Chhattisgarh Consumer Commission Slams Postal Department Over Savings Fraud, Awards Rs 1.91 Crore Compensation

In a landmark ruling that underscores the accountability of government-run financial institutions, the Chhattisgarh State Consumer Disputes Redressal Commission has ordered the Department of Posts to pay over Rs 1.91 crore, plus interest, to a retired couple and their daughter. The case involves the disappearance of lifetime savings from multiple term deposit accounts, which the commission termed a clear breach of consumer trust.

Detailed Order Exposes Systemic Failures

Issuing a comprehensive 21-page order on January 29, Commission President Justice Gautam Chourdiya and Member Pramod Kumar Varma partially allowed a complaint filed by Dr. Anil Kumar Pandey, his wife Dr. Rama Pandey, and their daughter Roli. The complainants, residents of Rohinipuram in Raipur, had alleged severe financial misconduct by the postal department and its Raipur-based officials.

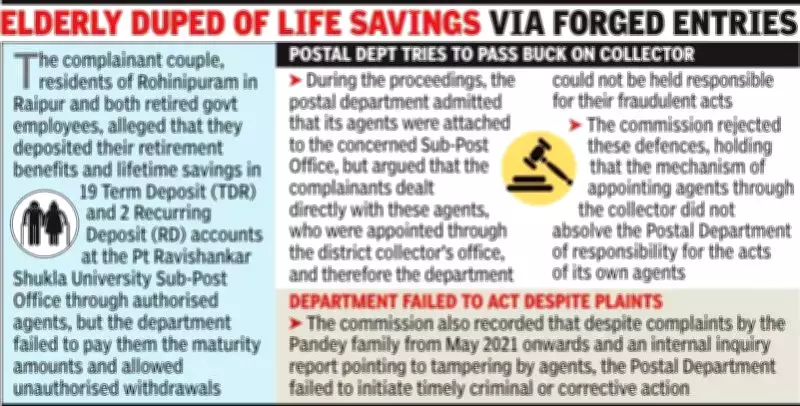

The family deposited their retirement benefits and entire life savings into 19 Term Deposit (TDR) and 2 Recurring Deposit (RD) accounts at the Pt Ravishankar Shukla University Sub-Post Office through authorized agents. Shockingly, the department failed to disburse the maturity amounts and permitted unauthorized withdrawals, leaving the family in distress.

Substantial Claims and Heartbreaking Intent

The Pandeys claimed a total of Rs 1,97,42,705, which included the maturity value of the deposits, accrued interest, compensation for immense mental agony, and litigation costs. The couple revealed they had invested the money specifically for their daughter's marriage and to secure their old age, making the loss particularly devastating. They emphasized that all cheques were issued solely in the name of the Postmaster, and they received passbooks bearing the official post office seal and the Postmaster's signature, which should have guaranteed security.

Postal Department's Defenses Rejected

During the legal proceedings, the Postal Department admitted that its agents were attached to the concerned Sub-Post Office. However, it argued that the complainants dealt directly with these agents, who were appointed through the district collector's office. The department contended it could not be held responsible for the agents' fraudulent acts.

The department further relied on its Citizen Charter and agency rules to claim that any misappropriation by agents appointed under a state mechanism was the liability of the state government. It also alleged that several passbooks produced by the complainants were forged documents.

Commission's Firm Rebuttal and Legal Precedents

The commission firmly rejected these defenses. It held that the mechanism of appointing agents through the collector did not absolve the postal department of responsibility for the acts of its own agents, whose activities were directly linked to its regular financial business.

The commission relied on established judgments from the Supreme Court and the National Consumer Commission, including Pradeep Kumar vs Post Master General and Superintendent of Posts vs Prabhakar Keshavlal Mehta. These precedents reiterate that the post office is liable for fraud or negligence committed by its employees or agents in the course of their official functions.

Internal Inquiry Reveals Fraudulent Tampering

A departmental inquiry conducted earlier by the Postal Department itself uncovered damning evidence. It found that 17 passbooks issued to the complainants were fraudulently prepared. Agents had misused discontinued RD passbooks, converting them into fake TD accounts by overwriting entries and affixing forged seals.

The commission noted that while the department blamed the agents, the presence of official postal seals and the fact that cheques were issued in favor of the Postmaster indicated connivance or, at minimum, serious negligence by postal officials. This pointed to a systemic failure within the institution.

Deficiency in Service and Inaction Condemned

The commission also recorded that despite complaints from the Pandey family starting in May 2021 and an internal inquiry report highlighting tampering by agents, the postal department failed to initiate timely criminal or corrective action to safeguard the investors' interests. This failure was explicitly termed a deficiency in service under consumer protection laws.

Final Award and Compensation

While the commission declined to accept 3 disputed accounts due to a lack of original or photocopied passbooks, it held that 18 TDR accounts were conclusively proved through original passbooks bearing the post office seal and the postmaster's signature. There was no credible evidence presented to show that maturity amounts from these accounts were ever paid to the complainants.

Holding the department fully liable, the commission issued a direct order:

- Payment of Rs 1,91,39,965 towards the maturity amount of the 18 proven TDR accounts.

- Simple interest at 6% per annum from the date of filing the complaint (November 20, 2023).

- This financial restitution must be completed within 45 days.

In addition to the principal amount, the commission awarded:

- Rs 1 lakh as compensation for the severe harassment and mental agony endured by the family.

- Rs 15,000 to cover litigation costs.

The final ruling emphasized that this case represents a clear instance where consumers' trust in a government-run savings institution was breached due to fraud perpetrated by agents and compounded by inaction from the postal authorities themselves. This decision sets a significant precedent for consumer rights and institutional accountability in financial services.