Titan Engineering & Automation Ltd (TEAL) Sharpens Focus on Domestic Equipment Manufacturing

In a significant strategic move, Titan Engineering & Automation Ltd (TEAL), the engineering subsidiary of Titan Company, is actively working to fill the critical equipment gap in India's manufacturing landscape. As global disruptions, tariff uncertainties, and supply-chain realignments prompt manufacturers worldwide to seek alternatives to China, TEAL sees a unique opportunity to establish itself as a domestic supplier of high-precision equipment and automation solutions.

Global Disruptions Create Unprecedented Opportunities

The convergence of multiple global factors is reshaping manufacturing dynamics. US tariffs, Europe's strategic shift away from Chinese dependencies, and India's ambitious push into semiconductors, solar energy, and battery technologies are creating fertile ground for companies capable of building the sophisticated equipment these industries require. For TEAL, this represents a pivotal moment to leverage its deep capabilities in automation and precision manufacturing.

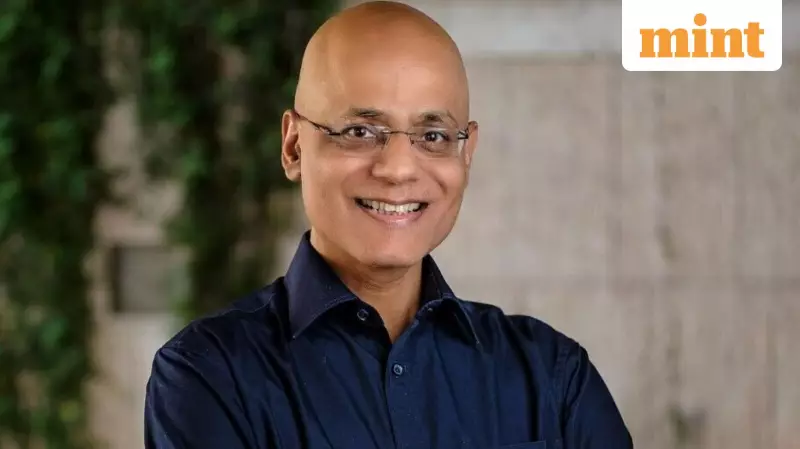

"This is probably the best time for manufacturing in this country," emphasized Sridhar N.P., Managing Director and Chief Executive of TEAL. "Unfortunately, it has come many years later than it should have, but better late than never. We are seeing industries where the entire value chain is coming in together. I do not know if this has ever happened elsewhere, where the whole ecosystem is being set up in two years."

Despite India's accelerated investments in production capabilities across key sectors, a substantial portion of the equipment used in semiconductors, solar, and battery manufacturing continues to be imported from China. TEAL aims to emerge as a viable domestic alternative in selected equipment categories where its automation and precision engineering expertise can be effectively applied.

Strategic Response to Geopolitical and Trade Uncertainties

The changing global landscape presents both opportunities and challenges. While Trump-era tariffs and broader geopolitical uncertainties have encouraged companies to reassess their supply chains and manufacturing footprints, creating new openings for firms like TEAL, they also raise questions about how prolonged trade tensions might influence future investment decisions and market access.

TEAL operates through two distinct business segments. One focuses on designing and building automation equipment for high-volume manufacturing, while the other manufactures high-precision components primarily for global aerospace customers. The manufacturing services business, heavily oriented toward aerospace, maintains significant exposure to the US market. In contrast, the automation business currently has limited presence in North America.

Although TEAL harbors ambitions to eventually scale its automation operations in North America, prevailing tariff uncertainties have led to a temporary pause in expansion plans. "North America is definitely an area of focus, but we are waiting and watching how we would want to do that (expand in the US market)," Sridhar explained. "On the automation front, we hardly export anything to the US, so that hasn't been impacted, but it has impacted our North American strategy."

He clarified that aerospace manufacturing exports have remained largely unaffected by tariffs, thanks to long-term contracts and established customer relationships. Approximately 95% of TEAL's manufacturing services output is export-oriented, with the US serving as a key market.

Europe's Evolving Dynamics and India's Advantage

Europe presents a different set of dynamics. While near-term industrial demand has softened, structural factors are compelling European manufacturers to diversify their supply chains away from China and toward alternative partners. Defence and aerospace spending in Europe is projected to increase significantly, yet building local capacity remains cost-prohibitive.

According to Nithin Chandra, Partner at consulting firm Kearney, this creates a natural inclination toward India. "Europe will see a sharp increase in defence and aerospace spending, but creating capacity there is costly," he noted. "That naturally pushes sourcing towards Asia, and India is viewed far more favourably than China as a long-term partner."

Sridhar highlighted that even as the US and Europe advocate for bringing manufacturing closer to home, high labor costs in these regions make automation an essential rather than optional consideration. This scenario opens up a distinctive operating model for automation suppliers, where proximity matters but complete localization is not imperative.

"The same model that worked really well for the software industry can work for automation as well," he remarked, alluding to an offshore-onsite approach. Under this model, core design, engineering, and equipment manufacturing can be executed in India, with machines subsequently shipped overseas for final commissioning and tuning on-site. "If you do this model well, there is a very unique way in which we can render solutions," he added.

