A magisterial court in Paud, Pune, has ordered the police custody remand of Sheetal Tejwani, a power of attorney holder, until December 23. This development is part of an ongoing investigation into an alleged illegal stamp duty waiver concerning the registration of a sale deed for a valuable 40-acre government land parcel located in Mundhwa.

The Core of the Alleged Fraud

The case, currently under the scrutiny of the Bavdhan police, revolves around a transaction with a declared value of Rs 300 crore. Tejwani, who claims to hold the power of attorney for 272 Watandars (the original holders of the Mahar Watan land now under government control), entered into an agreement with Amadea Enterprises LLP. The sale deed was registered on May 20 at the sub-registrar Haveli IV office.

Authorities allege that Tejwani, the then-suspended sub-registrar Ravindra B Taru, and Amadea's partner Digvijay Patil conspired to cause a significant loss to the state exchequer. The estimated revenue loss is pegged at approximately Rs 6 crore. The accusation states that the sale deed was registered without proper document verification and based on bogus claims, thereby illegally bypassing mandatory stamp duty payments.

Key Figures and Political Links

A notable aspect of the case is the involvement of Amadea Enterprises LLP, where Deputy Chief Minister Ajit Pawar's son, Parth Pawar, is a partner. However, Parth Pawar has not been named as an accused in the First Information Report (FIR) because he was not a signatory to the specific sale deed in question.

In a related move, the Bavdhan police questioned Digvijay Patil for nearly 10 hours on Tuesday. Deputy Commissioner of Police Vishal Gaikwad indicated that information was gathered during this interrogation and that Patil would be called again after Tejwani's custodial questioning.

Multiple Cases and Legal Proceedings

This is not the only legal trouble for Sheetal Tejwani concerning this land deal. She was initially arrested by the Pune police's economic offences wing on December 3 in a separate case registered at the Khadak police station related to the same land parcel. Following a court order on Monday, she was placed in judicial custody.

Subsequently, the Bavdhan police obtained a production warrant from the Paud court, secured her custody on Tuesday, and presented her before the magistrate to seek a 10-day remand, which was granted until December 23.

The Stamp Duty Evasion Mechanics

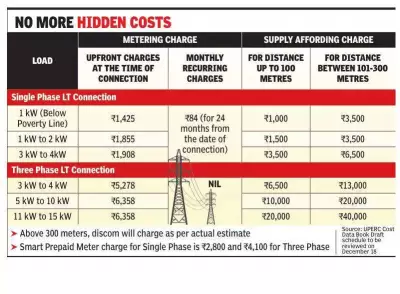

The financial implications of the alleged fraud are substantial. As per the Maharashtra Stamp Act, the applicable duty for such a transaction is 5% stamp duty, plus 1% local body tax, and 1% metro cess. On the declared consideration of Rs 300 crore, this would amount to a total government revenue of roughly Rs 21 crore.

However, the sale deed was registered after collecting only a token stamp duty of Rs 500. The registration was facilitated by citing an industrial concession under a Letter of Intent (LoI) from the District Industries Centre, Pune. The government's case argues that even if such a concession was applicable, the 1% local body tax and 1% metro cess (totaling ~Rs 6 crore) were not exempted, leading to a prima facie loss of public revenue.

The investigation continues to unfold as police probe deeper into the connections and the full extent of the alleged financial misconduct in this high-value land deal.