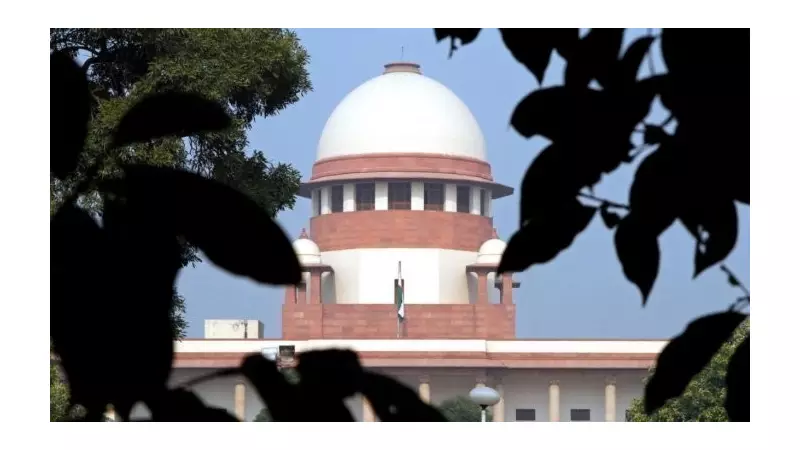

The Supreme Court of India has taken significant action in a major financial case, issuing formal notices to multiple high-profile entities regarding allegations of substantial bank fraud.

Court Proceedings and Key Players

A Supreme Court bench served notices to the Central Government, Central Bureau of Investigation (CBI), Enforcement Directorate (ED), and businessman Anil Ambani in response to a Public Interest Litigation (PIL). The PIL specifically demands a court-monitored investigation into bank fraud allegations totaling a staggering ₹20,000 crore.

The legal proceedings saw prominent advocate Prashant Bhushan presenting arguments before the bench. Bhushan appeared on behalf of the petitioner, Sarma, pushing for judicial oversight of the fraud investigation.

Timeline and Next Steps

The Supreme Court has established a strict deadline for responses, giving all parties three weeks to submit their replies to the allegations. This timeframe puts pressure on the respondents to prepare comprehensive answers to the serious charges outlined in the PIL.

The case, which came before the court on November 18, 2025, represents one of the most significant financial fraud cases to reach India's highest judicial authority in recent times. The involvement of multiple central agencies and one of India's most recognized business figures adds considerable weight to the proceedings.

Broader Implications

This development marks a crucial moment in the ongoing scrutiny of large-scale financial transactions and banking practices in India. The court's decision to entertain the PIL and issue notices indicates the seriousness with which the judiciary is treating the allegations.

The case has drawn widespread attention due to the substantial amount involved and the prominent names associated with the proceedings. The court-monitored probe being sought could set important precedents for how similar financial fraud cases are handled in the future.

As the three-week response period begins, financial and legal circles are closely watching how the various parties will respond to the Supreme Court's notice. The outcome of this case could have far-reaching implications for corporate governance, banking regulations, and financial accountability in India.