Nagpur Court Denies Pre-Arrest Bail in Major Land Fraud Case

In a significant legal development, the additional sessions court in Nagpur has firmly rejected the anticipatory bail applications of two directors from Urban Township Private Limited. This decision comes in connection with a high-profile cheating and criminal breach of trust case involving a staggering amount of 10.6 crore rupees. The case has drawn considerable attention due to its allegations of fraudulent activities concerning company land that was specifically reserved for the construction of a primary school.

Court's Decision and Judicial Observations

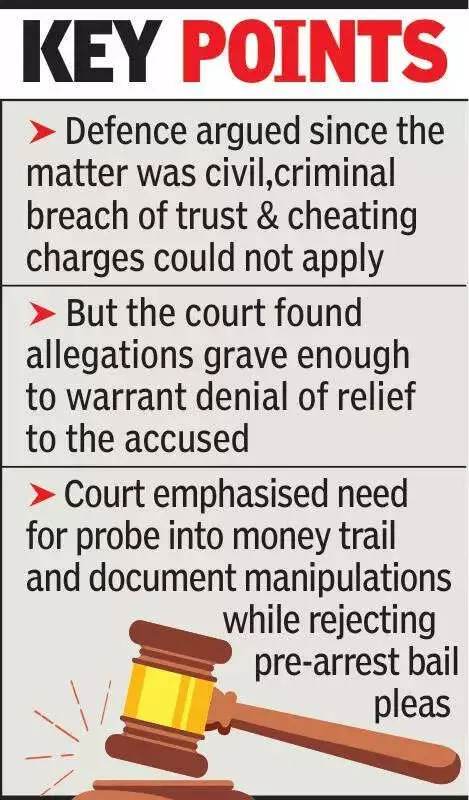

On January 20, additional sessions judge A V Dhuldhule delivered the ruling, denying pre-arrest bail to the applicants, including Atul Yamsanwar and a co-accused. The case was registered at the Sitabuldi police station under relevant sections of the Indian Penal Code pertaining to cheating and criminal breach of trust. The court's decision underscores the seriousness of the allegations, with the judge noting that the actions of the accused prima facie demonstrated dishonest intent and mala fide motives. This observation was particularly highlighted in the context of bypassing the majority shareholder's rights and interests.

Background of the Allegations

The complainant in this case had acquired a 60% controlling stake in Urban Township Private Limited after being assured of profits from various land dealings. However, he alleged that he was misled into investing further funds to cover losses on a property located at Mouja Chikli (Deo). Despite holding majority ownership, the complainant claimed that the accused directors engaged in a series of deceptive practices. These included concealing critical transactions, reflecting only 30% shareholding in official audit reports and Registrar of Companies filings, and secretly appointing additional directors without his knowledge or consent.

Core Fraudulent Activity

At the heart of this case lies the alleged fraudulent sale of disputed land that was earmarked for educational purposes. On April 20, 2022, the land was sold to M/s Mahadeo Infra (also referred to as Mahadev Infra Projects) for 10.6 crore rupees, a figure significantly below the market rate. The court noted that this transaction was conducted without the complainant's consent, knowledge, or any share in the proceeds. Furthermore, it was alleged that the sale deed was undervalued, with the ready-reckoner valuation estimated at around 16 crore rupees, indicating major cash transactions and potential financial irregularities.

Implications and Legal Context

The court's rejection of the bail pleas emphasizes the gravity of the accusations, particularly the sale of land designated for a school, which is seen as a wrongful gain achieved through dishonest means. This case not only highlights issues of corporate governance and shareholder rights but also raises concerns about the misuse of assets intended for public welfare, such as educational infrastructure. The legal proceedings are expected to continue, with the accused facing serious charges that could have long-term implications for their professional and personal lives.

This ruling serves as a reminder of the judiciary's role in addressing complex financial crimes and protecting the interests of stakeholders in corporate entities. As the case unfolds, it will be closely watched for its potential impact on similar fraud cases and the enforcement of laws against economic offenses in India.