Indian equity benchmarks, the Sensex and Nifty 50, are likely to begin Tuesday's trading session on a flat note, reflecting a cautious stance from investors as they digest mixed signals from global markets and key domestic economic indicators.

Market Recap and Near-Term Outlook

On Monday, the domestic market extended its losses for a second straight session, closing marginally lower due to selling pressure at higher levels. The Sensex declined by 64.77 points, or 0.08%, to settle at 85,641.90. Similarly, the Nifty 50 ended 27.20 points, or 0.10%, lower at 26,175.75.

Siddhartha Khemka, Head of Research at Motilal Oswal Financial Services Ltd., noted that markets may stay range-bound in the near term. "Participants await clarity on the potential rate-cut trajectory and developments on the trade deal front," he stated, highlighting the prevailing uncertainty.

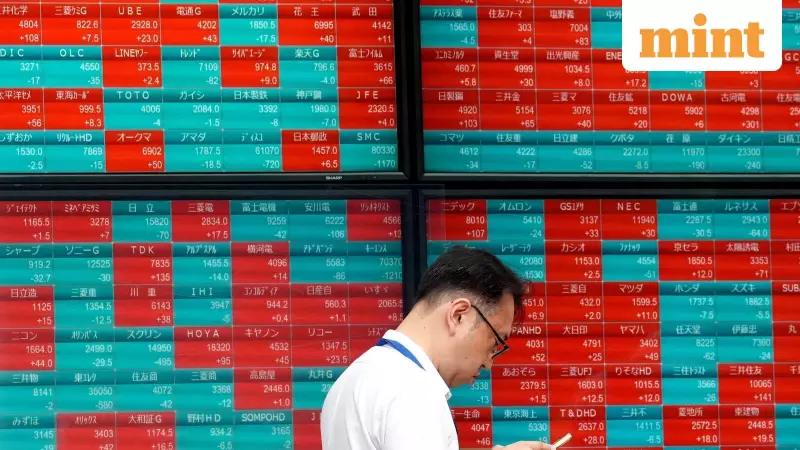

Global Market Influences

Asian markets presented a mixed picture on Tuesday morning. While Japan's Nikkei 225 and Topix edged higher, and South Korea's Kospi saw a strong rally, US markets had closed in the red overnight. The Dow Jones Industrial Average, S&P 500, and Nasdaq Composite all fell, pressured by a jump in Treasury yields.

Back home, the Gift Nifty was trading around the 26,332 level, indicating a flat-to-slightly negative start for the Indian indices, closely aligning with the Nifty futures' previous close.

Key Domestic Economic Data Points

Several important economic data releases are shaping market sentiment:

- Industrial Production (IIP): Growth slowed sharply to a 13-month low of 0.4% in October 2025, down from 3.7% in the same month last year.

- Current Account Deficit (CAD): Narrowed to $12.3 billion (1.3% of GDP) in the September quarter, improving from $20.8 billion a year ago.

- GST Collections: Dipped to a year-low of ₹1.70 lakh crore in November, showing minimal year-on-year growth of 0.7%.

These figures present a nuanced view of the economy, with external balances improving but domestic industrial activity and tax collections showing signs of moderation.

Commodities and Currency Movements

In the commodities space, gold prices retreated from a six-week peak on profit-booking. Spot gold declined 0.2% to $4,222.93 per ounce. Meanwhile, the cryptocurrency market witnessed a selloff, with Bitcoin prices falling to $86,715.

The US dollar remained under pressure, with the dollar index falling to 99.408. The rupee is expected to take cues from these broader currency movements and domestic equity flows.

Investors are advised to monitor global bond yield movements, especially in Japan where JGB yields hit multi-year highs, and corporate results for further directional cues. The market's trajectory will heavily depend on a combination of local economic health and evolving international financial conditions.