Telangana has become the Indian state with the highest level of government guarantees relative to the size of its economy, a new report reveals. This highlights a growing dependence on borrowing-backed support mechanisms that could pose significant financial risks.

Alarming Numbers in State Finances Report

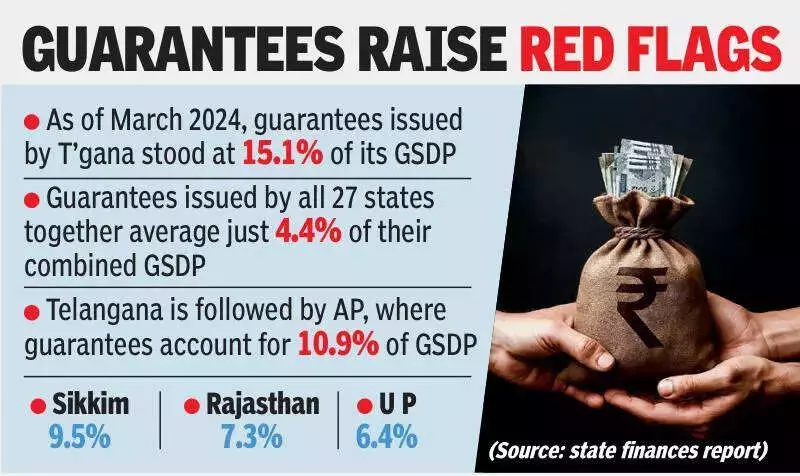

According to the latest state finances report, the guarantees issued by the Telangana government stood at a substantial 15.1% of its Gross State Domestic Product (GSDP) as of March 2024. This figure is dramatically higher than the national average for all Indian states.

For perspective, guarantees issued collectively by all 27 states average just 4.4% of their combined GSDP. This places Telangana's exposure at more than three times the national norm.

Following Telangana, the states with the highest guarantee levels are Andhra Pradesh at 10.9% of GSDP, Sikkim at 9.5%, Rajasthan at 7.3%, and Uttar Pradesh at 6.4%.

Understanding the Guarantee Mechanism and Its Risks

Government guarantees are not classified as direct state debt, but they represent a serious contingent liability. Essentially, these are promises made by state governments to repay loans taken by their public agencies or enterprises if those entities default.

Most guarantees support borrowings by state public sector undertakings (PSUs), which often struggle to secure loans independently due to weak finances or poor credit ratings. The government's backing allows these entities to access funds on easier terms.

The critical risk is that if repayments are missed for any reason, the financial burden shifts directly to the state treasury, potentially straining its budget and resources.

Sector-Wise Exposure and Calls for Caution

A sectoral analysis shows that power utilities account for the largest share of guarantees across Indian states, constituting an average of 47% of all outstanding guarantees.

However, specific states show dominance in other sectors. In Andhra Pradesh, agriculture accounts for 26% of guarantees. Cooperatives make up 60% in Chhattisgarh, while food and civil supplies form 49% in Jharkhand. In Telangana, the irrigation sector is the biggest beneficiary, receiving 37% of the state's total guarantees.

Recognising the systemic risk, a specialised working group on state government guarantees in 2023 recommended strict limits. It suggested that states should cap fresh guarantees each year at either 0.5% of GSDP or 5% of their revenue receipts, whichever is lower, to prevent excessive exposure.

Financial experts consistently caution that while guarantees can support development projects and essential services, over-reliance on such off-budget liabilities is risky. They note that even long-term loans backed by guarantees can become a heavy burden during economic slowdowns or periods of market volatility, underscoring the need for prudent fiscal management by state governments.