In a significant update on the Pradhan Mantri Fasal Bima Yojana (PMFBY), Union Agriculture Minister Shivraj Singh Chouhan informed the Lok Sabha that a substantial number of farmers in Odisha have been covered under the flagship crop insurance scheme. The government has disbursed a massive sum in claims over the past five years, highlighting the scheme's reach and impact in the state.

Substantial Enrollment and Financial Support for Farmers

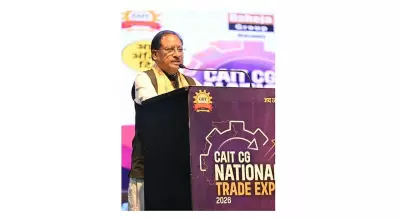

Replying to a question by MP Sangeeta Kumari Singh Deo on Tuesday, Minister Chouhan stated that 8,85,504 farmers in Odisha have been enrolled under the PMFBY. For these enrolments, the government has facilitated the disbursement of a whopping Rs 2,580.06 crore to farmers as claims over the last five years. This financial support is crucial for stabilizing farm incomes and providing a safety net against crop losses due to natural calamities.

Operational Framework and Addressing Past Challenges

The minister detailed the operational structure, noting that key tasks like selecting insurance companies through transparent bidding, enrolling farmers, assessing crop loss, and uploading yield data on the National Crop Insurance Portal (NCIP) are handled by the state government or joint committees. He acknowledged that past implementation saw complaints regarding claim payments. These issues were primarily linked to delays in the state's subsidy share, discrepancies in field data, and disputes between state authorities and insurers.

"Pending claims on account of these issues are settled after their resolution as per provisions of the scheme," Chouhan assured. To streamline the process, the government has developed the NCIP as a central platform for transparency and direct benefit transfer.

Leveraging Technology for Transparency and Timely Payments

A major push has been made to integrate technology for smoother operations. From the 2022 Kharif season, a dedicated 'Digiclaim Module' has been operationalized. This module integrates the NCIP with the Public Finance Management System (PFMS) and insurers' accounting systems to ensure timely claim processing.

Furthermore, to enforce accountability, a penalty of 12% is auto-calculated and levied through the NCIP if an insurance company delays payment, effective from the 2024 Kharif season. A similar penalty applies to state governments for delays in their premium subsidy share.

Other tech-driven steps include capturing crop-cutting experiment (CCE) data via a mobile app, integrating state land records with the NCIP, and allowing insurers to witness CCEs. The central government has also de-linked its share of premium subsidy to ensure farmers receive claims proportionate to the paid premium without central delays.

This comprehensive update underscores the government's ongoing efforts to refine the PMFBY, leveraging digital tools to enhance efficiency, transparency, and, ultimately, farmer welfare in Odisha and across the nation.