In a significant ruling that clarifies financial liabilities in cancelled real estate deals, the West Bengal Real Estate Appellate Tribunal in Kolkata has decreed that a home buyer cannot directly demand a refund of Goods and Services Tax (GST) from the property developer once a purchase agreement is terminated.

The Core of the Dispute: Who Refunds the GST?

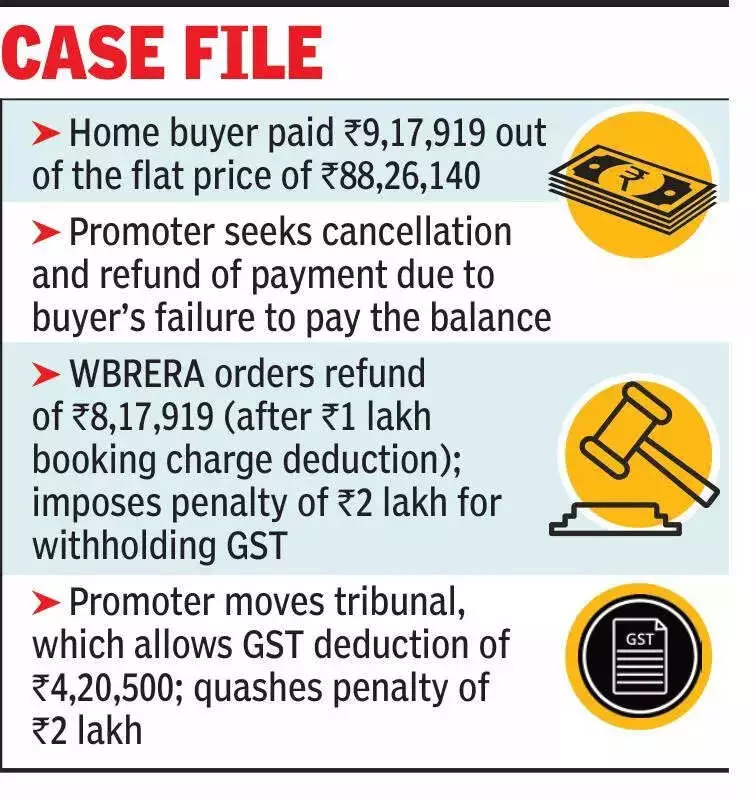

The case centered on a dispute between an allottee, Malabika Bhoumic, and the promoter, PS Group Realty Pvt Ltd. Bhoumic had agreed to purchase a 665 sq ft flat on the 15th floor of Project ONE-10 on May 25, 2022, for a total consideration of Rs 88,26,140. She paid an initial amount of Rs 9,17,919.

However, due to a failure to pay the remaining balance, the promoter terminated the agreement on June 16, 2023. Following this, Bhoumic sought a cancellation and full refund through the state's regulatory authority.

Regulatory Orders and the Tribunal's Intervention

The West Bengal Real Estate Regulatory Authority (WBRERA) initially directed the promoter to refund Rs 8,17,919 to the allottee, after deducting a booking charge of Rs 1,00,000. The authority also imposed a penalty when PS Group withheld a portion of this refund, citing it as GST already paid to the government.

Challenging this order, the promoter filed an appeal. After hearing arguments, the tribunal bench, comprising Justice Rabindranath Samanta (chairperson) and Subrat Mukherjee (administrative member), delivered a pivotal verdict. The tribunal modified the regulatory order, allowing PS Group to deduct Rs 4,20,500 as GST from the refundable amount. It also set aside the Rs 2,00,000 penalty imposed by WBRERA on the promoter.

Legal Basis and Implications for Buyers

The tribunal's decision, which disposed of two appeals against regulatory orders dated January 24, 2024, and February 25, 2025, was grounded in specific tax laws. Referring to Sections 13(2) and 31(2) of the Central Goods and Services Tax Act, 2017, and a circular dated December 27, 2022, the bench clarified the legal position.

The ruling established that once the promoter issues an invoice, they are legally obligated to pay the applicable GST on behalf of the allottee to the tax authorities. Consequently, if the agreement is later cancelled, the allottee must claim the tax refund directly from the GST authority, not from the developer. The tribunal held that the promoter's action of deducting the already-deposited GST from the refund was justified under this framework.

This judgment provides crucial clarity for both developers and home buyers navigating the financial aftermath of terminated property deals, emphasizing the separate channels for recovering principal amounts and tax components.