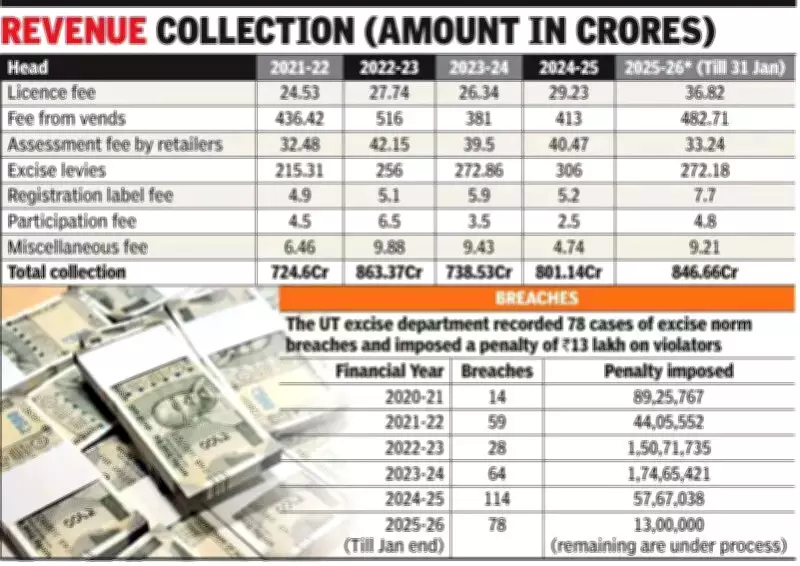

The Chandigarh excise department has reported robust financial performance, collecting a substantial Rs 846.66 crore in revenue up to the end of January in the current fiscal year. This impressive figure comes as the Union Territory administration prepares to introduce its new Excise Policy for 2026-27, with implementation targeted for late February or early March.

Breakdown of Revenue Sources

Official records reveal a detailed composition of the collected revenue:

- Vend Licence Fees: The single largest contributor, generating Rs 482.71 crore, highlighting the significance of licensing in the excise framework.

- Excise Levies: Contributing Rs 272 crore, these taxes form a substantial portion of the overall revenue.

- Various Licences: Adding Rs 36 crore to the treasury through diverse permit categories.

- Assessment Fees from Retailers: Accounting for Rs 33 crore, reflecting payments from retail establishments.

Enhanced Monitoring and Enforcement

Administration officials have emphasized that revenue monitoring has been intensified significantly. Specific targets have been established, with a special focus on areas that previously demonstrated lower collection potential. This strategic approach aims to optimize revenue streams across all sectors.

An administration official confirmed that the excise department remains Chandigarh's biggest revenue generator, prompting continuous evaluation by senior officers. Stricter enforcement measures have been implemented, including penalties for violations, to ensure compliance and maximize fiscal contributions.

Projections and Historical Context

With two months remaining in the financial year, officials anticipate a significant jump in total revenue by March 31. The department is optimistic about surpassing its highest-ever revenue of Rs 863 crore, achieved in the 2022-23 fiscal year, given that collections have already reached Rs 846.66 crore.

To achieve this goal, all ward and zone officers have been directed to maximize recovery efforts during the final phase of the fiscal period. This concerted push underscores the administration's commitment to fiscal excellence and resource mobilization.

The impending rollout of the new Excise Policy for 2026-27 is expected to further refine revenue mechanisms, ensuring sustained financial growth for the Union Territory. The policy's development reflects ongoing efforts to adapt to evolving market dynamics and enhance regulatory frameworks.