When people typically ask ChatGPT about getting rich, they often anticipate vague or fantastical suggestions. However, what truly astonished listeners of The Diary of a CEO podcast was not the question itself, but how precisely the AI's response aligned with decades of established, orthodox investing advice.

The Experiment: Testing AI Against Investing Wisdom

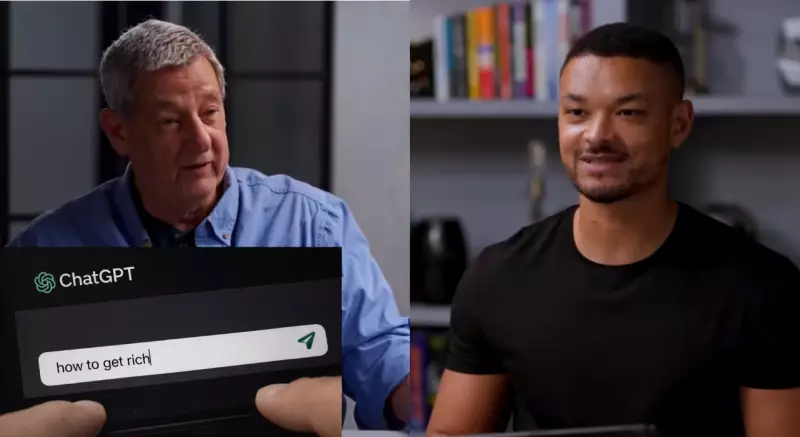

During a recent episode of The Diary of a CEO, host Steven Bartlett, a business owner and avid investor, crafted a deliberately simple prompt for ChatGPT. He framed it around an "ordinary" income and a long-term goal of achieving financial freedom.

Sitting opposite Bartlett was JL Collins, author of The Simple Path to Wealth and a leading voice in long-term, low-cost investing. Often referred to as the "Godfather of FI" (Financial Independence), Collins is renowned for his influential blog, jlcollinsnh.com, and his best-selling book that has guided countless individuals toward financial independence.

Bartlett explained his motivation for the experiment: he wanted to test whether artificial intelligence could distill decades of investing wisdom into a coherent answer. With Collins by his side, he shared his curiosity about integrating AI into the conversation.

"I thought it would be curious 'cause we now have this new alien amongst us called AI," Bartlett remarked. "I thought it would be curious if I went on ChatGPT and I asked ChatGPT the question." He then read the exact prompt aloud: "I'm a normal person who earns $50,000 a year. I want to be financially free in the future. Give me a one-sentence answer based on all of the wisdom in the world taken from every expert in investing ever."

Expert vs. AI: Striking Similarities in Advice

Before revealing ChatGPT's response, Bartlett turned to Collins and asked for his answer. Without hesitation, Collins offered his mantra: "Avoid debt. Live on less than you earn, and invest in surplus," a concise summary of the philosophy from his book The Simple Path to Wealth.

When Bartlett read out ChatGPT's response, the overlap was remarkable. The AI advised: "Focus on saving and consistently invest in low-cost broad-based index funds like the S&P 500 while living below your means and allowing compounding to work over time."

The resemblance was so close that Collins could only laugh in disbelief. "I should sue them for mining my book," he joked, acknowledging that the advice was fundamentally sound. ChatGPT's response mirrored the core principles Collins has promoted for years: minimize costs, avoid debt, invest broadly, and let time work its magic through compounding.

Exploring Further: Skills and Income in an AI-Driven World

Bartlett extended the experiment with a second, more open-ended question: "How do I earn more?" Collins responded instinctively, advising to "develop your skills." ChatGPT's answer echoed this, urging people to "focus on developing high-demand skills," seek career advancement, explore side hustles, or invest in assets generating passive income like real estate or dividends.

What intrigued Bartlett was not just the familiarity of the advice, but the underlying uncertainty, particularly around "high-demand skills." This shifted the conversation to the future of work and how technological changes might impact income and financial freedom.

AI's Impact on Skills and the Labor Market

When discussing what "high-demand skills" might entail in coming years, JL Collins noted the rapid evolution of the landscape. For instance, programming, once highly sought-after, is seeing its relative value shift in the AI era. Collins humorously pointed out that the AI chatbot seemed to have "mined his book" for advice, highlighting AI's growing presence in personal finance discussions.

Collins' concerns reflect broader anxieties voiced by tech leaders like OpenAI CEO Sam Altman, who has warned about potential job displacement due to accelerating automation. Altman stated on The Tucker Carlson Show, "I'm confident that a lot of current customer support that happens over a phone or computer, those people will lose their jobs, and that'll be better done by an AI."

These fears are not merely hypothetical. Reports from the BBC indicate that several companies have attributed recent layoffs to the "new realities" of AI. Forbes projects that by 2026, more human roles may be replaced to cut costs. Microsoft has identified 40 jobs most vulnerable to AI, including interpreters, historians, mathematicians, proofreaders, coders, journalists, data scientists, geographers, and radio DJs, underscoring AI's wide-reaching impact across technical, creative, and analytical professions.

Enduring Principles Amidst Uncertainty

Despite these uncertainties, Collins emphasized that the core principles of wealth-building remain steadfast. Avoiding debt, living below your means, and consistently investing continue to form the foundation of financial independence, even as the labor market grows increasingly unpredictable. This episode of The Diary of a CEO not only showcased AI's alignment with traditional wisdom but also sparked crucial dialogues on adapting to a tech-driven economic future.