Domestic Policy Momentum and Industry Response

Nevertheless, it is the burgeoning Indian opportunity that most excites TEAL. The Indian government has been proactively developing a policy framework aimed at reducing import dependence and attracting technology-led manufacturing across semiconductors, electronics, and new-energy sectors.

The flagship India Semiconductor Mission, supported by approximately ₹76,000 crore in incentives, promotes end-to-end semiconductor manufacturing—encompassing design, fabrication, packaging, and testing. It offers fiscal support of up to 50% of project costs for approved fabrication plants and related infrastructure. Comparable policy support has been extended to solar manufacturing and electronics production.

Industry players have responded positively to these initiatives. Intel and the Tata Group have signed a memorandum of understanding to localize semiconductor manufacturing and advanced packaging in India. Tata's semiconductor projects, including a fabrication plant and an OSAT facility, are collectively valued at an estimated $14 billion.

Concurrently, electronics manufacturing services providers are expanding local assembly and testing capacities, while solar and battery manufacturers are investing upstream into cells, wafers, and ingots. This signals a broader shift toward full-stack technology manufacturing within India.

Distinctive Characteristics of the Current Manufacturing Cycle

India has witnessed manufacturing booms in the past, most notably in the automotive sector. However, Sridhar contends that the current cycle is fundamentally different in both speed and structure. The automotive industry evolved gradually, beginning with vehicle assembly using imported components. As volumes expanded and incomes rose, suppliers followed, eventually leading to a balanced ecosystem where engines, tyres, and systems are manufactured locally over decades.

In contrast, the progression in semiconductors and solar is being dramatically compressed. "In semiconductors, everything is coming together," Sridhar observed. "From silicon ingots to wafers, to fabs, to packaging and final ICs (integrated circuits). Massive investments are being made across the entire value chain at the same time." A similar transformation is evident in solar manufacturing and other sectors.

"What is not coming along is equipment," Sridhar pointed out. "Whether it is semiconductor or whether it is solar, all the equipment today is coming in from China."

TEAL's Pragmatic Strategy and Targeted Approach

TEAL is not attempting to become a manufacturer of core semiconductor process tools or proprietary chemistry—a goal Sridhar deems unrealistic. Instead, the company is targeting downstream and adjacent equipment where automation and precision engineering are most critical. This includes assembly automation, material handling, packaging equipment, and discrete manufacturing systems for semiconductors, solar, and electronics manufacturing services.

The same rationale extends to batteries, where India is building manufacturing capacity under production-linked incentives, yet equipment and technology remain largely imported. According to Kearney's Chandra, this represents a pragmatic strategy. "Becoming a full-fledged equipment OEM in semiconductors is extremely hard," he acknowledged. "Having said that, being a trusted component or subsystem supplier is a much more logical and scalable path, especially if done through partnerships."

Dual Business Segments with Divergent Growth Trajectories

TEAL's strategy is anchored in its twin businesses, which confront markedly different demand dynamics. The manufacturing services business centers on high-precision components, primarily for aerospace. Much of this segment's output is export-oriented, supplying critical parts used in commercial aircraft systems such as engine starters, air-management systems, and thrust-reversal mechanisms.

This business has demonstrated resilience amid global disruptions. "My aerospace (and defence) customers have not stopped taking from us," Sridhar affirmed. "It is a very sticky business. In aerospace, you do not take short-term decisions because the ramifications on the supply chain are very high." Extended qualification cycles and switching costs mean aerospace supply chains tend to look beyond short-term tariff fluctuations.

The automation business presents a different narrative. While it was evenly divided between domestic and export markets last year, the balance has shifted decisively toward India. This year, approximately 70% of automation revenue is expected to be domestic, with exports accounting for the remainder. "While international opportunity is also growing, we see a far greater opportunity in India," Sridhar stated.

Competitive Landscape and TEAL's Positioning

TEAL operates within an industrial automation market dominated by multinational corporations. Companies such as Siemens India, ABB India, Schneider Electric India, Rockwell Automation India, and Honeywell Automation India supply standardized platforms across various industries. Globally, Siemens AG reported revenue of about €78.9 billion (approximately ₹7 trillion) in FY 2025, highlighting the scale of these players.

In India, subsidiaries of these firms have built substantial businesses based on enterprise relationships and broad portfolios. For instance, Honeywell Automation India reported total revenue of ₹4,189.6 crore in FY25. Alongside them exists a smaller cohort of Indian specialists, including robotics firms like Addverb Technologies and GreyOrange, and aerospace component suppliers such as Aequs, Dynamatic Technologies, and Sigma Advanced Systems.

TEAL occupies a niche between these categories. With FY25 revenue of about ₹860 crore, it is considerably smaller than multinational leaders but ranks among the more scaled Indian engineering specialists. Automation contributes slightly over 60% of revenue, with manufacturing services accounting for the rest.

Sridhar indicated that both manufacturing services and automation equipment businesses will continue to receive investment, particularly in factories and new technologies. The company is also exploring establishing facilities in East Asia to better serve electronics equipment customers in the region. Additionally, it is investing in capabilities such as lasers, vision systems, robotics, high-speed automation, and new-energy applications, especially batteries.

Chandra believes TEAL is well-positioned to capitalize on emerging domestic and global opportunities. "This is a long-cycle opportunity," he concluded. "If semiconductors, solar, batteries and aerospace scale the way they are expected to, suppliers with deep engineering capability will compound over a decade or more."