Cuttack police have successfully cracked down on a sophisticated investment scam that was operating through the Telegram messaging platform. The operation, which led to the arrest of seven individuals and the freezing of assets worth over Rs 90 lakh, exposed a network built on fake companies and mule bank accounts designed to defraud investors.

The Scam's Modus Operandi and Arrests

Acting on their own initiative, officials at the Cyber Crime and Economic Offences Police Station in Cuttack registered a case and launched the investigation. According to Deputy Commissioner of Police (Cuttack) Khilari Rishikesh Dnyandeo, the gang targeted victims through alluring social media advertisements and Telegram groups. They promised exceptionally high returns on relatively small investments, a classic hook for such financial frauds.

Once the victims transferred money, the accused executed a rapid layering process. The funds were moved swiftly through a chain of 10 to 15 different bank accounts using UPI and online banking, a technique intended to obscure the money trail and complicate recovery efforts.

The police have apprehended the alleged masterminds: Bainu Nayak (27) of Balikuda, Pannaga Narayan Dash (25) of Mahanga, and Rudra Madhaba Mohapatra (23) of Tirtol. In a significant development, the net also closed in on four bank officials and facilitators accused of complicity. They are alleged to have helped open fake current accounts in return for monetary benefits.

Bank Officials Among Those Apprehended

The arrested bank personnel include:

- Harekrushna Sahoo (30), a relationship manager with Utkarsha SFB in Nuabazar, Cuttack.

- Abhisek Mohanty (31), deputy manager at Bandhan Bank in Jagatsinghpur.

- Debasish Mallick (32), PRO at Axis Bank in Jagatsinghpur.

- Swaraj Kumar Samal (32), assistant branch manager at Suryodaya Small Finance Bank in Dolamundai, Cuttack.

Police confirmed that two other accused are currently absconding and efforts are on to track them down.

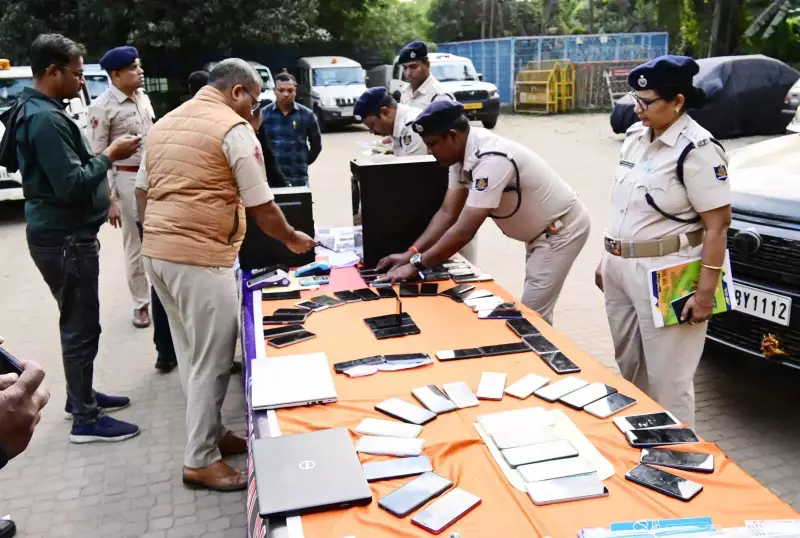

Massive Haul of Evidence and Wider Links

The police raid yielded a substantial cache of digital and financial instruments, painting a picture of a large-scale operation. The seized items include:

- 69 mobile phones

- 4 laptops and 3 desktop computers

- 215 SIM cards from various telecom providers

- 554 bank account passbooks

- 702 debit and credit cards

- Two four-wheelers and one two-wheeler

DCP Khilari stated that the accused followed a well-planned modus operandi involving the creation of fake companies, the use of mule accounts, and rapid fund transfers. The investigation has also uncovered prima facie links to similar cyber fraud cases in Chandauli district of Uttar Pradesh and Supaul in Bihar, suggesting the network's operations may have had a wider geographical reach.

The probe remains active, with authorities working to identify more victims who may have been duped by this scheme and to trace the full extent of the financial network. The freezing of over Rs 90 lakh across multiple bank accounts marks a crucial step in mitigating the losses suffered by investors.