US Tariff Reduction Sparks Immediate Order Revival for Indian FIBC Manufacturers

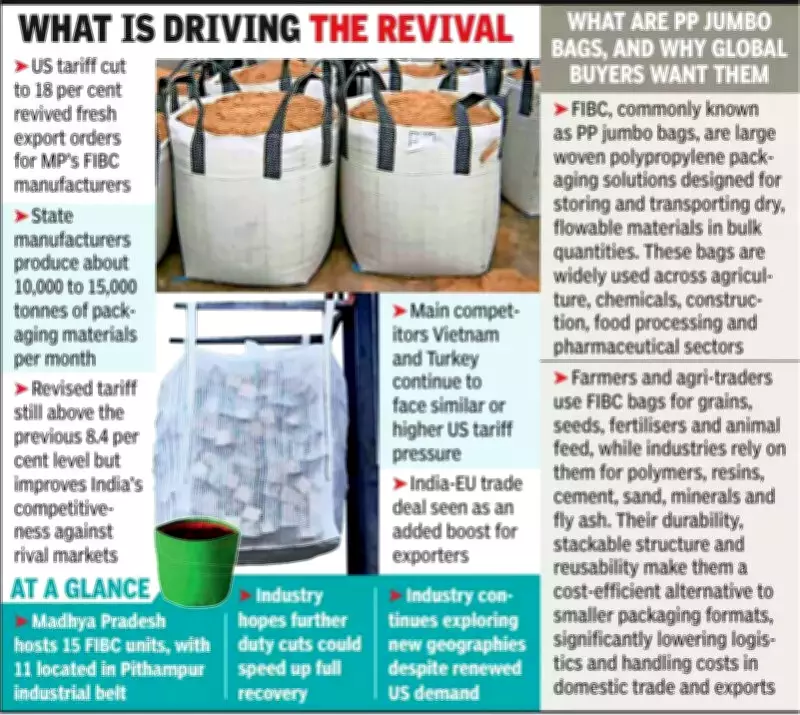

The Flexible Intermediate Bulk Container (FIBC) manufacturing sector in Madhya Pradesh has experienced a significant resurgence in export orders from United States buyers following a crucial reduction in reciprocal tariffs. Industry sources confirm that fresh inquiries and purchase orders began flowing almost immediately after tariffs were lowered from 50% to 18%, marking a potential turning point after nearly eight months of disrupted trade.

Immediate Market Response and Pent-Up Demand

A senior executive from a prominent Pithampur-based FIBC manufacturing unit revealed the swift market reaction. "Soon after the tariff cut announcement, we secured an order for 500 tonnes from a US buyer," the executive stated. "American importers were actually waiting for this reduction to source products at more economical prices. The pent-up demand is now shifting back to Indian suppliers."

This development comes after the earlier 50% tariff regime had severely hampered exports to the United States, forcing numerous manufacturers to explore alternative markets in Europe and elsewhere. While the revised 18% duty remains substantially higher than the previous average tariff of approximately 8.4%, industry experts note it significantly improves India's competitive positioning in the global market.

Madhya Pradesh's Strategic Position in FIBC Production

Madhya Pradesh serves as a crucial hub for India's FIBC manufacturing industry, hosting 15 specialized production units. Of these, 11 are strategically concentrated in the Pithampur industrial belt, collectively contributing close to 30% of the nation's total FIBC output. These facilities produce between 10,000 and 15,000 tonnes of bulk packaging materials monthly, with a substantial portion traditionally destined for American and European markets.

Ravi Choudhary, CEO of Commercial Syn Bags Limited, emphasized how tariff clarity has revitalized buyer planning. "US buyers were awaiting certainty on tariffs before committing to purchases. Now that we have clearer parameters, purchasing decisions are being reactivated. Simultaneously, Indian manufacturers continue diversifying their export destinations to mitigate future risks," Choudhary explained.

Competitive Landscape and Future Prospects

Exporters highlight that India's revised tariff position creates relative advantages compared to competing supplier nations like Vietnam and Turkey, which continue facing comparable or even higher tariff pressures in the US market. This recalibration allows Indian manufacturers to regain lost ground despite the higher-than-historical duty structure.

Industry consultant Manoj Dwivedi, who advises multiple FIBC units, observed renewed inquiry momentum from American buyers. "Comparing directly with the old tariff regime has limited value since the US implemented new tariffs across multiple countries. Within the current revised framework, we must reassess India's competitiveness and opportunities. A potential trade agreement with the European Union could provide additional support to the sector," Dwivedi noted.

While exports declined over the past six months due to prohibitive tariffs, they never ceased completely, underscoring India's position as a key global FIBC producer. With inquiries now resuming, several companies are considering production enhancements after operating at reduced capacity during the slowdown period.

Path Forward for the Industry

Industry stakeholders acknowledge that relatively lower tariffs within Asian supplier groups provide India with a distinct advantage in the current trade environment. However, they emphasize that further reductions toward previous levels could substantially accelerate export recovery and market recapture.

The sector's resilience during the challenging period, combined with strategic market diversification efforts, positions Madhya Pradesh's FIBC manufacturers for sustainable growth. As global supply chains continue evolving, India's packaging industry appears poised to leverage both renewed American demand and emerging opportunities in other international markets.