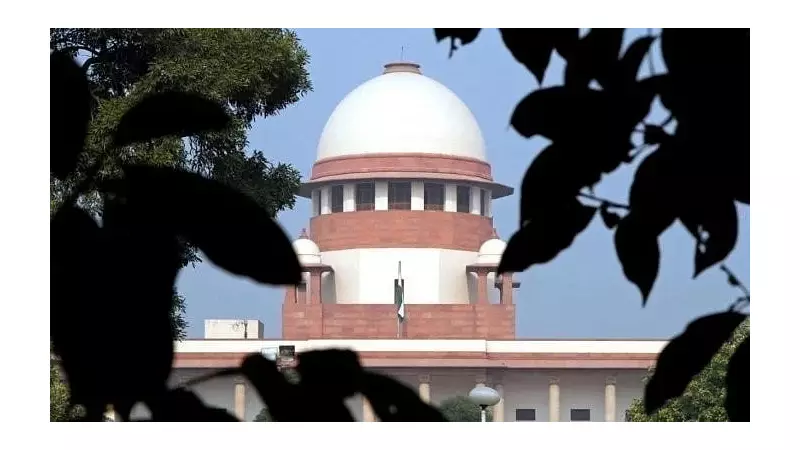

In a landmark judgment with far-reaching implications for the management of religious endowments, the Supreme Court of India has firmly ruled that funds and assets of a temple belong to the deity and must be used exclusively for the temple's interests. The court stated that this sacred money cannot be utilized as a financial lifeline for struggling cooperative banks.

A Sacred Trust, Not a Bailout Fund

The apex court's ruling, delivered on 05 December 2025, draws a clear and uncompromising line between secular financial institutions and religious trusts. The Chief Justice of India, heading the bench, emphasized that temple money is held in a sacred trust. The primary duty of the temple management is to ensure these resources are "saved, protected and utilised only for the interests of the temple."

The court categorically rejected any notion that these dedicated funds could become a source of income or a survival mechanism for a cooperative bank facing financial difficulties. This decision underscores the legal principle that the deity is a juristic person, and its property must be safeguarded with the highest degree of care and for its intended religious and charitable purposes alone.

Implications for Temple Management and Banking

This verdict sets a powerful precedent for how temples and other religious institutions across India manage their substantial assets. It serves as a strict directive against the diversion of religious donations and offerings for unrelated secular purposes, no matter how pressing those needs might seem.

The judgment highlights several key responsibilities for temple trustees and state-appointed boards:

- Fiduciary Duty: Trustees have a non-negotiable fiduciary duty to protect the deity's assets.

- Purpose-Bound Use: All expenditures must align directly with the temple's maintenance, rituals, development, and charitable activities as per its traditions.

- No Cross-Subsidization: Temple funds cannot be used to prop up or rescue external financial entities like cooperative banks, even if they are community-based.

Broader Context and Future Safeguards

The Supreme Court's ruling arrives at a time when the governance and financial transparency of religious endowments are under increased public scrutiny. By affirming the inviolable nature of temple funds, the court has reinforced the wall of separation between specific religious endowments and broader fiscal challenges.

This decision is expected to influence ongoing audits and management practices of countless temples, ensuring that devotees' offerings are used strictly for the purposes for which they were given. It also sends a clear message to regulatory authorities that the autonomy and specific purpose of religious trusts must be respected in financial governance.

Legal experts believe this judgment will act as a crucial safeguard, preventing the potential misuse of temple wealth under the guise of addressing wider economic or banking sector crises. The sanctity of the religious trust, the court has made clear, is paramount.